Better finance for every Tom, Dick & Haarith

Here are the wide array of Islamic financing options available

Islamic home finance

There are now a number of halal home financing providers in the UK. You can check them out on our compare page.

Islamic Mortgage ComparisonIslamic business finance

-

Unfortunately, things are still a little patchy when it comes to business finance.

In the UK, for SME businesses you should check out Qardus. Asset financing is often halal too (so check out people like Investec for this).

-

Overseas, there are now a range of options in the Middle East such as Funding Souq, Erad, Lendo and many others.

-

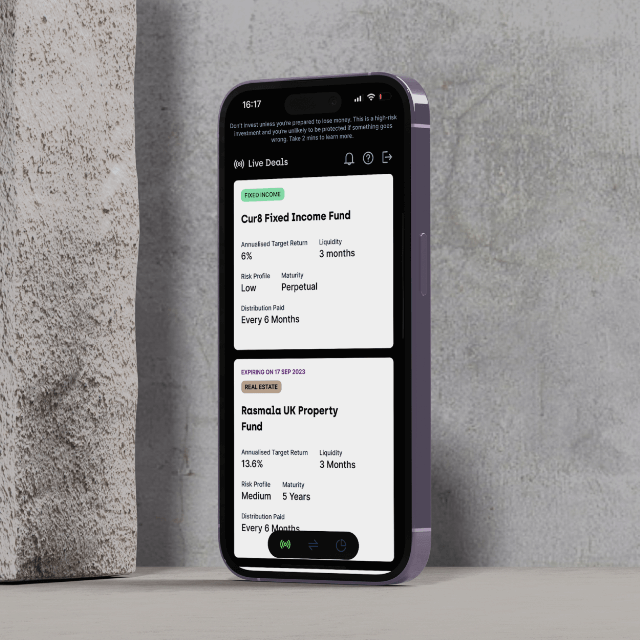

For startup funding, we can potentially help at cur8.capital (we only focus on high potential tech startups though and we unfortunately have to be pretty picky).

-

There are now other players like Maydan Capital, Ethis in Malaysia and Falcon Network in the UAE. You should check them out too.

The AAOIFI Standards Unpacked Course

Master the AAOIFI Standards with Usul Fiqh and Maqasid Shariah: A Comprehensive Two-Year Study Program

Enroll in Course Explore DetailsIslamic banking

For savings accounts and current accounts there a number of banks to choose from

Traditional banks include: Al Rayan, Gatehouse, Al Ahli, BLME, QIB (UK) and Habib Bank AG Zurich. Digital (neobanks) include: Kestrl, Nomo, Algbra and Niyyah.

We did a detailed comparison between them.

View Comparison

Guides & FAQs

-

Riba is commonly translated to ‘interest’ or ‘usury’ in English and is a charge for the use of another’s money. It also includes unequal exchanges.

An example of this would be taking a loan from someone who expects it to be repaid in addition to 5% per month on anything that has not been paid at the end of each month.

So, for example, you lend £100 for one month. At the end of that, you would repay £105.

Riba plays an important part in Islamic Finance because interest is forbidden and Islamic Finance looks to create Financing options for Muslims that are shariah-compliant and without riba.

You can read about Riba in depth here.

-

Gharar means ‘uncertainty’ and is associated with deception involving uncertainty and risk. It is rooted in the Arabic word ‘to deceive’ (gharra).

Gharar is a broad concept and can involve:

- Unclear or suspicious claims

- Uncertain existence, quality, or characteristics of a commodity.

- Pure speculation where an outcome depends on excessive uncertainty and this risk is not shared.

- Where consequences are concealed due to lack of openness between parties or a lack of information of the contract or the nature and quality of the subject matter or where a deal is made based on a misunderstanding.

Gharar can include:

- Gambling (maysir).

- Contracts that are not drawn out in clear terms.

- Derivative transactions (such as forwards, futures, options, and forms of speculation such as short selling).

- Selling something of uncertain quality.

You can read more about Gharar here.

-

In order for an investment to be halal, it must be compliant with the regulations and principles set out by Islam in the Quran and sunnah (known as ‘shariah law’).

There is nothing inherently haram (impermissible) about earning money through profit distributions from business activity or from the increase in value of assets.Read about the halal investment criteria here.

-

For a property investment to be halal, each investment and element of the investment contract must be in line with shariah.

This requires that:

- The subject matter must be halal i.e. you don’t want to collect rental income from a casino for example

- You are not charging interest such as late payment fees

- You must have a form of ownership of the property

- The capital amount you are using to invest – must be halal.

Read about this in detail here.

-

Riba (interest) is prohibited in Islam because it is seen as exploitative, treats money as a commodity rather than a medium of exchange, and undermines economic justice. Learn more about why riba (interest) is haram in Islam in our full guide.

Related Articles

Wahed Invest – A Detailed Review & How to Use It (2025)

24 July 2025 15 min read

The Fall of Riba in the New York of Ancient Arabia

21 March 2025 4 min read