Islamic Mortgage Remortgage Guide: What to Do When Your Fixed Term Ends

02 December 2025 8 min read

Ibrahim Khan

Co-founder

11 min read

Last updated on:

Getting on the UK property ladder has never been more difficult, especially as a Muslim. House prices continue to soar while lenders tighten their criteria, and if you’re self-employed or have a non-traditional income stream, your options are even more limited.

However, one emerging player in the halal mortgage space is working to change that. StrideUp is offering home finance in a way that works completely differently from regular mortgages and is more accessible than some other halal mortgages.

I’ve personally used StrideUp twice. I’ve also used Gatehouse Bank and Al Rayan (who, by the way have paused their home finance product), so I know first-hand what the process is like.

In this comprehensive review, I’ll explore what StrideUp is offering in 2025, how it compares against other options and how to tell if their mortgage product is right for you.

StrideUp is a UK-based home financing fintech company started in 2017 by Sakeeb Zaman with the intention of giving people “banking products that are fair, ethical and Shariah-compliant.”

They offer 3 main products:

Their primary product is their Home Purchase Plans (HPPs).

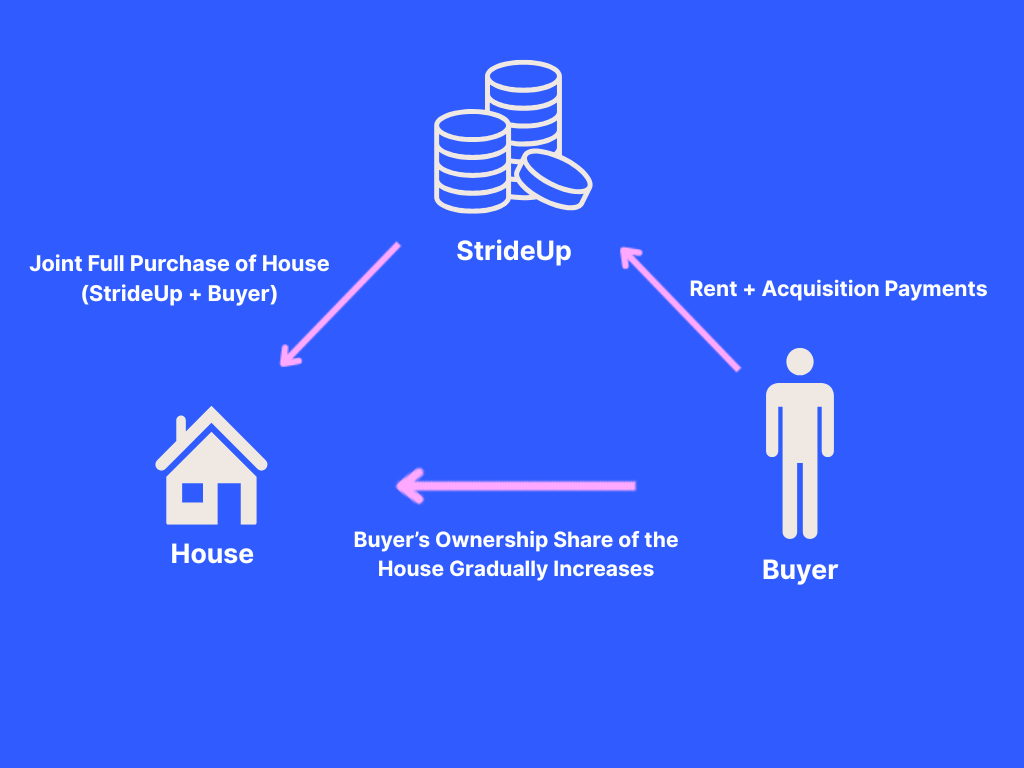

When you buy a home through StrideUp’s HPP, you don’t actually borrow money from them like you would in a traditional mortgage.

Instead, you and StrideUp buy the property together.

You put down a deposit of at least 10%, and they cover the rest.

Then, every month you make two types of payments:

This structure isn’t unique to StrideUp. Others like Gatehouse and BLME offer similar solutions, and Al Rayan before them. If you’re interested in learning more about HPPs, read this explainer on home purchase plans.

Yes, they are; their products are sharia-certified by Amanah Advisors.

Instead of lending you money and charging interest like a traditional mortgage, StrideUp buys a share of your property with you. You’re co-owners, and you pay them rent on their share until you buy it back in full.

What makes it halal is that Strideup buys the house – it is actually in their name – and will remain so – until you fully buy it from them.

In the UK, most mortgages are based on interest, which we know is not allowed in Islam.

Although traditional halal mortgage providers have been around thus far, they have been too expensive, too rigid, and too limited in who they serve.

For many Muslims who are self-employed, contractors, or who are new to the UK, this door of Islamic mortgages is actually completely shut before they can actually knock.

And it’s not just Muslims who stand to benefit from StrideUp’s products. Let me explain.

Unlike some shared ownership schemes, with StrideUp’s plan, if house prices go up, you benefit from the increase in value of your share of the property.

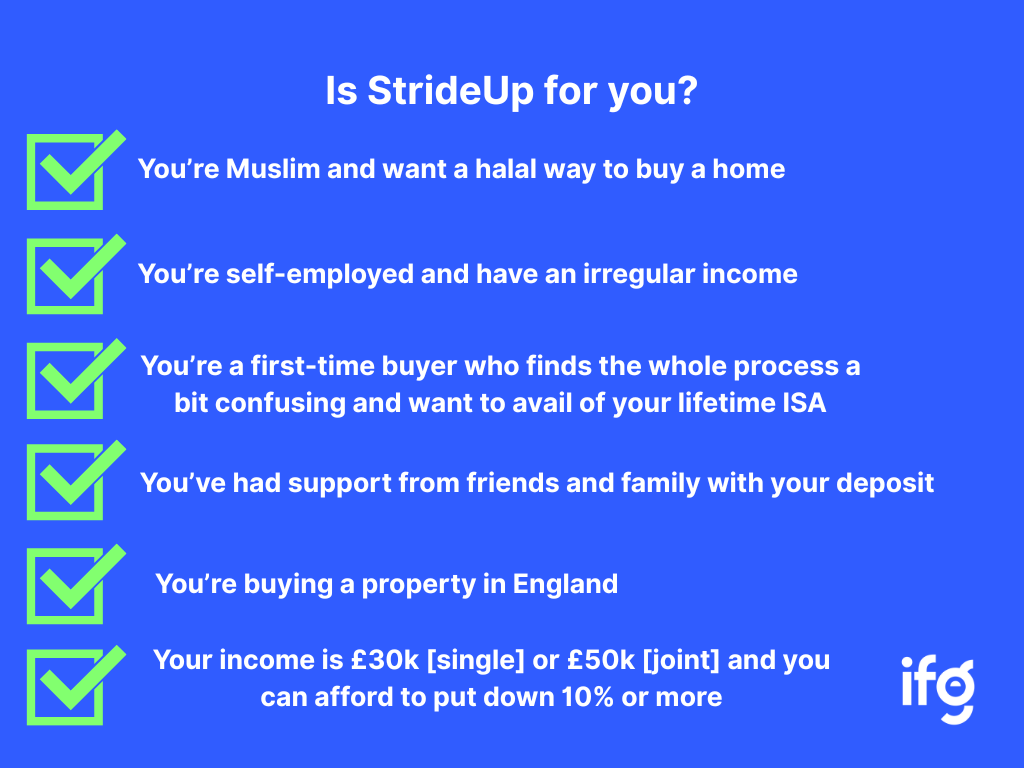

Looking at the StrideUp website, they point out that people who are underserved by traditional providers – contractors, people who are self-employed, or people who have recently moved to the UK – may be able to access StrideUp’s services. StrideUp’s approach, they say, involves assessing situations individually, rather than just running your details through a computer system as other providers do.

StrideUp is FCA authorised, which means buyers can use their Lifetime ISA savings towards the deposit, making it even more attractive for first-time buyers.

What is also very appealing is that Strideup also offers to lend you up to more than six times your income, while other banks cap it at around 4.5x. And you only need three months’ worth of bank statements – much less than the pile of complex paperwork lenders usually demand.

StrideUp will fund up to 90% of your property’s value, meaning you’ll need at least a 10% deposit. They’ll take on properties worth up to £1 million if you’re putting down a 20% deposit, or up to £750,000 if you only have a 10% deposit.

The income side is where the real benefit lies. While most banks lend you up to only 4.5 times your annual salary, StrideUp goes beyond, offering up to 6.5 times. So, if you earn £50,000 a year, a traditional bank might only lend you £225,000, while StrideUp could go up to £325,000.

Their current rental rates depending on your deposit amount range between from 5.59% and 6.49% for a 2-year fixed deal and between 5.69% and 6.49% for a 5-year deal (please note that the rates will change over time so for more accurate rates check directly with StrideUp or use our islamic mortgage comparison tool).

You can opt to pay a higher monthly acquisition payment to build equity and own the property sooner.

You can also spread payments over up to 40 years, and they’ll work with people up to the age of 75, so long as they can afford the payments.

StrideUp has made its application process simpler than what you’ll find with most lenders. As mentioned, other providers or banks might want to see 6-12 months of bank statements, but StrideUp only asks for 3. You’ll still need the usual stuff – proof of income, details about the property you want to buy and so on, but the paperwork burden is on the lighter side.

You can apply directly through StrideUp’s website, or through a mortgage broker authorised to arrange HPPs. StrideUp says that they manually review applications, rather than using automated systems.

The more human process can make a big difference if you’re self-employed, have an irregular income or have had credit problems in the past. Traditional lenders might reject these applications automatically.

StrideUp works particularly well for people who might struggle with getting a traditional mortgage:

See below for a visual breakdown:

StrideUp seems to be working to fill a genuine gap in the market; while traditional banks have been increasingly automating their decision processes, and the criteria for halal mortgages have often been restrictive, StrideUp sits in the middle, offering both Shariah-compliance and accessibility.

Throughout 2024 and 2025, StrideUp has only been making its service more competitive and accessible, with rate cuts bringing its prices closer to traditional mortgages.

In 2025, they secured £280 million of funding, with key backers being investors in Cur8 Capital’s GBP Income Fund, allowing them to expand their offering and extend their support to 1,000 more customers. They’ve also lifted some of their property value limits and increased how much they’re willing to finance.

Despite their efforts to make their products more accessible, the 10% minimum deposit requirement might be tough for many buyers to meet.

While it’s lower than some Islamic finance alternatives, conventional mortgages can allow deposits as low as 5% and Gatehouse Bank, another HPP provider, also allows a 5% deposit.

They also only accept buyers with an income of £30,000 or above.

As well as all this, StrideUp only covers properties in England, so if you’re based elsewhere in the UK, you won’t be able to access their services.

StrideUp has built a reputation for strong customer service and support.

On Trustpilot, they have a score of 4.7 out of 5 at the time of writing, which is very high for any mortgage provider, let alone a halal one.

Key positives named by buyers include:

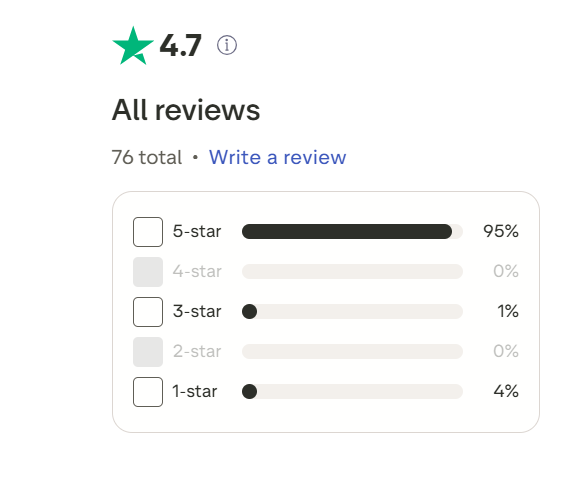

95% of their reviews are five stars, which is very impressive. For the remaining 5% the feedback shared was around rates being too high and the deposits being too high as well.

We also asked our own readers through our newsletter, and we got 13 responses, which pretty much echo what Trustpilot said. What our readers felt which could be improved was mainly to do with StrideUp’s higher rates and having a lower deposit option.

There were other quibbles and concerns about some people’s experiences not being very fast and not being as smooth as they would have liked and there was sometimes some back and forth that could happen when it came to the documentation stage. However, overall the feedback was that it’s mostly been positive.

And this shows in the responses to the favourite question that we always ask when we do these surveys; how disappointed would you be if Stride Up ceased to exist?

This is called a product market fit question. And what you want to see is that at least 40% of the people are extremely disappointed if you weren’t to exist because that would mean that you’re doing something of real value that they would really miss if you were gone. Any number less than 40% should be a concern for any good business. And the good news is that StrideUp scored more than 60%. So they’re clearly on to something.

All in all, there are things for Strideup to work on for sure. And I think that there’s a whole bunch of product innovation that they can do as well, especially as they start scaling and getting into £300m+ in deployments. And once they get into that phase, they really should think about different products and also adding more capacity to the team so that they are able to deal with some of the concerns that have been raised by the customers in these reviews.

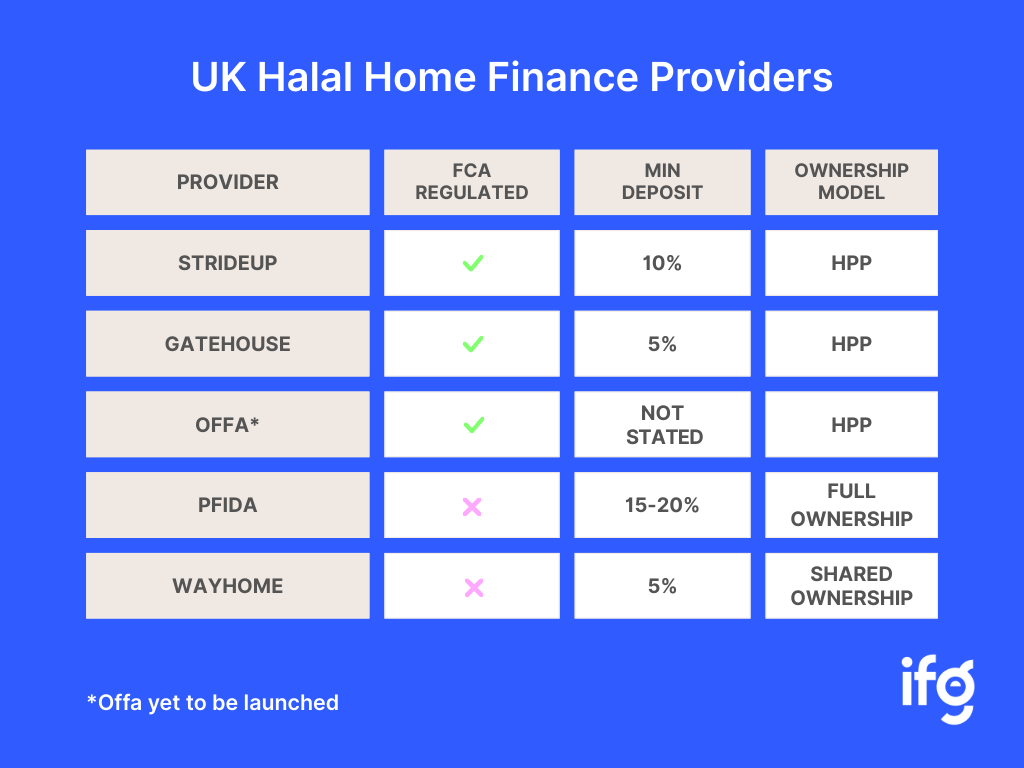

If you’re considering StrideUp, it’s worth understanding how it stacks up against other halal finance providers in the UK market.

Gatehouse Bank is probably StrideUp’s biggest competitor and one of the most active halal mortgage providers. They offer more competitive pricing and sometimes accept deposits as low as 5%, compared to StrideUp’s 10% minimum. But they can be a bit strict on paperwork and employment. For the latest rates and a comparison, check out our free mortgage comparison tool here.

Pfida are known for taking a community-driven approach and has adopted a structure that side steps the issues that some people have with Islamic mortgages, around risk-sharing.

Pfida’s deposit requirements are quite high, up to 15-20% and they tend to have a very long waiting list up to five years. Pfida are also not yet FCA-regulated, which could mean you end up having to ultimately pay two stamp duties rather than one. This makes them less practical for those of you who need to move quickly or want to avoid extra costs.

Offa is a relatively new entrant who was recently approved by the FCA to offer HPPs. They are very tech-driven, which means their process might well be a lot easier to navigate, especially for first-time buyers. The only issue is their still not fully launched yet, so we don’t really have a sense of the exact details of the product until they launch.

Once launched, I do fully expect them to be pretty good because Offa’s team is the same group that pioneered the Al Rayan mortgage in the early years of the Islamic finance industry in the UK.

Wayhome also take deposits as low as 5% but you could end up making multiple smaller stamp duty payments over time because they don’t necessarily have that double stamp duty exemption that comes with being regulated.

You will only be allowed to buy up to 40% of your house, which is not ideal. You are buying back your house at market rate, so you’re not necessarily getting the upside that you’re given in an HPP product.

Below is a table summarising the key differences between StrideUp’s HPPs and these alternatives:

So folks, what’s the final verdict? Ultimately, Halal Home Finance is still evolving in the UK. Strideup, like Gatehouse, Offa and the others, is a great example of a company in my view from the community for the community.

I’ve seen the struggles of how they’ve got to where they have over the last 5 years. It’s not been an easy journey and they could have pulled the plug many a time over this period, but they haven’t. They’ve persevered.

Unlike some of the traditional Islamic mortgage providers that are backed by large overseas shareholders, what I like about Strideup is that they truly understand the challenges faced by home buyers, especially Muslims in this country. Strideup to my mind is an exciting fintech-driven halal finance option that is very viable for many Muslims today.

So that’s the good news. I think the tech and the community aspect and all of its promise of wanting to offer new products—like the buy-to-let offering, the bridge financing, the commercial finance—are all very exciting and wonderful. But this is not a one-size-fits-all solution either.

For me, honestly, the winner is whoever will offer the best price and that fits with your personal situation. If there is only one Islamic bank that is making you the offer, then you go with that. If you’ve got multiple options to choose from, then I would slightly incline towards those that are community-first and you support their clearly articulated vision of where they want Islamic finance and our community to be. That, I think, Strideup have in spades—and so do some of the others—but Strideup certainly do, and I would want to support that if I could.

If you do want to take a deeper look at how StrideUp compares with other mortgage providers, then check out our free Islamic mortgage comparison tool.

I’d also love to hear from you: What have your experiences been like with Gatehouse, with StrideUp, with Al Rayan, and some of the other providers that I’ve mentioned? I’d love to hear from you in the comments below.

02 December 2025 8 min read

Leave a Reply