Is StrideUp The Best Islamic Mortgage Provider In The UK? (2025 Review)

05 September 2025 11 min read

Ibrahim Khan

Co-founder

8 min read

Last updated on:

Here’s a crazy fact that I came across recently: there are thousands of people today in the UK who are on an Islamic mortgage, paying hundreds of pounds more than they should be, and they’re doing nothing about it. How do they avoid that? Simple, by remortgaging.

I started looking into this area because I remortgaged my own property for the first time last year, so I looked into this fully, and I’ll be sharing with you my six top tips that will end up saving you thousands of pounds.

This is the article version of our video on remortgaging so if you prefer watching over reading, then check that out instead here.

But first, let’s actually explain what exactly remortgaging is…

An Islamic mortgage (also known as a home purchase plan or home financing) is a way to pay for your home over a longer period of time. You will typically enter into a 2, 3, 5, or sometimes even a 10-year fixed term with your provider and pay a set monthly rate to them over that period.

A remortgage is what happens when that fixed term ends, because, of course, your mortgage is still there; you’ve not paid off your house. So, you need to renegotiate and effectively get into your next term with whichever mortgage provider you’re going to enter into.

Just like with your car insurance company, if you do nothing, then your current mortgage will revert to what is called the standard variable rate. And just like when you are dealing with a car insurance company, you don’t want to be going back to their standard rate because it will be a lot more expensive. That variable rate today stands at 8% per annum for most Islamic banks.

So, just like how you remember to renew your car insurance for the next year, don’t let it default; the same applies to Islamic mortgages. You should consider remortgaging and entering into a new fixed-term mortgage, either with your current provider or by shopping around and potentially finding another provider. That way, you’ll save a big hike in your monthly expenses that otherwise will come automatically.

So now that we’ve understood what remortgages actually are, let’s get into the tips

The very first thing you should do when your term is coming up for expiry is to actually consider all of your options.

A remarkable number of people already hate finances and money-related admin so much, they end up paying thousands more over the years because they don’t want to face this “life admin.” Come on, guys, it’s worth it for a few thousand pounds.

It’s often the case that your current provider is where you’ll end up staying, because if you stick with them, you’ll only pay about £200-£300 more for the admin and paperwork, and then you’re done because you’re already on their system.

If you switch, you’ll have to pay for redemption fees with your current provider, legal fees with your new provider, upfront product fees, surveying costs, etc.

I ended up switching away from Gatehouse to StrideUp, as at the time, they were offering a competitive rate, and I personally wanted to support them as an Islamic fintech that was more community-oriented. I didn’t necessarily lose out financially, so I wanted to do that.

All in all, the switch cost me about £4,600 in legal and product fees, but because of the competitive rate I got, the whole thing smoothed out and I ultimately didn’t end up losing any money.

By the way, I had a chat with them and got a few expenses knocked off or trimmed down, so it is definitely worth chatting with your mortgage provider too.

And it depends on where these mortgage providers are in their business cycle, because sometimes they’re keen to onboard customers and will give you great incentives. While other times, they don’t really want to get new customers on board and so they won’t give you a sweeter deal.

The choice that will present itself to you from all Islamic Finance providers will be: Do you want a 2-year, 3-year, or 5-year fixed rate term, or do you want something floating, pegged to the Bank of England base rate?

Look of course, Islamic mortgages don’t deal in interest, but unfortunately, interest rates are set by central banks and are so fundamental to our modern financial system that whenever they change it, it will affect Islamic mortgages too, because that’s how the entire market is priced, either indirectly or directly, we are affected by whatever the Bank of England says.

So if you think interest rates will go up in the next few years, then you want to be locking in the rate you are getting now so that your payment doesn’t go up even if the interest rates start to rise but if you think interest rates will go down then you want to lock yourself in for as short a term as possible so that you can remortgage again in a couple of years’ time when the rates have dropped quite a bit and then you can just switch over to a lower rate product.

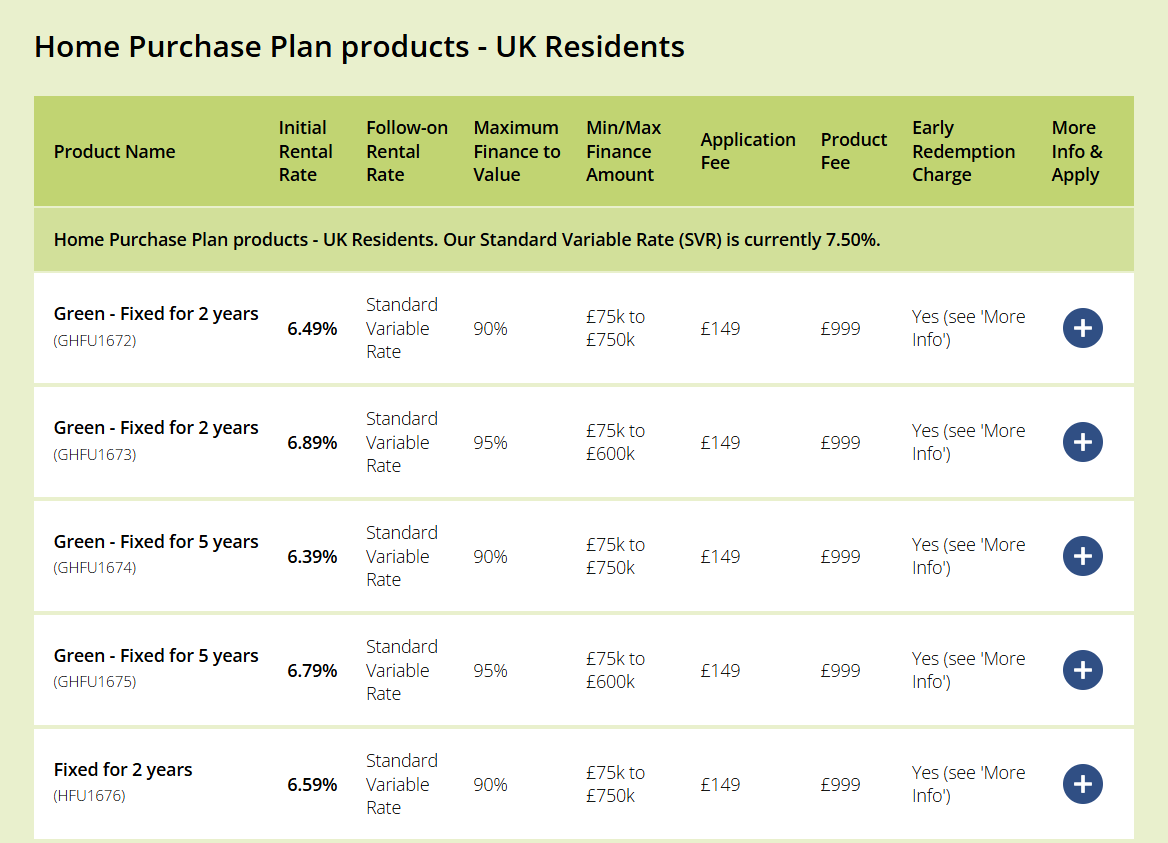

So let’s take a practical look at the Gate House Bank website:

So what this is telling you is that Gatehouse offers you a 2-year and a 5-year fixed term mortgage at various different financed values, which is basically how much of a deposit you are going to be putting towards the purchase.

So right now my assessment is that interest rates are likely to remain high but start falling over the next couple of years. The IMF have said that the UK should be targeting 3.5% by the end of 2025. Now we don’t know if that will happen but using that as a yardstick you can see that rates are going to fall but they’re not going to fall anytime soon so I would lock in personally for as short a term a period as I could in the hope that by the time that I return back to the market to do my next remortgaging the rates have dropped so much that I go on to a much better rate.

So I ended up saving hundreds of pounds by doing this one thing, asking Gatehouse to revalue my house. Because you see, if I hadn’t asked them, Gatehouse were just going to roll me over on their 80% Finance to Value product, which was more expensive.

But once I asked them, they rather sheepishly agreed to get a survey done which valued my house nearly £100,000 more and this then meant that I had a much larger equity in the house which now meant that I had access to their cheaper product i.e. their 65% Finance to Value product, because now effectively I had more of a chunk of the house that I owned and so the more of a chunk of the house that you own the cheaper your rent is and so that meant I got a cheaper rate as a result of that. So always get a survey done, especially if you think the house price has increased substantially.

In my case I had saved up some money separately and once the property valuation came through I realised that I was pretty much there at the 65% threshold but I hadn’t quite got there so what I did was I put in a few thousand extra into the house to bring myself fully over the 65% threshold and get the more attractive rates it comes with.

And right now, by the way, with mortgage rates being so expensive, it actually makes a lot of sense to put more money into your house, as for every pound that you put in, you are saving yourself from paying around 6% cost on that amount per annum. Sure, you could invest that money, but then you would need to be darn well confident that you would make back more than just 6% that you would otherwise be saving by putting it into your house.

As part of my research for this article, I actually spoke to Sakib, who’s a CEO at StrideUp, and he was explaining to me that there are still several thousand people with legacy HSBC Amanah mortgages and Al-Buraaq mortgages and they haven’t remortgaged in years and as a result they are at the standard variable rate, which I said to you earlier was a scary thing which is today around 8%. So 8% is what these people are paying. If they remortgaged, they would immediately get around 6% or even lower because many of them would have paid out a big chunk of their house by now, a saving of 25 to 30% on your mortgage bill every single month. It’s a no-brainer.

So if you are reading this and you vaguely recall your parents or yourself even being on an HSBC Amana or Al-Buraaq mortgage, then get them to switch today, it will save you a lot of money.

It is vital that you have a quick read of the terms and conditions, as there will be things in there that will surprise you or catch you out.

For example, some banks don’t allow you to pay extra repayments until 1 to 2 years have passed. That’s important because if you know you’re about to come into a lot of money and would like to repay a chunk of your mortgage in 6 months’ time, but then you’re not allowed to do that, then what you’ll end up doing is paying more because you’re not actually paying down your mortgage.

Another important term is exit fees, if you have to exit or redeem your mortgage early. So in the case of StrideUp, you pay 2% of the entire finance amount if you exit within one year, and you pay 1% of the entire finance amount if you exit within the second year, and by exiting, it basically means selling your house. That, for me has actually turned out to be quite a painful move, as I moved to Manchester and so I hadn’t fully factored that in, so keep that in mind as well.

If you enjoyed reading this, consider subscribing to our newsletter and sharing this article with someone in your network who is currently on a fixed term or worse, those on standard variable rate deals.

If you’re looking for somewhere to place those extra savings generated, our free halal investment checklist is a great place to start learning about how to invest in a halal way.

Yes. When your fixed term ends, you can move to a new fixed rate with your current provider or switch to another Islamic bank.

Typically 3–6 months before your fixed term ends.

No as long as you’re moving to another shariah-compliant provider.

Yes. Islamic SVR can be around 8%, while fixed rates are closer to 5–6%, saving many homeowners thousands.

05 September 2025 11 min read

Leave a Reply