Is the S&P 500 Halal? A Guide for Muslim Investors

26 August 2025 7 min read

Mohsin Patel

Co-founder

6 min read

Last updated on:

Having a retirement pot will be an absolutely vital part of most people’s investment strategy. We are happy to see that there are increasing number of halal options to choose from. In this article, I look at one option – PensionBee Shariah – and analyse its shariah compliance and general attractiveness.

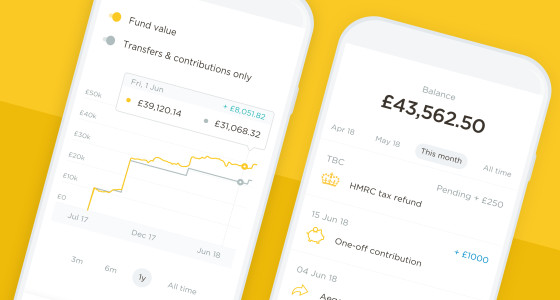

PensionBee is a UK based online pension provider. Their mission is to make pension plans more straightforward and accessible for existing pension plan holders through an easy to understand online interface. They are new, having established in 2014, but have over 332,000 customers and have invested over one billion pounds on behalf of their customers. They are regulated by the FCA and are FSCS protected.

There are three main features to note:

They combine old pensions into one easy to access online plan. This works particularly well for those who have several pension plans linked to their previous employer’s pension schemes. They have a personal ‘beekeeper’ who helps with the switch and transition process. There are a few different pension plans to choose from:

All of these pension plans are not sharia-compliant apart from the Shariah pension plan – but more on that later.

Through the app, users can contribute and add one-off payments to the fund very quickly with no minimum contribution. If you are eligible for tax relief, they automatically claim your 25% government top-up.

At the age of 55, you are eligible to income drawdown. The first 25% withdrawn is tax-free; anything above that is subject to income tax. [1] You may withdraw lumpsum amounts, increments, or withdraw a mixture of non-taxable and taxable cash.

They have a nifty calculator that help simply what your withdrawals will look like post-tax.

They also have a pension annuity income calculator [2] which estimates retirement income for you.

One option is to invest with their shariah-compliant pensions fund. This fund invests solely into the HSBC Islamic Global Equity Index fund and is managed by State Street Global Advisors and HSBC Global Asset Management. They charge 0.95% annually up to 100k- their highest fund fee. Due to being 100% equity-based, they have marked it as a relatively higher risk, higher reward plan. [3] However, the fund invests in some of the biggest companies worldwide and has a strong weighting towards the tech industry.

Therefore, in our view, if you are considering the long term, the short-term equity risk evens out a little so that the higher risk becomes palatable. Of course, this depends on your risk appetite and planned investment horizon.

Performance-wise, the fund tracks the DJ Islamic Market Global Titans 100 index and has performed well. It has outperformed the benchmark by 10.48% over the last 5 years. [4]

Pensions plans are of two types: defined benefit pensions and defined contributions pensions; also known as final salary and money purchase pensions.

The value of your pensions for a defined benefit pension plan is dependent on three things; how long you’ve worked for the company, your final or average salary, and the accrual rate. As for its permissibility, IFG has written an extensive article which discusses Mufti Zubair’s fatwa. [5]

To summarise the article, the debate hinges on the level of uncertainty (gharar) within final salary contracts. It is of IFG’s view that final salary pensions are permissible to take, and the payments are not sinful because the level of uncertainty of such a remuneration is not grossly uncertain (gharar fahish). By extension, one is not obliged to switch from a defined benefit to a defined contribution plan.

If you find yourself in this type of plan and want to transfer over to PensionBee, your pensions will be transferred onto a defined contribution plan.

However, it is worth noting that PensionBee cannot help entirely with final salary transfers; some plans have hidden fees and high exit costs, so it is worth looking at your existing pensions scheme beforehand and also studying if there are other penalties or downsides to exiting. PensionBee will let you know if your old plan is a final salary scheme, but they do not offer financial advice.

With defined contribution plans, employees will typically contribute a fixed amount of percentage of their income into an investment pot. The amount of contributions made alongside the performance of the investments will determine the total value of your retirement income. If you are eligible for tax relief, HMRC will top up £25 for every £100 that you contribute.

Defined contribution pensions are only permissible if the underlying investments are sharia-compliant. PensionBee’s shariah-compliant fund invests your pension savings and contributions into the HSBC Islamic Global Equity Index fund so they tick that box.

To keep in line with Islamic law, the HSBC fund has specific conditions in place.

Firstly, it does not invest in companies whose primary business is inherently un-Islamic. Such sectors include:

Additionally, income from non-shariah compliant investments should not go beyond 5%; these usually come in the form of company dividends generated from company business operations. It typically ranges between 1-5%. As per shariah guidelines, any non-compliant income is purified; the shariah board approve a charity which receives the income. [6]

The central committee is made up of three reputable scholars: Sheikh Nizam Yaquby, Sheikh Dr Mohamed Elgari, and Dr Mohamed Imran Ashraf Usmani.[7] They also carry out an annual review and certification of the fund’s shariah compliance.

Finally, companies should be below 33% in the following:

To conclude, we consider PensionBee’s Shariah Plan to be an effective way to grow your pensions savings and consolidate existing pension pots. Their transparent costing structure and user interface are useful for those who want to save themselves the hassle of researching, carefully choosing, and managing a halal pension plan.

The main disadvantage is its limited investment choice. As an alternative, I recommend checking out WahedInvest and Simple Ethical’s SIPP product, or DIY any SIPP through AJ Bell or Hargreaves Lansdown – though this requires ability to screen halal investments. IFG has written an article comparing these options. [8]

The key conclusion of that article with respect to Pensionbee was:

Pensionbee makes a lot of sense particularly for smaller pensions where the set-up fee and ongoing admin fee will actually form a larger percentage of your pension. You should do the numbers carefully, accounting for the drawdown fees, ongoing admin fees, and set up fees, particularly where you have a total pot under £50k as that’s where Pensionbee could be particularly effective. Certainly, under £20k, Pensionbee‘s number’s should make it cheaper. But do bear in mind the others pros and cons discussed above.

[1] https://www.pensionwise.gov.uk/en/take-cash-in-chunks

[2] https://www.pensionbee.com/annuity

[3] https://www.pensionbee.com/plans

[4] https://markets.ft.com/data/funds/tearsheet/performance?s=LU1092475968:GBP

[5] https://www.islamicfinanceguru.com/personal-finance/are-pensions-halal/

[7] http://www.assetmanagement.hsbc.com/gam/attachments/mena/amanah/islamic_invest.pdf

This article was co-authored with: Raihan Karim

He is a PPE undergrad at LSE. He’s also a student of the islamic sciences and participant of The Islamic Finance Codex Course by Mufti Faraz.

26 August 2025 7 min read

24 July 2025 15 min read

16 July 2025 5 min read

Leave a Reply