Are Prediction Markets Halal or Haram? The Truth About Polymarket & Kalshi

06 February 2026 7 min read

Ibrahim Khan

Co-founder

15 min read

Last updated on:

Wahed is one of the largest halal investing platforms, and for many years has been the leading (and frankly, only) viable halal alternative for Muslims wanting to invest in the public markets. However, thankfully there are now a lot more options for Muslim investors, so in this review we will analyse how Wahed stacks up against the competition.

We’ll cover their product range, we’ll share what 50 real investors think of the platform, and we’ll give you our honest verdict on whether Wahed still deserves a place in your halal investment portfolio today.

If you prefer, you can watch our Youtube review of Wahed instead.

Now, before we dive in, I should flag that in a few product areas, Cur8 Capital, our investment firm, and Wahed are competitors.

Whilst fundamentally we focus on private investments and Wahed’s bread and butter is public investments, there are 2 areas where we have started to overlap further to Wahed’ recent product expansion – real estate and venture capital. There are nuances between the two offerings still – and we’ll explain those later.

You might also wonder – why do we regularly give coverage to our competitors? The reason is simple: We want our mission to succeed – for Muslims to level up financially – and if that happens with us – great – and if it happens with a competitor? Also great.

We have a platform at IFG and we think its only fair to you – our audience – to give you a full perspective so you can decide for yourself.

Plus, Cur8 won’t be right for everyone, and you need multiple players in a field for the customers to have the best experience.

With that, let’s dive in.

Let’s start with what Wahed actually offers in 2025.

In the early days, it was a robo-advisor. You picked your risk level, and it allocated your money across halal stocks, a bit of sukuk, and maybe some gold.

That core model still exists — and it’s still the main reason many people use Wahed.

But over the last few years, the platform has expanded significantly.

Today, you can use Wahed to invest in real estate. You can back startups through their venture offering. You can open a pension. You can even write your Islamic will.

It’s become a much more comprehensive ecosystem.

But of course, with more products comes more complexity. So let’s break down each of their product offering and stick around for the end where I discuss how Wahed stack up against the competition.

Wahed is akin to a brokerage platform or a financial adviser in that it doesn’t invest money into its own funds. What it does do is it allocated your money across a variety of other funds that you can buy (more on whether you should just buy these directly below). The main funds/instruments it invests in are the below.

Global Equities:

Emerging markets:

Sukuk:

Gold:

The idea here is simple: you get exposure to hundreds of companies and assets in one go, without having to build that portfolio yourself.

This is especially valuable if you’re just starting out or you want something hands off.

You can choose your risk level — from conservative to aggressive — and Wahed takes care of the allocation.

So far, so familiar.

What’s changed is two things:

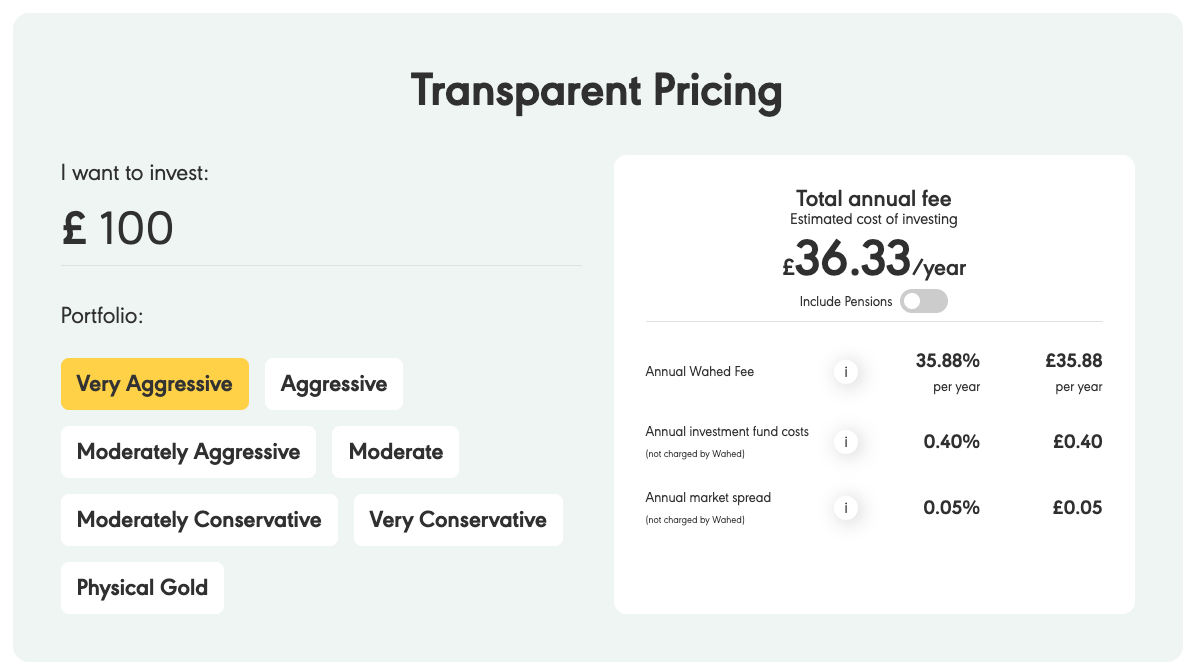

Their fee structure. Since last year, the fee structure has changed from:

Before:

After:

Bottom line, for most investors, their fees have gone up and fairly substantially. And if you were thinking of dipping your toes in with just £100, then you should avoid as their fees on that over a year will be a whopping c36%.

So if you’re coming in with a small amount, you should do it with a view to quickly getting to a level where their fee is at max 1% of your portfolio (which is £3,600+) or you should look at some lower-cost alternatives that we’ll get into later.

Do I think their fee changes are a good thing?

Well the answer is complicated.

The problem is – I don’t think roboadvisory is a great business model if I’m honest. Margins are wafer thin and you need to get to significant scale for things to stack up.

That’s why Wahed is still not at break-even across the global business to this day.

So fees have to go up in order for the business model to work – but then consumers rightly ask themselves – can’t I just do this myself for a lot cheaper?

So the only way out of this for Wahed in my humble opinion is leave roboadvisory as a loss-leader – keep fees really low – and then to get into higher margin products – and to do them really well.

And the kinds of products they should do should be focused around public markets – not the private markets. Because they have nowhere near solved all the public markets problems and that is their competitive edge.

To be fair to them, one such product is the SIPP. You can now open a SIPP (a self invested personal pension account) and invest in those portfolios for your pension.

Now SIPPs are different from your normal workplace pension which is where you and your employer contribute as SIPPs are standalone pensions that you voluntarily open and where you usually have a choice over where to invest it.

The fees are the same as the core portfolios but with an added £2.50 monthly maintenance fee

If you’re self-employed or a freelancer or you have some old pensions you want to consolidate, and need a halal option, this could be a good way to take control of your pension situation.

Wahed have recently launched Wahed Real Estate, which is a product that allows you to invest in individual properties in the UK and potentially benefit in the rental income and any gains in the property value.

You can start with just £500. And Wahed manages the whole thing for you; tenants, maintenance, legal stuff

That all sounds great.

Now, this model isn’t entirely new, with platforms like Yielders doing fractional property investment a long time before. But what Wahed’s done is bring it into a wider ecosystem. If you’re already using Wahed for your investing, it’s quite convenient to have real estate in the same place too.

For many Muslims, property has always been a go-to asset. The idea of steady, tangible rental income (especially in the form of quarterly dividends) just feels a lot more grounded than the ups and downs of the stock market. So this adds a nice bit of balance to an equity-heavy portfolio.

But let’s talk fees, because this is where things start to bite a little.

There’s the associated costs that come with buying, maintaining and selling a house which is all standard. What investors want to know is how much Wahed are charging.

Here’s the breakdown:

And by the way, the amounts of both vary depending on the property or the deal. We’ve included an example below:

So yes, you’re getting hands-off, Shariah-compliant property exposure, but you’re definitely paying for the privilege.

It is also early doors – Wahed have done less than half a dozen deals and deals have all been sub-7-figures. So if you’re someone who wants to build a portfolio, you’ll have to do it slowly over time as this is not a fund vehicle.

It’s also worth noting: this is still property. Your money is tied up for 5 years, and there’s no real secondary market yet as far as we know — so once you’re in, you’re in.

If you’re looking to add some real estate exposure to your halal portfolio and don’t want the hassle of managing it yourself, this could work.

But if you’re fee-conscious, or you think you might need that money soon — this probably isn’t the place to start.

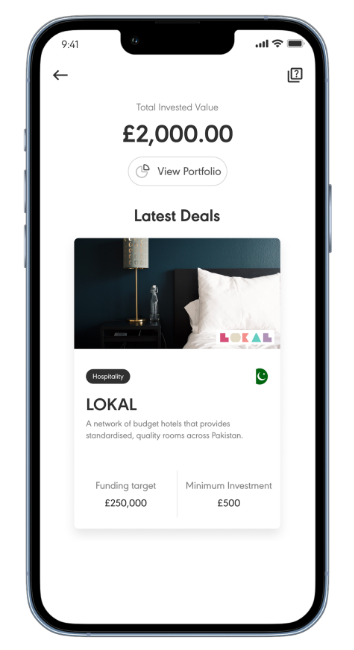

If Wahed Real Estate is the “slow and steady” option, then Wahed Ventures is the exact opposite.

This is their startup investing platform, where you can back early-stage companies with as little as £500. It’s high-risk, high-reward stuff. You’re putting money into startups that are at the pre-seed or seed stage, long before they’re profitable — or even proven. You can learn more about venture capital and startup investing in our explainer article here.

Now as someone who often looks at the same deals as Wahed – I think it would be unfair to Wahed Ventures and to their portfolio companies to comment on individual deals but as a general comment let me explain to you the key indicators to look out for with Wahed Ventures, Cur8, or any investment platform that deals with VC investing:

Customer service I’ve heard is good and the platform they use is a standard one used by many in the industry – so well tested, clean and reliable.

The other thing that the product doesn’t provide right now is – pooled vehicles to invest through. It is only deal-by-deal. This is a problem for many reasons – the big one being lack of diversification for investors, and the fact that the best startups typically don’t want to publicly list their details on a crowdfunding platform.

The other thing is, having to talked to many folks in the Wahed team the direction of travel by Wahed is now much more towards the real estate side of things – not VC. So I’m not sure new deals will be coming along with any degree of regularity.

So should you jump in?

Well the big worry I have is, if they’re not as focused on this area as before, you won’t get the regular dealflow with them that you need to build a diversified portfolio.

But if you’ve already got your core investments sorted — things like stocks, sukuk, maybe even a bit of gold or real estate — and you’ve got money you can afford to lose… then sure, a dabble on a random startup could be exciting.

Even for this type of investor though, I would encourage a portfolio approach – just because of the risks in VC. You can use platforms like Wahed, Crowdcube, Seedrs etc to at least build a diversification but honestly, I’m not sure you’ll get the best deals. For that you need to invest through funds.

I know because I started our platform like Wahed – deal-by-deal – but I very quickly realised that the fund route was the best route as otherwise you don’t get allowed into the best startup deals. Since we became a fund – things have become a lot easier.

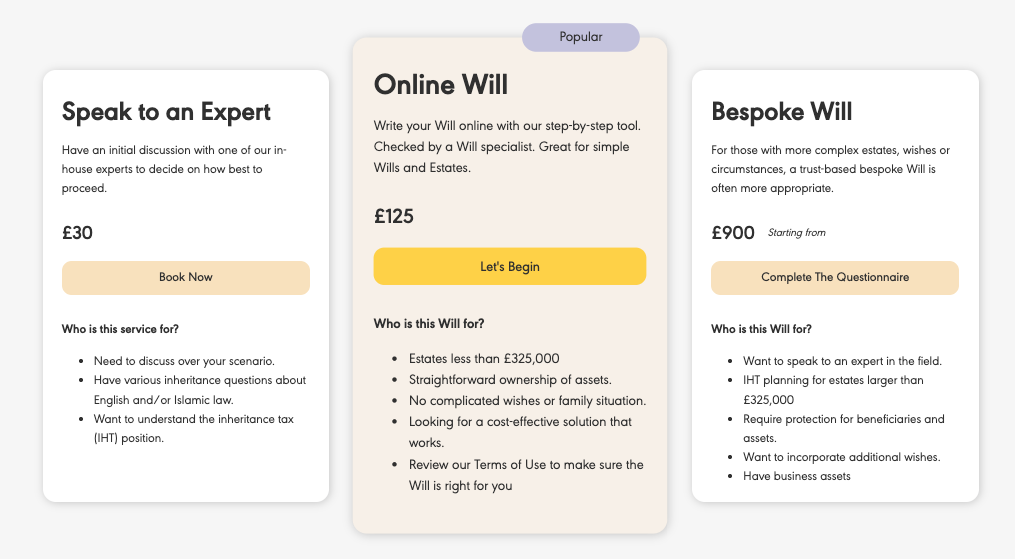

Let’s talk about wills.

Most Muslims know they need a Shariah-compliant will. But for one reason or another, it never gets done.

Wahed now offers a will-writing service, powered by iWill Solicitors, where you can create a UK-legal, Islamic-compliant will online in as little as 20 minutes.

How much does Wahed Wills’ cost?

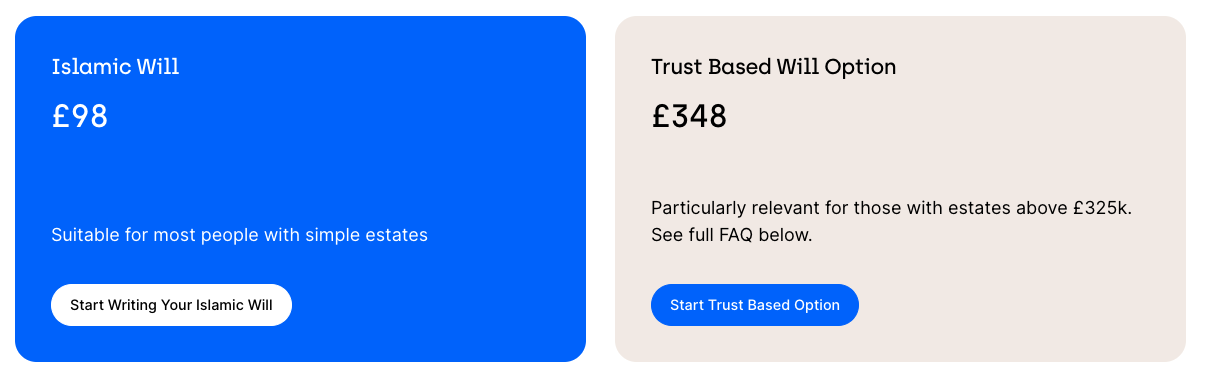

Now, for comparison: we at IFG Wills charge £98 for a simple will, and £348 for larger estates — so Wahed isn’t the cheapest around but it’s pretty price-competitive. Other Islamic-friendly solicitors also exist, often within the same ballpark.

That said, if you’re already using Wahed and like the idea of keeping it all in one place, it’s a tidy little add-on.

And for more complex wills, iWills are an excellent team with a lot of experience dealing with larger pots.

Bottom line: just get it done. Whether it’s through Wahed, IFG, or anyone else — don’t leave your family with a mess.

Wahed doesn’t just offer portfolios — they’ve also got their own ETFs listed on the US stock exchange.

$HLAL – this gives you exposure to large Shariah-compliant US companies, think of it as a halal version of the SP500

$UMMA – their broader global Islamic ETF which is diversified across geographies and not US heavy like HLAL.

These ETFs are Shariah-compliant, diversified, and relatively low cost, with annual fees around 0.5%.

And they’ve performed decently, especially $HLAL which is up 101.67% over 5 years at the time of writing, just a tad better than $SPY the actual SP500 which is up 100.4%

Now here’s the interesting part: you can buy these ETFs yourself, directly from any decent broker. So you might be wondering…

One of the most common things we hear is:

“Can’t I just do this myself on Trading212 or Hargreaves Lansdown and skip Wahed’s fees?”

And the short answer is: yes — to an extent.

You can buy some of the same ETFs Wahed uses, like the iShares MSCI World Islamic or the Physical Gold fund. You’ll avoid the platform fee and keep full control.

But here’s the trade-off:

And let’s be honest — most people just don’t get around to doing that. Life gets in the way. Suddenly your portfolio is 80% tech stocks and you’re wondering why your returns are all over the place.

That said, if you’re planning to pick a few ETFs and also invest in individual stocks on the side, and you’re happy keeping an eye on it all — this can actually be a decent middle ground.

DIY investing can work really well if you enjoy it and you’re willing to stay on top of things. But if you want something more hands-off, Wahed still earns its keep through convenience.

Now let’s hear from what actual Wahed investors have to say.

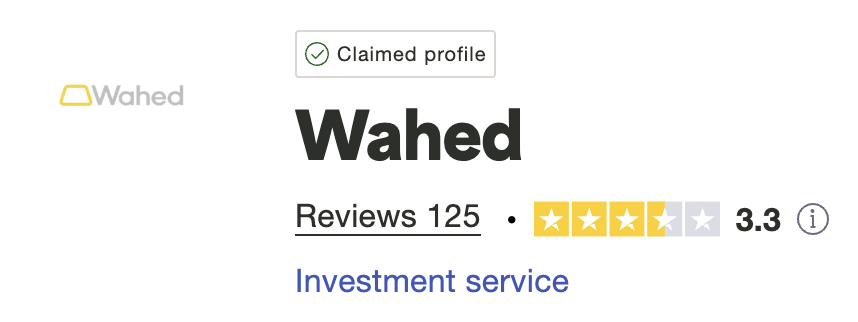

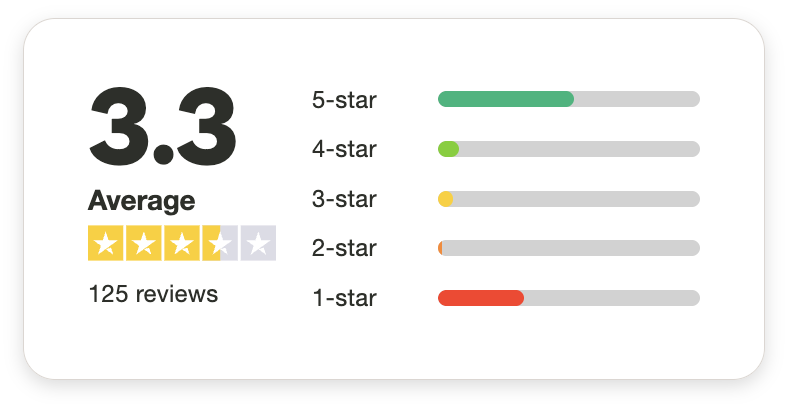

Let’s start with Wahed's trustpilot score which is a bit of mixed bag with an average score of 3.3 which is not great.

The common themes are:

– withdrawals taking too long

– slow customer service support

Around 50% of their reviews are 5 star with investors happy with the platform and returns.

We also asked our own readers via our newsletter and got 45 responses.

The positives were the app was halal and easy to use so good feedback from there.

But what our readers felt could be improved was:

– mainly with regards to their high fees

– with a few comments on performance and customer support

The good news for Wahed though is that the feedback to them is plentiful – from customer feedback like the stuff we shared, to the more strategic advice I gave earlier.

If Wahed implement that, they should see this score improving. But they desperately need to do that.

Back in the day, Wahed was the only serious halal investing option on the block.

Now, thankfully, that’s changed — and it’s good news for Muslim investors. More platforms means more choice, more innovation, and better pricing pressure.

So how does Wahed stack up?

Let’s break it down:

If you’re just looking for a simple halal portfolio, Simply Ethical can be cheaper than Wahed, especially for smaller investments. The platform’s pretty no-frills, but if cost is your main concern and you’re not fussed about extra services, it’s worth a look.

They also offer financial advice for larger clients, which can be very helpful for some.

Amal is a relatively new platform that takes a slightly different approach. Instead of charging an ongoing percentage fee like Wahed, they have a one-off setup charge, which can be more cost-effective over the long run.

It’s also a great business model because you get a whole chunk of revenue upfront to then further reinvest into the product and into marketing.

They offer two types of portfolios:

But what really stands out with Amal is their built-in screening. They actively filter out companies involved in activities Muslims may want to avoid — including those on boycott lists. If ethical screening beyond just halal compliance matters to you, Amal’s worth considering.

Another investing platform is Zoya, a halal investment research and screening app, that now integrates with brokerage accounts for self-directed investing.

Here are some things that Zoya offers:

Zoya’s best for investors who want to make their own choices about where to invest, but just need help finding up-to-date data and might like extra ethical filters. It’s not a robo-advisor: you make all the decisions and investments yourself – Zoya just gives you the tools to do this.

Like Amal Invest they too allow integrations in with various brokers so you can trade directly through these other apps – but stay within Zoya.

This is the wildcard option. If you know what you’re doing, you can build your own halal portfolio using ETFs and stocks and skip the platform fees entirely.

But you’ll need to screen your own investments, rebalance your portfolio, and stay on top of the admin. If you’re comfortable with that, it’s an option. It’s not for everyone but this is what I personally do for my own investments.

And then there’s us. We also offer halal investing, but we do something quite different. Wahed gives you public market access — stocks, sukuk, ETFs.

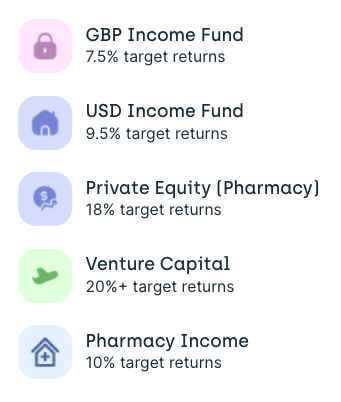

At Cur8, we focus on private markets — startups, income funds, private equity, venture capital.

As you can see, Wahed is the place to go to when it comes to stocks and shares because we don’t offer that yet.

On the private market side, this is our expertise and we’ve got a really deep amount of experience but also coverage in this space.

When it comes to real estate and startup investing, Wahed have now (as we’ve covered above) started offering those products as well, but they are a little bit earlier in their journey.

The other key difference is that because of our regulatory license, our minimum ticket is £5,000. And we only deal with high net worth or sophisticated investors, at least at this moment in time.

So the typical investors we attract are naturally a little bit older and/or well-off. And honestly, we’re not necessarily the perfect fit for a first time investor looking to just dip their toes with £100 or £500.

So, whether Wahed is the best option for you really depends on what you’re looking to invest in, how hands-on you want to be, and what stage you’re at in your financial journey.

If you’re a beginner or a time-poor investor looking for halal investments that are diversified, automated, and compliant — Wahed is still one of the best options out there. Better even than Cur8.

If you’re more experienced, have a larger portfolio, and want to take a hands-on approach — then you might save money going DIY or mixing platforms, including more advanced platforms like Cur8 Capital.

Ultimately, Wahed has built something impressive and they have blazed a trail where others have followed – and for that they deserve some credit.

If you’ve used Wahed yourself, let us know in the comments: what worked for you, what didn’t, and what you’d like to see improved.

And if you’re starting out on your investment journey, use our free investment checklist to get started on thinking about what your investment objectives and risk appetite is.

06 February 2026 7 min read

26 August 2025 7 min read

Leave a Reply