Islamic Mortgage Remortgage Guide: What to Do When Your Fixed Term Ends

02 December 2025 8 min read

Haider Saleem

4 min read

Last updated on:

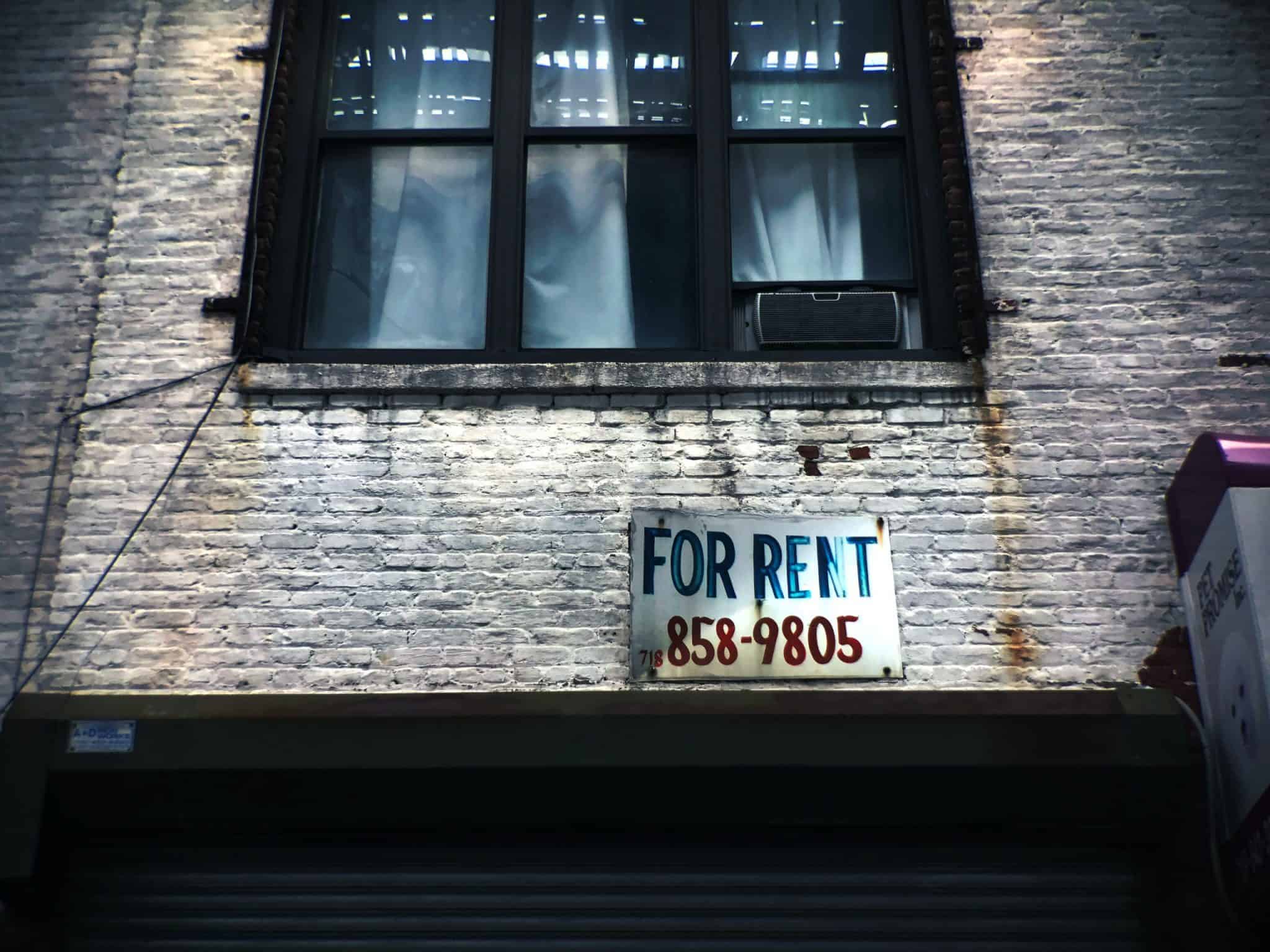

Investing in property through Buy-to-Let (BTL) is a popular way to earn passive income. But for Muslim investors, there’s a challenge: how do you finance a property if you don’t have the funds to pay in full without compromising your values?

The good news is that several Islamic banks and finance providers now offer Sharia-compliant BTL mortgages. This means you can invest in property ethically, using rental income to gradually repay what you owe, without dealing with interest.

Recently landlords have suffered from many tax changes and lower yields, so this area is not as lucrative as it used to be. However, there are some parts of the country where you can still achieve a high yield.

In this article, we’ll take a look at

There are only two things you want when investing in property:

It’s rare that you will get both

With a BTL, you’re typically looking for a high yield.

We have a further explanation on our Halal Property Investing 101 Guide. However briefly, I will explain.

Yield = the money you get back per year.

It’s important to carefully calculate the yield on the property before you purchase it. It shows you how much you will make on the property through rent.

The very basic way is as follows:

Yield % = Rental Income / Price x 100

If you buy for £100k and rental income is £10k per year, the yield = 10%.

Yield = £10,000/£100,000 x 100 = 10%

This is a very basic calculation, and you’ll need to account for costs, insurance, upkeep, etc (you can deduct this from the rent per annum) in the calculation above. Bear this in mind if you’re calculating if it’s a good return. Net rent yield is a better measure.

Net Yield = [(yearly rental – costs)/property value] x 100

What’s a good yield? Different investors give you different answers. Typically, an average yield in London is around 4-5% while the best yields are in commercial and HMO properties and can be up to 15%.

Capital growth = an increase in the value of an asset or investment over time.

There are various Islamic banks such as Gatehouse Bank, Al Rayan and QIB which offer shariah-compliant BTL. There are also financing providers such as Strideup and Offa who are new entrants with a digital-first approach to offering BTLs. We go into the various options below in more detail.

This is a bit of a headache when it comes to BTL.

In April 2016, the government imposed a 3% stamp duty surcharge on second homes and buy-to-let properties. The new Labour government raised this to 5% from October 2024 in Rachel Reeve’s first budget.

Since April 2020, BTL landlords now must also pay income tax on the entire rental income, regardless of how much is taken up by mortgage interest (previously there was a relief for this). However, now you can receive a tax-credit on 20% of your mortgage interest payments.

Furthermore, tax liabilities will apply regardless of if you are a private individual or a business. Do also bear in mind Capital Gains Tax implications upon exit.

Check the GOV website or speak to your accountant if you would like to know the full tax liabilities and credits available for a BTL.

Now you know a bit about tax liabilities, let’s look at some areas that can give you a good yield.

According to Zoopla, the highest yields in the UK can be found in Sunderland, Aberdeen and Burnley, which offer average gross yields of 8%+.

The best region is the North East, which offers average gross yields of 7.65%.

The north has low house prices and feature in many of the top hotspots for BTL.

Islamic banks offer Halal BTL mortgages if you do not have the funds yourself. They are similar to your traditional mortgage with some key differences. This includes fees and interest rates.

If you want to check mortgage offers for yourself, use the IFG Mortgage Calculator.

02 December 2025 8 min read

05 September 2025 11 min read

26 August 2025 7 min read

Leave a Reply