Are Prediction Markets Halal or Haram? The Truth About Polymarket & Kalshi

06 February 2026 7 min read

Khizar Mohammad

Community Lead

11 min read

Last updated on:

In 1990, the India and Pakistan economies were basically level. They had almost identical GDPs, a little under $370 per person. But by 2020, India’s GDP is now $3.5tn – 10x more than Pakistan’s.

You probably didn’t expect that, did you?

As a proud British-Pakistani, I don’t like to see that India has become the 5th largest economy in the world, overtaking the UK – never mind Pakistan as well. In comparison, Pakistan is struggling.

In this article, we aim to dive deep and study what it is that Pakistan can do to get back on a level playing field with India. We’ll also run through what India did that put it so far ahead of Pakistan.

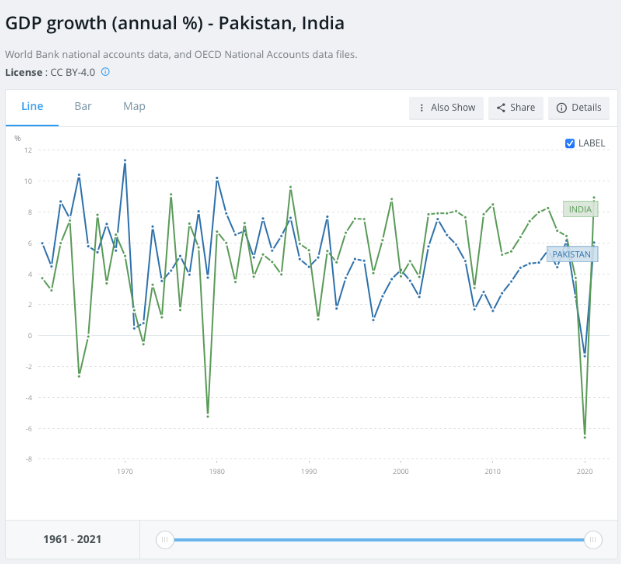

When we diagnose problems, we love to dive into the data. So this is a graph of India and Pakistan’s GDP over the last 60 years. GDP stands for Gross Domestic Product, and simply put it is one of the measures economists use to assess the size and health of a country’s economy over a period of time. The higher, the better.

What you can see is a crucial turning point in the 1990s when India began outpacing Pakistan over the next three decades. Consistently growing at 50% faster than Pakistan.

To understand why this happened, let’s talk about Rishi Sunak.. Rishi’s father-in-law Narayan Murthy founded Infosys, today one of the largest Indian tech companies and in a book about their growth, the co-founders of Infosys pinpointed 1 key thing that the government did in the 1990s that led to their growth: trade reform.

Basically, before the 1990s – if you were a businessman in India and were trying to get in foreign investment or export stuff – you would join a line at the local govt office all young and energetic and 40 years later, you would still be there. India cleverly made a bunch of changes to its laws around business, trade, and investment that made it much easier for businesses to operate and flourish.

India’s IT firms Infosys, Wipro and Tata Consultancy Services saw tremendous growth and propelled Indian industry and the economy into global view. They expanded faster than any other industry through the decade, they grew from $150 million in 1991 to more than $5.7 billion in 2000.

The rapid growth meant that Indian firms were now competing with Western ones and in some cases even doing better. Competing on a global level also meant that Indian IT firms absorbed global management practices and standards. This led to a huge number of Indians going into the IT industry and raising living standards of the working class that their parents couldn’t have even dreamt of.

Not only that, many of these IT firms had an enormous impact on attitudes towards entrepreneurship. Breaking the stereotype that only those born into big-wealthy business families can make it which had previously been the case. For example,Rishi’s father in law – N.R. Narayana Murthy’s father was a schoolteacher and his business partner’s own father worked in a textile mill.

So the Indian economy was booming thanks to its trade reforms.

Now if you imagine the economy as a bucket, you use your money to create something and then sell it, what happens is that the goods go out but more money comes back in.

And what India was doing was helping goods go out, software for example, so lots more money came in and that money was then used to create more goods that went out and then even more money came in.

So when foreign investors started seeing the profits being made in India, they became really keen to get involved so they started pumping even more money in. Which is what we call foreign direct investment.

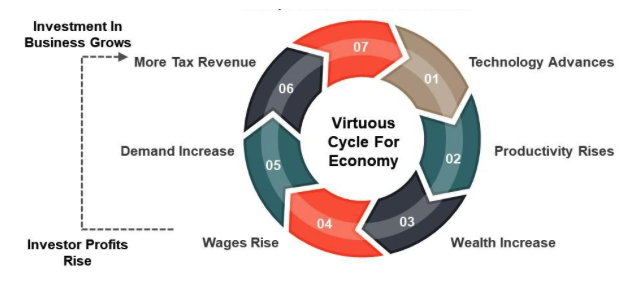

So this started a virtuous cycle where the Indian bucket grew and grew and grew.

Now you contrast this with Pakistan. Pakistan had too many barriers to exporting goods. Pakistan didn’t have the same acceptance of foreign direct investment. They didn’t make it easy for investors to even get their money out either.

All this meant that instead of a virtuous cycle of a growing pot like India, Pakistan had a stagnant or even shrinking pot.

However it’s not all doom and gloom – the clever amongst you will have noted that Pakistan’s economy didn’t contract in this period. The economy of Pakistan did grow, it just didn’t grow as fast as India’s.

So what was it that was making the Pakistani economy grow that we could potentially double-click on and accelerate?

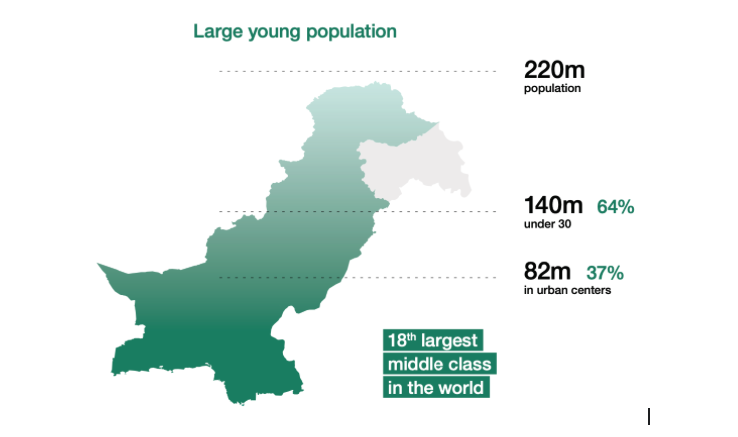

Well the answer is really a basic macroeconomic policy, Pakistan has a huge population, the 5th largest population in the world which means its got a large economy, and lots of talent.

64% of its population are under the age of 30. It has the 18th largest middle class in the world as well, which means there are a lot of wealthy people in Pakistan as well.

So Pakistan has got a young population that is tech-savvy, educated, outward-looking and with an improving political and security situation at least in the context of a democratic government and reduced terrorist attacks; Pakistan for the first time has a great opportunity to catch up.

You might be wondering why this has been the case for a few years now, what has changed?

The answer is that for the first time, because we’re living in a truly global space and following how prevalent remote working has become post-pandemic, people within Pakistan can work for companies anywhere in the globe and bring money into their economy.

Cloudways – a Pakistani company was recently bought out by Digital Ocean for $350m. And Cloudway’s customers aren’t Pakistani – they are global. That is a truly exciting development that would never be possible a decade ago.

In fact, we have colleagues who live in Pakistan and work with us at IFG, a UK company. So the money we make and pay our employees with is now flowing back into the Pakistani economy.

So the people of Pakistan, who have serious talent, are no longer restricted anymore by where they live. They can work abroad, sell abroad, earn abroad and spend locally. The world is a truly global place today, so that means more opportunities for Pakistanis to take matters into their own hands and bring money to their economy.

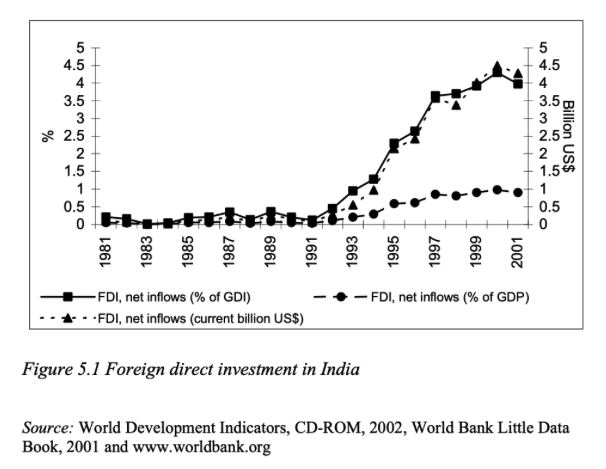

The other key trend that we saw in India’s success story was the foreign direct investment coming in. After 1991, foreign investment skyrocketed: from 1981 to 1990, FDI grew by 23 per cent annually; this increased to 44 per cent annual growth from 1991 to 2001.

Huge players like Sequoia Capital – a US venture capital firm had started investing in Indian startups and by 2000 even set up a brand in India, now known as Sequoia Capital India and have since made over 607 investments.

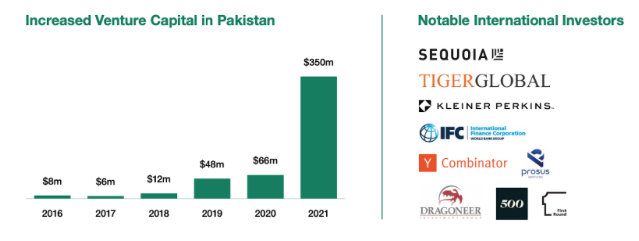

So here’s where it gets interesting. We’ve spoken about how FDI was one of the golden tickets in the Indian success story. This is now being replicated in Pakistan!

Foreign direct investment into Pakistan is hugely increasing year on year.

Some of the people that these investors will be riding alongside will be China with its $60bn+ China Pakistan Economic Corridor (CPEC) and a number of large VC funds such as Sequoia, Tiger Global and many others.

2021 saw $350 million invested by these VC funds. This is almost 6X more than what was invested the year before.

I know, I know many of you are thinking Pakistan is so backward, it doesn’t have any of this infrastructure – and yes, it’s true that it doesn’t have as good infrastructure as other places in the world.

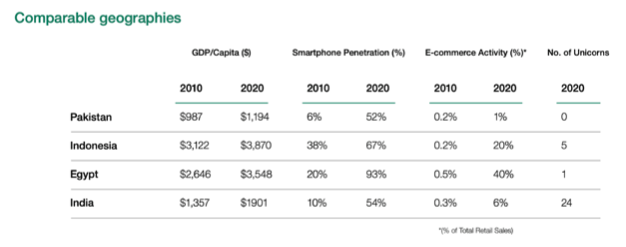

However the digital penetration, the smartphone penetration has been 52% in 2020 compared to 54% in India for the same time.

What this means is that there’s huge digital potential there. And a report commissioned by Google said that almost $60 billion worth of annual economic value can be unlocked in Pakistan by 2030 just by this aggressive digital tech penetration which is already underway.

To give you context to that number, the overall GDP of the Pakistani economy at the end of 2021 was $346Bn – so $60bn, roughly a 17% increase that is pretty significant for both investors and the people of Pakistan.

So we know Pakistan has all of the ingredients for a very very compelling biryani – how can we help put these ingredients together to benefit the country and also how can we as investors get access to this potentially one-in-a-lifetime pie?

The answer, folks, is venture capital.

In 2011, India had its first Unicorn – InMobi, a multinational mobile marketing technology company, and since then India has been raining unicorns. In 2022, India added its 100th Unicorn to the list. A unicorn is a privately held startup company with a value of over $1 billion.

Over the years, these unicorns have raised over $94 Bn in funding and have a combined valuation of $344 Bn.

In the FIFA 2022 World Cup, you saw adverts for Byju’s which is an Indian ed-tech unicorn. So we are directly affected by these unicorns every single day and if they’re reaching us here, thousands of miles away, that means that they have become truly global.

Now, what’s so special about a startup in the first place? What’s special is that startups attract investment to the country that they’re in and the success makes a lot of money and that money usually goes into the economy in the form of business expenditure, job creation, further infrastructure development etc.

So imagine, you have just one successful company, that means that the whole area that the company is based in suddenly has better jobs; people are better paid; they go and spend that money locally; which helps more local businesses; they then grow that then leads to more taxation; that then leads to better public services; and then even more people want to live there; which means more companies want to base themselves there because they have better access to talent and that whole virtuous cycle continues.

So if we want to play an active role in helping a country like Pakistan prosper, we need to invest in its startup economy. So how does one do that? Well there are 3 ways that you can get in on the action. Let’s unpack them.

The first way is to directly invest in the startup as an angel investor and investing your personal money doing that.

Here you might end up saving on some management fees that you would otherwise have to pay someone and have direct contact with the companies that you’d be investing in, but the minimum investment usually is in the 5-6 figures, which is normally not feasible for most people.

And given this is Pakistan and it doesn’t have a well established angel network just yet and because due diligence is so much harder in a region like that, we don’t particularly recommend this option unless you have local people on the ground whom you are trusting and investing alongside.

So this leads us to option 2.

Option two is to invest through an Angel syndicate which is a group of investors who’ll directly source their own deals from people on the ground, and they may also be on the ground themselves; they pool their money together and invest.

The benefit is that there will be a lead investor who’s experienced who other members can benefit from and all of them will have collective networks and the ability to source deals i.e. deal flow, that everyone can benefit from.

However, a warning – again if this is an angel network based outside of the country that is investing in the country without local partners, I’d be very wary.

The third option is investing through a fund. In our opinion, this is the best and safest option as long as you’ve got specialist fund managers on the ground in Pakistan.

A fund invests in a basket of startups, which already diversifies the risk, in other words, you’re less likely to lose all of your money if any one startup fails as your investment is split across all those startups.

And a second key thing is that if you have a top fund manager in that region, they will be getting access to the best startups, i.e. deal flow. And its access to the best deal flow that will enable you to really win when it comes to venture capital investing.

So as a rule of thumb, you want to pick out the top two or three funds in any industry, in any region and back them, because they’re the ones who’ll be getting the vast majority of the venture returns from that ecosystem.

And lastly, this is the fund manager’s full-time job, and remuneration depends on their startups’ success, so they are properly looking after these startups every month.

However, the downside is that these funds are typically long-term – 10 years typically – and are usually reserved for HNW individuals who can invest seven figures or more, so these remain largely inaccessible to most. Up until now, that is.

We at Cur8 Capital wanted to give the opportunity for even more people to invest in Pakistan, not only the already wealthy, so we teamed up with Sarmayacar Ventures, the oldest and most established Pakistani VC firm to deliver a fund that will invest in over 20 companies. The fund is led by a team with directly relevant investing experience, coupled with wide connectivity and an execution track record in Pakistan.

So if this is something of interest to you, head over to Cur8.Capital, sign up and you can review the detailed pack on the investment opportunity and decide from there.

Pakistan is a major player in Asia and has so much potential. Unfortunately social and political circumstance has hindered its growth, but that’s all about to change. As the pendulum of power swings back to the East, we can see more investors flock to the key economies and Pakistan is no different.

As Muslims, we should willingly support the growth of other Muslim nations and enable them to prosper the best way we can, one of the decisive ways we can help is by investing in Pakistan’s economy. The country does have a long way to go to reach its pinnacle, but by jumping on the bandwagon now and doing proper due diligence, we can ride that wave and make some profit for ourselves at the same time – hitting two birds with one stone, as the saying goes.

06 February 2026 7 min read

26 August 2025 7 min read

24 July 2025 15 min read

Leave a Reply