Wise up with

halal crypto

We share our sharia screening of the top 50 cryptocurrencies. This is a live list that will be added to inshAllah.

If you're new to investing, download our free halal investment checklist for a step-by-step guide on how to build a diversified portfolio here.

Halal cryptocurrencies to invest in

Take a look at our sharia analysis on over 50 crypto currencies

BTC is a straightforward cryptocurrency and has been deemed permissible by many scholars (though some do disagree. See this article). It is best understood at this point as a digital asset (as opposed to a currency just yet) and as such delayed delivery/receipt of BTC is permissible.

BTC is a straightforward cryptocurrency and has been deemed permissible by many scholars (though some do disagree. See this article). It is best understood at this point as a digital asset (as opposed to a currency just yet) and as such delayed delivery/receipt of BTC is permissible.

Similar analysis to BTC

Although it’s backed by interest bearing instruments, it cannot be said that the owner of USDT is the actual owner of a portion of a debt. The reserve is created with the objective of supporting the currency and network and not with the aim of transferring debts to a third party.

Although it’s backed by interest bearing instruments, it cannot be said that the owner of USDT is the actual owner of a portion of a debt. The reserve is created with the objective of supporting the currency and network and not with the aim of transferring debts to a third party.

Similar analysis to BTC

Similar analysis to BTC

Similar analysis to USDT

Similar analysis to BTC

Similar analysis to BTC

Similar analysis to BTC

Similar analysis to DOT

Similar analysis to DOT

Similar analysis to DOT. Learn more here.

Similar analysis to DOT

The DOT token is simply an agnostic token that allows you to transact within the Polkadot ecosystem however the idea is that lots of external third parties can plug and use this ecosystem to transact. Fundamentally, the more people use this ecosystem, the greater the liquidity and demand for the DOT token. One point to bear in mind from a sharia perspective is if one ecosystem becomes overwhelmingly linked with a haram industry then there may be an issue. However right now its all too early to make such a judgement call.

The DOT token is simply an agnostic token that allows you to transact within the Polkadot ecosystem however the idea is that lots of external third parties can plug and use this ecosystem to transact. Fundamentally, the more people use this ecosystem, the greater the liquidity and demand for the DOT token. One point to bear in mind from a sharia perspective is if one ecosystem becomes overwhelmingly linked with a haram industry then there may be an issue. However right now its all too early to make such a judgement call.

The native token of the bitfinex exchange. They reward you with discounts on their platform based on how much LEO you own. There is nothing problematic with these kinds of rewards for holding such a utility token.

The native token of the bitfinex exchange. They reward you with discounts on their platform based on how much LEO you own. There is nothing problematic with these kinds of rewards for holding such a utility token.

Similar analysis to BTC

Similar analysis to BTC

As it is a synthetic coin using short future positions it would be impermissible

As it is a synthetic coin using short future positions it would be impermissible

UNI is a token for a project that essentially doubles up as a broker-less crypto exchange platform. Think coinbase, but automated and without a central clearing authority. So far so good. But the issue here is that UNI structure relies on people to contribute in their coins and get paid a fee for this into the system to provide liquidity.Exchanging using Uniswap itself is fine. But that is not the question here.The question is whether UNI itself is inextricably structured to be used in a way that ends up being sharia-non-compliant. The key issue is the contribution of coins to provide liquidity.Either we view this as some form of lending out or we see it as taking an equity-like position or revenue-sharing position that someone. On the basis that fundamentally each contract does not diminish with each exchange rather it is balanced out with the new coin that is entered in we consider uniswap to be using a form of revenue-sharing or taking mini-equity-like positions in each Exchange Contract.

UNI is a token for a project that essentially doubles up as a broker-less crypto exchange platform. Think coinbase, but automated and without a central clearing authority. So far so good. But the issue here is that UNI structure relies on people to contribute in their coins and get paid a fee for this into the system to provide liquidity.Exchanging using Uniswap itself is fine. But that is not the question here.The question is whether UNI itself is inextricably structured to be used in a way that ends up being sharia-non-compliant. The key issue is the contribution of coins to provide liquidity.Either we view this as some form of lending out or we see it as taking an equity-like position or revenue-sharing position that someone. On the basis that fundamentally each contract does not diminish with each exchange rather it is balanced out with the new coin that is entered in we consider uniswap to be using a form of revenue-sharing or taking mini-equity-like positions in each Exchange Contract.

Doubtful

While the creation of DAI might have some discussion over it, it is fundamentally a cryptocurrency and there isn’t anything obviously problematic about using it. The Dai Savings Rate however is a separate concept that we have not commented on here.

While the creation of DAI might have some discussion over it, it is fundamentally a cryptocurrency and there isn’t anything obviously problematic about using it. The Dai Savings Rate however is a separate concept that we have not commented on here.

AAVE is a lending ecosystem designed to help holders of cryptocurrency lend their coins out for a higher return. The crucial thing here is that a cryptocurrency is borrowed and then more of that cryptocurrency is returned. That is straightforwardly riba and not permissible.AAVE itself is not a haram asset per se, but our cautious view is that it is so inextricably linked up in its very origination as something that gets value from lending activity, that it is not something to support by even holding AAVE.

AAVE is a lending ecosystem designed to help holders of cryptocurrency lend their coins out for a higher return. The crucial thing here is that a cryptocurrency is borrowed and then more of that cryptocurrency is returned. That is straightforwardly riba and not permissible.AAVE itself is not a haram asset per se, but our cautious view is that it is so inextricably linked up in its very origination as something that gets value from lending activity, that it is not something to support by even holding AAVE.

Monero is a privacy-focused coin, so you can’t see source, amount destination as an outsider, which, inevitably, has seen strong uptake from criminal elements. From a sharia perspective there is nothing technically wrong with holding a coin that others use for criminal enterprises, however from a taqwa perspective we would be uncomfortable adding liquidity and value to a currency that is gaining most of its traction by the degree of uptake it is getting in the criminal world.

Monero is a privacy-focused coin, so you can’t see source, amount destination as an outsider, which, inevitably, has seen strong uptake from criminal elements. From a sharia perspective there is nothing technically wrong with holding a coin that others use for criminal enterprises, however from a taqwa perspective we would be uncomfortable adding liquidity and value to a currency that is gaining most of its traction by the degree of uptake it is getting in the criminal world.

Similar analysis to BTC

CRO broadly has a similar analysis as that applied to BTC

CRO broadly has a similar analysis as that applied to BTC

Similar analysis to DOT

Similar analysis to BTC

A nice simple vanilla crypto token with staking and governance rights – nothing problematic here.

A nice simple vanilla crypto token with staking and governance rights – nothing problematic here.

THETA aims to reward users with THETA tokens for opening up their free CPU resource so that video streaming services can be provided without lag or glitches etc. The underlying issue is that last-mile-delivery on video streaming is poor and THETA can help provide the computational resource to help solve that. This is all fine.Where it gets a little bit greyer is THETA being used within the video ecosystem itself. Ultimately my view is that this is fine too, but one to keep an eye on, in case THETA suddenly has mass adoption by illicit streaming sites etc.

THETA aims to reward users with THETA tokens for opening up their free CPU resource so that video streaming services can be provided without lag or glitches etc. The underlying issue is that last-mile-delivery on video streaming is poor and THETA can help provide the computational resource to help solve that. This is all fine.Where it gets a little bit greyer is THETA being used within the video ecosystem itself. Ultimately my view is that this is fine too, but one to keep an eye on, in case THETA suddenly has mass adoption by illicit streaming sites etc.

Similar analysis to BTC

Similar analysis to BTC

IOTA is a token used to power the technology ecosystem that IOTA have created. Nothing to suggest any issues with this

IOTA is a token used to power the technology ecosystem that IOTA have created. Nothing to suggest any issues with this

Maker operates a dual token system MKR which is a governance token. And DAI which is a token created out of loans made by the platform to the users. The interest on these loans are paid through the stability fee. This stability fee should not be confused with a maintenance fee or service fee for using the Maker Vault. It is clear that the crypto deposits are used as collateral for borrowing DAI. Hence, if the collateralization ratio drops below one hundred and fifty percent the traderÕs collateral will be liquidated to pay off their loan. The platform is used to generate interest based loans, hence creating DAI and owning MKR are not shariah compliant.

Maker operates a dual token system MKR which is a governance token. And DAI which is a token created out of loans made by the platform to the users. The interest on these loans are paid through the stability fee. This stability fee should not be confused with a maintenance fee or service fee for using the Maker Vault. It is clear that the crypto deposits are used as collateral for borrowing DAI. Hence, if the collateralization ratio drops below one hundred and fifty percent the traderÕs collateral will be liquidated to pay off their loan. The platform is used to generate interest based loans, hence creating DAI and owning MKR are not shariah compliant.

Similar analysis to BTC

Similar analysis to Monero

What our Customers say

Guide & FAQs

-

Yes, please see above list.

-

Zakat on Crypto is a topical question. You can calculate your zakat on crypto here plus you get a free portfolio health check too.

-

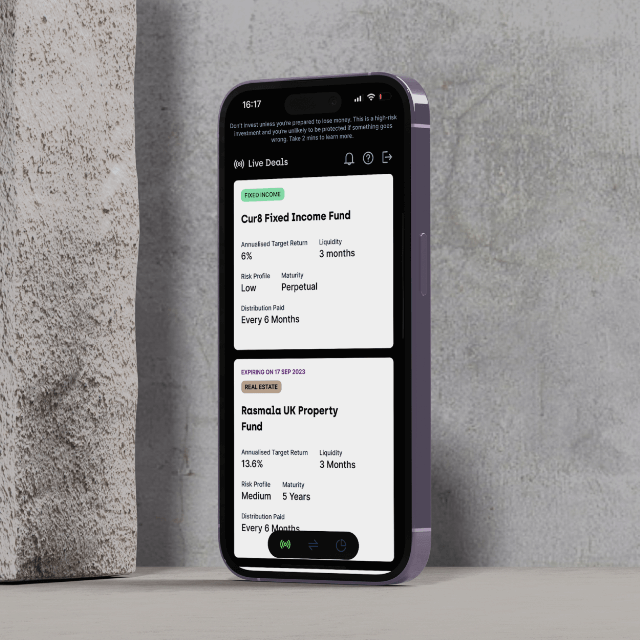

Bitcoin/crypto is a high-risk high-reward investment. See this guide to these kind of investments and what other options are available out there. We have relatively safer halal investments list here. In particular, we do recommend you check out venture capital investing in early-stage technology startups. You can learn about this investment class for free on our Ultimate Startup Course and you can hear about cool investment opportunities in this space when you join our angel investor syndicate: Cur8 Capital.

-

You should check out out Crypto FAQ and articles compendium here.

Related Articles

Is Bitcoin and Crypto Haram? The Ultimate Guide for Muslim Investors

14 July 2025 9 min read