Are Prediction Markets Halal or Haram? The Truth About Polymarket & Kalshi

06 February 2026 7 min read

Khizar Mohammad

Community Lead

7 min read

Last updated on:

Everyone loves the idea of passive income. Imagine making £1000 extra every month without any additional work. A quick look at Google keyword tools shows that passive income is searched thousands of times every month, and when you actually search, you find hundreds of options out there.

But here’s the problem, how do you sort the good stuff from the bad stuff? Just this week the US Securities and Exchange Commission (SCC) fined a con artist who scammed Muslims out of $8 million.

Well in this article we’re going to explore one specific, very safe, a government-backed asset class which gives you precisely this. A nice passive income with the security of a very credible backer.

The answer folks in a nutshell is to invest in Sukuk. We will explain exactly what it is very shortly, but in order to explain what it is – you really need to understand this one asset class that the whole world invests in worth approximately $119 trillion dollars which Muslims aren’t allowed to invest in.

Let’s dive in.

Sukuk are often called Islamic bonds and every seasoned investor worth his salt will tell you that bonds are a MUST for every investment portfolio.

All of the top wealth managers – whether it’s UBS or Morgan Stanley – each of their classic investment templates have a portion allocated to bonds. In fact, I’m willing to bet that most – if not all – millionaires and billionaires will have a portion of their wealth in bonds as well.

So many would ask, why not just go for bonds then?

The answer is: bonds are haram.

Bonds are loans – you give your money to a company, or even a government, and they promise to pay you back what they borrowed from you plus some interest for your troubles. Simples. The interest in this transaction makes bonds straight up haram.

But at the same time, what makes bonds so appealing is the fact that you get a fixed return, they’re usually safe and they’re backed by very reliable people or institutions.

How does a Muslim get in on that? Enter Sukuk.

A Sukuk is often called an Islamic bond. In a conventional bond, there’s a clear loan agreement with the promise of paying interest. With Sukuk on the other hand, the debtor i.e. who wants the money, is effectively selling you an asset and paying you regular rent for use of the asset.

The smarty pants amongst you, will rightfully point out that there are different types of Sukuk such as mudarabah-based Sukuk or murabahah-based Sukuk – but for this article, we’ll keep it simple and focus on the ijarah-based Sukuk, but what we’ll discuss applies to all types.

Here are some of the key similarities and differences between bonds and Sukuk.

|

Similarities |

Differences |

|

|

Sukuk are not to be confused with SME or other types of financing, because although those types are also sharia-compliant debt financing with a fixed return, the nature of Sukuk is very different.

Sukuk are typically a lot less risky because only large corporations or sovereigns, i.e. governments would issue them, making it safer and low-risk, low-return. In comparison, other types of fixed-income debt financing such as sharia-compliant SME financing are classed as higher risk and so deemed as a high-return investment.

You can find out more about various halal GBP fixed income & USD income fund options by accessing our detailed guide here.

Believe it or not, non-Muslims have been investing in Sukuk for ages! The UK government even offered their own Sukuk in 2014 for the first time to institutional investors. So savvy professional investors have always been investing in Sukuk. But why?

The key lies in the kind of returns a Sukuk can offer.

The returns from Sukuk can vary depending on macroeconomic trends, such as interest rates. Historically it has always been between 3-8%.

So, it makes a nice return, but how can you actually use it?

I personally believe they’re a nice counterpoint to the stock market, so typically you’ll see when stocks are doing well, the returns from bonds and Sukuk aren’t as high and vice versa broadly speaking. So it’s a good asset to have in your portfolio to protect you against a market crash.

If you need a set amount for a future date, this can be a good way to get to that

Everyone needs a relatively liquid place where they can park their money short term and Sukuk is a great place for that.

But like with any investment, your capital is at risk and that’s because despite being a low risk asset there are still ways that you could lose your money.

Let’s identify them so that you can avoid them.

The biggest and most obvious risk is defaulting. Whoever is taking your money whether it’s a company or a government, if they’re not doing well enough in terms of profit – or GDP in a government’s case – to pay you back, then you’re in trouble.

So it’s better to invest in a fund to spread your risk.

You definitely need to look at currency risk as Sukuk are typically denominated in the currency of the company or government the money is given to, so typically it may be Indonesian or Malaysian where Sukuk are very popular investment choices or in the USD for the Middle East.

So if you’re investing in GBP currency risk is a big issue as when exchanging currency both ways might mean you get slightly less. But if the pound gets stronger whilst your money is in the other currency, you will actually end up getting more.

The way to protect yourself from this is to hold the return in USD. So instead of converting back to GBP, you then only convert when you’re happy with the rate.

Speaking of Malaysia and the Middle East, another potential risk (or reward) is that Sukuk are mostly available in Muslim-majority countries and as such are tied to the fortunes of the country they’re based in. A major disaster or turmoil, such as civil war or a volcanic eruption etc, could negatively impact your investment.

Now we’ve spoken at some length about Sukuk and I can tell you’re ready to get some passive income flowing into your pocket.

Let’s talk about how Sukuk can be accessed.

Al-Rayan and Gatehouse savings accounts are akin to Sukuk so that’s one way to get in, but there’s one big problem – the returns just aren’t that great. You’re looking at 2% at most for the more liquid options. If you’re happy to lock away money for 2-4 years you can unlock returns of 4%+.

There is a better way – and that is institutional offerings, i.e. the stuff reserved for rich people. Here’s how you can typically get in on those.

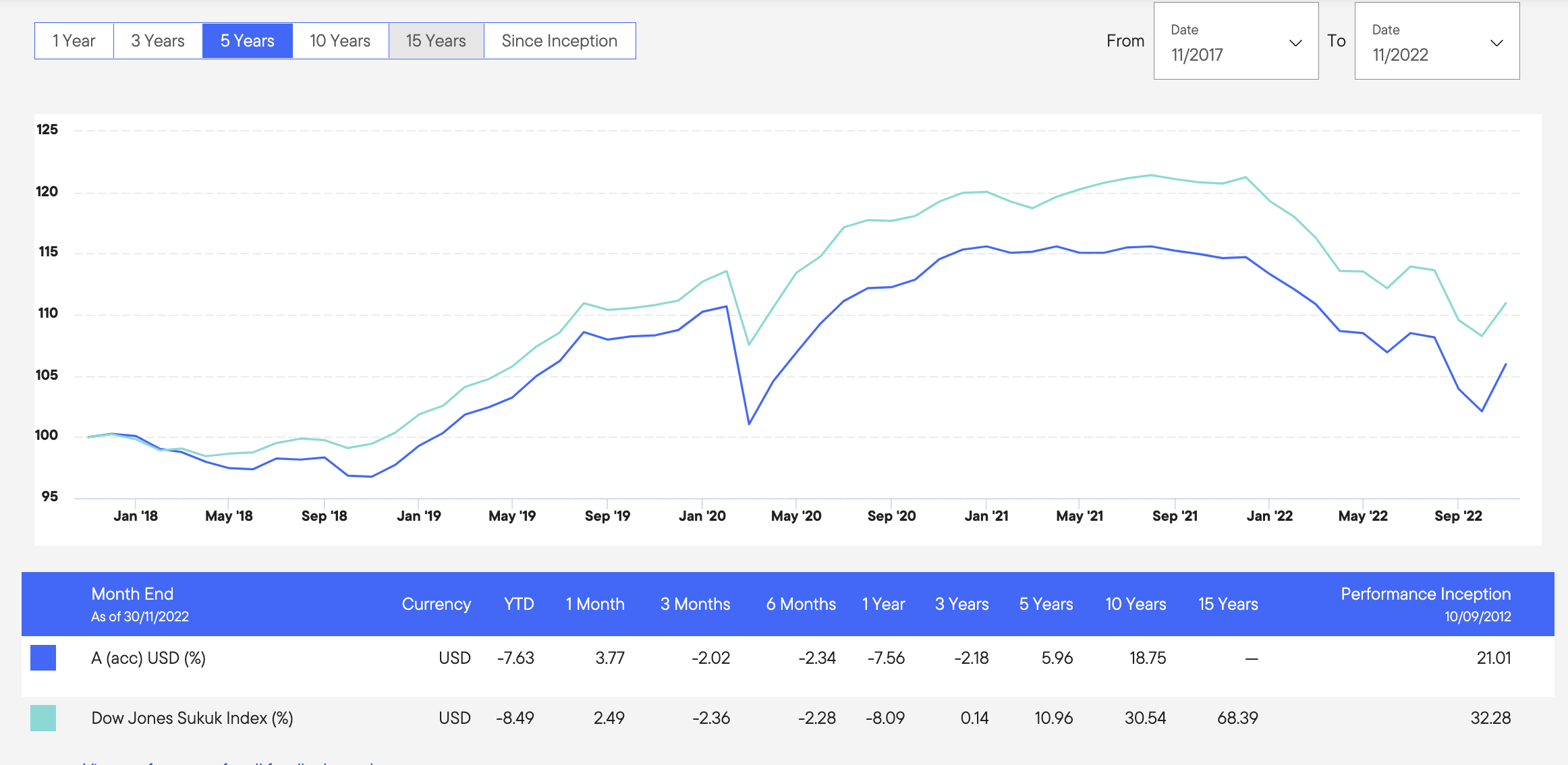

So the first way is investing in publicly listed Sukuk funds such as the Franklin Templeton Sukuk fund, which is probably the most prominent public fund out there – though there are others. You can do this by using a broker like Hargreaves Lansdown, but typically FT does charge a hefty fee and historically it has underperformed against the industry standard index as it outlines on its own website:

The second way is to directly go ahead and buy a Sukuk via your private banker. Obviously this isn’t possible for the vast majority of people.

A third and final option is to use our investment platform Cur8 Capital where we offer institutional-level Sukuk via our Sukuk fund. We’ve collaborated with GFH on this, a $16bn Middle-Eastern investment manager, that has a really interesting Sukuk strategy where they invest directly into government-level Sukuk.

These types of Sukuk are not available to the average investor (unless you have a few million to invest of course). But for the first time, we’ve made these accessible to the everyday Tom, Dick and Haarith.

You can find out more about the fund on the Cur8 Capital website.

We’ve learned that many top investors put a portion of their money in safe, fixed-income instruments like bonds. Muslims can’t do that, but Sukuk are the alternative.

Sukuk are a great way to create a regular passive income, but until now the average person could only access them via relatively low-returning Islamic savings accounts. Today, thanks to new platforms like Cur8 Capital, a lot more people can access the good stuff and invest in something that makes them money in their sleep.

06 February 2026 7 min read

26 August 2025 7 min read

Leave a Reply