6 Wealth-Building Lessons from Khadijah (RA) Every Muslim Should Know

03 December 2025 8 min read

Ibrahim Khan

Co-founder

11 min read

Last updated on:

The average wedding in the UK now costs £30,000. For that same amount, you could buy a house in Middlesbrough, a decent car, or even pay for a university degree.

Muslim and Asian weddings can often end up costing much more though, as typically you would have up to 500 and even 1,000 guests rather than 100 or so in a mainstream wedding. Also, the bride’s gold will need to be bought, then there’s the mahr (you can read more about how we think that should be calculated here), then there’s usually a mehndi and a reception and even a function abroad. So we’re looking at the £50k mark, all things considered.

Now contrast that with this: half of Muslims in the UK live in the top 10% of the most deprived areas.

Something’s seriously off.

In this article, we’re taking a deep dive into the billion-pound black hole that is modern Muslim marriages and doing an honest appraisal about the consequences of this spending and what we could be using the money for instead.

In a survey done in 2007, by VIA, an asian bridal magazine, a 1/4 of British Asians spent between £20,000 and £30,000 on their wedding and about as many were happy to stump up between £50,000 and £75,000. Given we’re 18 years on from this survey, I think it’s conservative now to model the average Muslim marriage cost at around £50,000.

Putting any religious points aside, let’s just look first at the cold, hard marriage numbers. Let’s say you spent £50k on a wedding, where is that money actually going?

Now, venues are typically mansions and country houses that are held by fairly affluent people or companies, and of course, the airlines and hotel chains are large international conglomerates, so in other words, you will be handing over £37.5k to the already rich and large corporations.

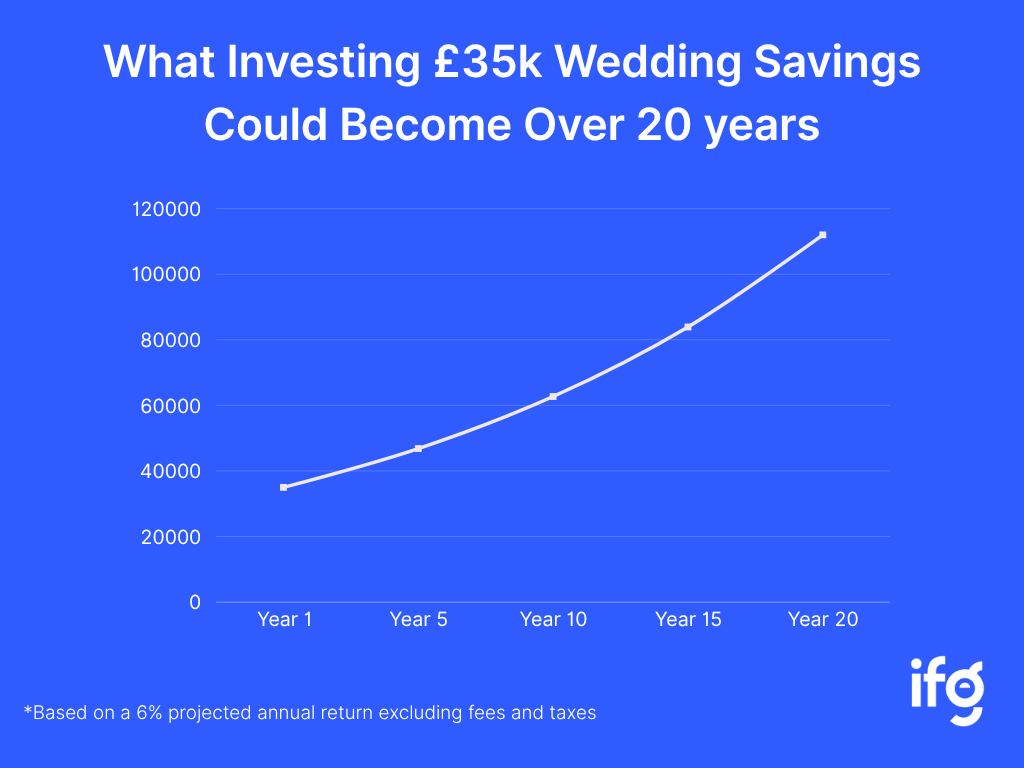

Let’s take a different tack with the same wedding; let’s do a budget wedding at £15k so you can save £35k.

That £35k could net you £112,000 if you invested it (assuming a conservative annual return rate of 6% before any fees and taxes).

University fees are right now £27k over three years, so let’s say the couple has three children and sends them to university, they will need to fork out £81,000.

That £112,000 that you’ve saved from the wedding more than covers it and that £35k doesn’t just save the parents the stress of having to pay university fees, it also stops those three children paying back collectively £225,000 over the next 30 years after their uni in paying back the student loans.

So, in other words, that £35k gets rid of a generation’s worth of debt from that family.

So, option 1 is that you hand over £37.5k to large and rich corporations.

And, option 2 is you get back £225,000 for your family over the next generation.

Then, there’s the wider community impact too.

In a recent article, the BBC reported that the UK wedding market is worth £10 billion, and Asian weddings constitute about half of that. [1]

Given that Muslims make up a large chunk of the south asian population, let’s conservatively say Muslims are spending £2 billion per year on weddings. Now, given that Muslims are six percent of the population, they really should be spending a maximum of £500 million to be in line with the average Brit. [2]

So, there’s an extra £1.5 billion per year that the Muslim community is spending on weddings.

To give you some sense of what that could achieve:

Eton College has £500 million as its endowment and the richest Oxford college, has £700 million as its endowment, so with £1.5 billion every year that we save in the Muslim community we could really impact the future of our children’s education and then it has a knock-on effect as well because for every highly educated person you will typically have a much larger economic output. [3] [4]

We can do that quite easily if we invest our money properly, or to look at it another way, the Church of England’s investment pot is worth £10 billion, which gives off £400 million a year, approximately, in income to support the Church and community projects. [5] [6]

Muslims could catch up to that in just six years time, if we cut back on our weddings and pooled our cash together for the community instead.

Imagine that, no more rundown Islamic schools, no more rundown Masajid and a community that is generally looking a lot more prosperous, so when you go into a Muslim area, you don’t feel like you’re going into a deprived area, you feel like this is actually a really nice place to live.

This kind of spending is not just uneconomic, it’s also un-Islamic, Allah SWT says:

“And those, who, when they spend, are neither extravagant nor miserly, but hold a medium [way] between those [extremes]” (Al-Furqan 25:67)

The Prophet (PBUH) said:

“The most blessed marriage [nikah] is the one with the least expenses”. [Mishkat al-Masabih 3097]

The Prophet’s most extravagant walima that we find in the hadith was for one of his wives, which was a walima where he sacrificed one sheep, and that was what the entire banquet ate from.

Now, look, guys, I’m not saying that you should make all your guests bring a packed lunch to the wedding, that’s not my intention at all, but what I am saying is we should have a look at what Islam teaches about weddings and make sure that is reflected in our ceremonies.

So, for example, Allah SWT says:

“Let the rich man spend according to his means, and the man whose resources are restricted, let him spend according to what Allah has given him. Allah puts no burden on any person beyond what He has given him”. [Surah al-Talaaq 65:7]

So we just need to understand our own budgets and then make sure that we are spending within them because that is literally what Islam and the Qur’an is teaching us.

But what about if you want to make it a once-in-a-lifetime thing, a fairytale wedding, a special day, full of memories?

Look, every bride, Muslim or non-Muslim, rightly wants their wedding to be a special day; they want it to be as much as they can, a fairytale wedding, and we should definitely try and make sure that every bride’s wedding is a really special day.

But that doesn’t mean extravagance and overspending to the point you go into debt and ultimately, you know what makes that wedding day special?

Is it the horse and the carriage?

Or, the hired Maserati?

Is it the pictures that you only look at once a year or once every five years?

Or, is it being with your friends and families and sharing that moment with them?

If it’s the latter, that is for free.

And, you know, making something too special is also dangerous. 42% of marriages in the UK end in divorce. [7]

Now, if you spent £100k on a wedding, there is a lot of pressure after that to make it work. And that pressure can really start showing. What if you do get a divorce after all? That’s necessary sometimes. Do you then fork out another £100k on your next wedding?

A wedding day is a special day. But I know what I would want for my son and daughter would be not just one special day in their life, but a lifetime of a really valuable and special relationship, because I know that is fundamentally what’s going to make them really happy over the lifetime.

Perhaps a sensible way to approach this might be to make a special day for the bride and groom. But rather than focusing on that one day, focus your efforts on spending and making that relationship special and strong for the rest of their lives. Help them financially in their early years.

Make sure that they have enough money to go on holidays, to spend time with each other, and build and solidify that relationship instead. Because that will, long-term, be much better at keeping their relationship special and strong. And that is really what’s going to make them happy.

Having a reduced wedding size is difficult, I know.

Everyone else in your street has gone to each other’s weddings, and they’ve been large. And I guess there are two things to say to this:

Firstly, you know, sometimes the Sahaba got married and didn’t even invite the Prophet. So it is okay to miss out on a few people; they shouldn’t be offended.

Secondly, you can just do a cheaper and larger wedding and invite a decent number of guests. So rather than Hilton, you might want to go to the local restaurant hall or even the masjid function hall. There’s nothing wrong with that.

Look, I know it’s difficult if five of your neighbours have invited you to the Hilton and then you’re going to invite them to the masjid community hall. But the difficult things are the things that we need to do, because this is a vicious cycle, right?

If everyone keeps on doing the same thing, we will never change. Someone has to make that hard decision and change the way we do marriages and weddings.

And look at it another way, maybe that simple wedding that you do will help and inspire dozens of future neighbours to do their weddings in a simple way as well. And that is going to help not just you, but the whole community.

And look, my family has been there as well. We went to the Hiltons, and then we had quite a simple wedding for our siblings (you can read about that here).

And you know what? It worked out. No one really complained. We didn’t really fall out with any of our neighbours or friends. Ultimately, it all works out.

The number one cause for divorce these days is financial worries and issues.

Have a read of this:

“My main issue is with large, expensive weddings. At my wedding, we spent about £55,000 between both parties. We both felt the financial strain, and my in-laws had to borrow money from the banks.” [8]

A big wedding doesn’t just put financial strain on the relationship during the wedding; it also affects it afterwards. For people with an average income, it’s a huge pressure.

If you’re an immigrant, then you’re worse off. I have to pay off my debts, run my family here, plus help my family back home, and at the same time pay loads of money to the UK Border Agency for my citizenship.

So, in other words, you will spend £55k to make a wedding happen that is more likely to break down as a result of you spending that much. That’s just not sensible.

And when you set such a high bar for a wedding, like £50k, the average person who saves up perhaps £5k a year, if he’s lucky, will be waiting for 10 years to save that up. My question is: what’s this guy doing for those 10 years when he’s not married?

Now, we don’t have any hard data on this, but my hunch would be that many Muslim young men and women have been pushed into haram relationships and even kids out of wedlock, because we have made marriage so difficult.

Of course, they are partly to blame for that decision and for those actions, but we are also partly to blame for those outcomes. Because we made marriage so difficult, because of our societal and cultural pressures, we need to think about what our actions have in terms of their ramifications.

My humble view is that marriages should cost no more than £20,000, and ideally under £10,000. My own wedding was £15,000, including the gold and honeymoon and everything. And my siblings’ weddings have come under £10,000.

And actually, you’ll get between £2,000 and £4,000 in gifts from the guests as cash as part of your wedding. So you can use that to offset your wedding.

The commercial part of me sometimes thinks: actually, you know, having a really cheap wedding and inviting lots of guests and making sure they give you gifts could actually be a money spinner. But of course, that’s not the way to think about it. The point I’m making is: make sure that you’re trying to spend as little as possible, and certainly under £20,000.

Have a budget mehndi. Have a nikah in a masjid, so the only big spending event is the walima itself.

Go for a cheaper venue, go for cheaper food, go for cheaper dresses, go for cheaper mahrs or presents. Cut out or reduce the photography, videography, and travel costs, wedding flowers, decorations, cakes, and entertainment. Just pare those back a little bit or go for cheaper options.

Get yourself a good, but not extravagant, honeymoon. And finally, invite less people.

Getting this problem sorted is a duty for us all, as it will cost our community dearly if we don’t. And this article has been written with the intention of just getting this important conversation started.

I know this is a sensitive topic for some of you, and you may not necessarily agree with what I say. All I ask is that you read this article with an open mind. Also, let us know your opinions by commenting down below.

If you want to learn more about managing finances in a marriage according to Islam, read this article or if you want to discover the unexpected financial perks of getting married, read this one.

Finally, consider signing up to our newsletter and unlocking access to our free email course: The 5 Money Mistakes Keeping Muslims Poor (and How to Fix Them). It’s packed with practical tips to help you build better financial habits and grow your income the halal way that can come in handy when saving for a wedding.

[1] BBC: Coronavirus: ‘Big fat British Asian weddings’ forced to slim down: https://www.bbc.co.uk/news/business-53312141

[2] Office for National Statistics: Religion, England and Wales: Census 2021: https://www.ons.gov.uk/peoplepopulationandcommunity/culturalidentity/religion/bulletins/religionenglandandwales/census2021

[3] The Telegraph: How Eton built reserves of £562m – while parents battle soaring fees: https://www.telegraph.co.uk/money/consumer-affairs/eton-built-562m-cash-pile-parents-battle-soaring-fees/#:~:text=Eton%2C%20one%20of%20Britain's%20most,the%20end%20of%20last%20year.

[4] Saint John Baptist College in the University of Oxford Annual Report and Financial Statements Year ended 31 July 2022: https://d307gmaoxpdmsg.cloudfront.net/collegeaccounts2122/St_Johns.pdf

[5] The Church of England: How we Invest: https://www.churchofengland.org/about/governance/national-church-institutions/church-commissioners-england/how-we-invest

[6] The Guardian: Church of England to pump £3.6bn into parishes and fund more social action: https://www.theguardian.com/world/2022/may/11/church-of-england-to-pump-36bn-into-parishes-and-fund-more-social-action

[7] https://www.mediateuk.co.uk/divorce-rate-uk/

[8] Metro, Muslim men open up about the financial strain of extravagant weddings: https://metro.co.uk/2019/11/30/muslim-men-open-financial-strain-providing-family-11061171

7 months ago

This article was a waste of my time reading. The author even suggested cutting out on the decor and photographer - if weddings are supposed to cost like this on average nowadays then so be it. Men need to learn how to save - v few girls will accept a super bland wedding these days so this advice is not practical.

7 months ago

Jazakallah khair Ibrahim for such an insightful and inspirational article. I am sure it will make many readers think seriously about cutting down wedding expenses.

7 months ago

Great article. We have many problems and unfortunately we will only realise when we are directly affected: There has not been a recession for over 20 years. We have forgotten that we could lose our jobs and not get another one. We are very materialistic. This is our drink and drug. We are financially illiterate. I speak to many educated Muslims, but they have no idea about personal finance. The United Kingdom of the Devil IsRael has revealed itself and its current target are Muslims and thus we will be directly impacted.

7 months ago

Excellent article, and about time we seriously reflect on this. Thank you for highlighting it and the solutions offered.

03 December 2025 8 min read

26 November 2025 6 min read

13 August 2025 12 min read

Sara

7 months ago

I think the cited figures are low. Add in bridal shopping trips, several complementing events, cost of looking after overseas guests and outfits, jewellery makeup for family members... easily minimum £70k onwards. Best to keep to a simple nikkah with immediate family serving a hi tea setup, and a valima event. Save money towards a down payment for a house!