Autumn Budget 2025: What This Means For UK Muslims

26 November 2025 6 min read

Adil Hussain

Head of Content

7 min read

Last updated on:

Every year during Dhul Hijjah, the sacred plains of Makkah come alive with the voices of the Hujjaj.

“Labbaik Allahumma labbaik…” echoes through the air, filling the hearts of millions around the world.

And for those of us watching from afar, there’s a deep ache in our hearts. A longing.

We want to be there too.

Performing Hajj is a once-in-a-lifetime obligation for every Muslim who is physically and financially able, but with the way prices are rising, you might be wondering if you’ll ever afford it.

The cost of Hajj from the UK has gone from around £3,000 a decade ago to around £10,000+ today.

Here’s the truth. Yes, Hajj is expensive.

But it’s not impossible.

It’s within reach for most people. You just need two things:

In this article, I’ll walk you through a clear, step-by-step plan to save and invest for Hajj, even if you’re starting from scratch or earning a modest income.

It’s realistic, simple, and achievable for anyone who’s serious about making the journey.

In recent years, the cost of Hajj has increased significantly.

While prices vary depending on package type, departure location, and duration, most Hajj packages from the UK now fall between £7,000 and £14,000. Factors that affect pricing include:

Planning for Hajj is not something to leave until the last minute. It requires sincere intention and proactive financial preparation.

The journey to Hajj doesn’t begin with money. It begins with a sincere intention.

Even if you’re ultimately unable to go, because of finances, health, or other circumstances, the intention alone carries immense weight in Islam.

The Prophet ﷺ said:

“Verily Allah has written down the good deeds and the evil deeds, and then explained it:

‘Whoever intended to perform a good deed but did not do it, Allah writes it down as a complete good deed. And if he intended to perform it and then did perform it, Allah writes it down as ten good deeds, up to seven hundred, or even more.’”

(Bukhari; Muslim)

This hadith is a powerful reminder that even when outcomes are uncertain, sincere effort is never wasted.

So if Hajj feels far off right now, start with a sincere intention. Make the du’a. Ask Allah to open the way.

Then take action.

In the rest of this article, I’ll walk you through three things you can start doing today to help bring your Hajj goal within reach.

Let’s get into it.

First, we need a target. Based on conversations with past and present Hujjaj, the average cost of Hajj today is around £10,000.

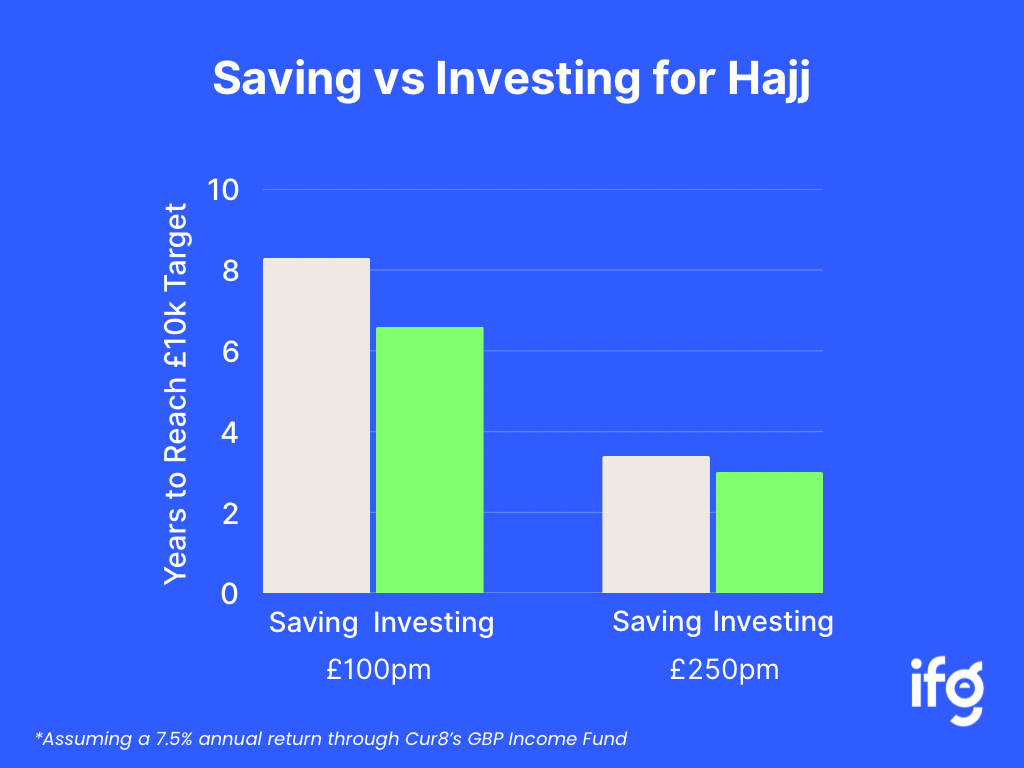

It’s a big number but not out of reach when you spread it over time. In fact, saving just £100 a month adds up to £10,000 after 8 years and 4 months.

Now here’s how we’re going to actually get there and get there faster (within 3 years):

We’ll start by forensically analysing our spending and identifying at least £100 in monthly savings. The key to this is tracking your expenses. You can use your bank statements, budgeting apps like Snoop or Kestrl, or even a simple spreadsheet you regularly update yourself (yes, we’re talking old-school Excel).

Take a look at these expenses and separate the wants from the needs. Be ruthless here, your future self will thank you.

Keep an eye out for small, regular payments for things like daily coffees or lunches. Skipping the daily Pret coffee and opting to make it at home might not seem glamorous, but doing this regularly can save you around £50 a month alone.

Look to switch to cheaper service providers where you can, and look out for sneaky ‘zombie subscriptions’, like that gym membership you haven’t actually used in months.

Now to help us reach our Hajj goal faster, we want to increase our monthly savings from £100 to £250.

To do that, there’s one simple golden formula you need to understand when it comes to personal finance.

Income – expenses = savings

What this formula tells us, is that to increase your savings, you have 2 options:

There’s a natural limit to reducing your expenses (you can only go so far) whereas theoretically there isn’t really a limit for how much you can increase your income by.

In this section, we will list 3 proven methods to increase your income and how for our Hajj gameplan we can eke out an extra £150pm:

A pay rise is one of the most efficient ways of increasing your income as you’re essentially getting paid more for roughly the same amount of work.

Generally speaking, we should always be aiming to secure a pay rise each year (whether that’s at your current job or by making an external switch).

For our gameplan here of saving for Hajj in just 3 years, you don’t necessarily need a large amount.

In fact, a £2,500 annual raise works out to about £150 per month post-tax, which is what we need for our Hajj target.

We know the idea of asking for a raise might seem daunting, so here are some things you can do to strengthen your position:

If you work in a job that’s shift-based or pays overtime, then you can just pick up an extra shift a week and put all of that extra money aside to your Hajj savings pot.

Side hustles are overly complicated on the internet with social media influencers constantly hyping up the next $10k per month side hustle (be that dropshipping or starting a marketing agency).

It can be as simple as doing a part-time retail job or delivering food. Even just 4 hours on a weekend nets you at least £40 per week, which adds up to £160 each month.

If you do have a more advanced set of skills under your belt however, jobs like tutoring, freelance writing (we’re looking for freelance youtube scriptwriters, so if you’re interested apply here), AI prompt-writing, or consulting can pay even better.

By increasing our savings to £250pm, we can now reach our target of £10,000 in just 3 years and 4 months.

However, we can speed this up through investing.

Investing is putting your money to work by purchasing assets that can grow in value over time. Rather than letting your saved money sit idle in an account, investing lets the money generate returns that will help to boost your Hajj fund.

Factors like inflation or increased demand for Hajj have meant that its price has skyrocketed over the years (20 years ago, our parents could pay as low as just £2,000!). By investing, you’re able to keep up with these price rises by protecting your purchasing power, or even getting ahead of inflation rates.

While there are loads of different investment options available (you can check these out in our halal investments comparison page), for Hajj savings we’re particularly interested in more stable, lower-risk options. Here are two examples:

Islamic savings accounts avoid interest (riba) and instead grow your money through halal investments ( typically funding home purchases or asset-backed deals). Islamic savings accounts in the UK typically pay between 0.5-4% and are also backed by the FSCS £85k guarantee per account.

This is a solid option to earn a small return on your savings offered by the likes of Gatehouse Bank and QIB.

To get a higher return, you can invest in property. Here you are two options:

Now, how much difference does investing make to our gameplan. If you invested the £250 saved each month and achieved a return of 7.5%, the time taken to reach the £10,000 Hajj goal falls to just 3 years.

In this example, the time saving isn’t that significant but it’s the principle that is important here:

Investing is quicker than saving alone.

The below chart shows the difference in time taken to reach our Hajj goal depending on whether we saved or invested £100 vs £250.

I hope this has shown you that once you break it all down, Hajj actually becomes quite feasible. And many of us already have some savings tucked away, whether that’s £1,000 or £3,000, which could mean you get there even quicker.

This is the essence of our mission here at IFG. We’re not here to help you grow your wealth for the sake of it. We’re here so that you can use your money for things that matter to you.

Like answering the call to Hajj.

For those of you reading this who have received the blessed invitation this year, keep the rest of us in your duas. May we all have a happy reunion on the plains of Arafat, in this life or the next.

If you want to learn more about halal investing and how to build a diversified portfolio, download our free Halal Investment Checklist; it’s a practical, step-by-step tool to get you started.

26 November 2025 6 min read

23 September 2025 4 min read

26 August 2025 7 min read

Leave a Reply