Is it cost-effective and competitive?

This is the big question. Wahed even has an FAQ on “why wouldn’t I buy securities suggested by Wahed directly?” Their answer is:

While you may be able to buy the securities suggested by Wahed directly through your broker, you may not be able to get them all at the same time in a cost-effective and efficient manner. In addition, some brokers may require a high minimum investment to open an account. Wahed’s service also monitors and facilitates the periodical rebalancing of your portfolio at no additional cost.

More importantly, you may not be able to open and monitor an account in the same seamless manner as you do with Wahed. With Wahed’s advanced technology, you can open an account online and in minutes and get access to global markets.

But let’s test that.

Can I buy the securities in one place at another major broker?

In short, no. Not any mainstream ordinary-person broker anyway.

I looked at Hargreaves Landsdowne and IG.com, two very large and reputable online brokers in the UK. The far column of the table below highlights up which instruments I could easily purchase through them. Importantly I couldn’t purchase global equities and sukuk funds – which for me are quite important (but more on that later).

| Instrument |

Costs and Charges |

Easily available elsewhere? |

| iShares MSCI World Islamic UCITS ETF USD (Dist) |

0.6% |

Yes |

| HSBC Islamic Global Equity Index GBP IC |

0.53% |

No |

| iShares MSCI EM Islamic UCITS ETF USD (Dist) (0.85) |

0.85% |

Yes |

| Franklin Global Sukuk Fund W(Qdis) |

1.1% |

No |

| ETFS Physical Gold (GBP) |

0.39% |

Yes |

So Wahed passes test 1.

Can I buy the securities in a cost-effective manner elsewhere?

In short, not really. However, as you become a larger investor (>£250,000) then you should reassess the market carefully for a better deal as you may find one.

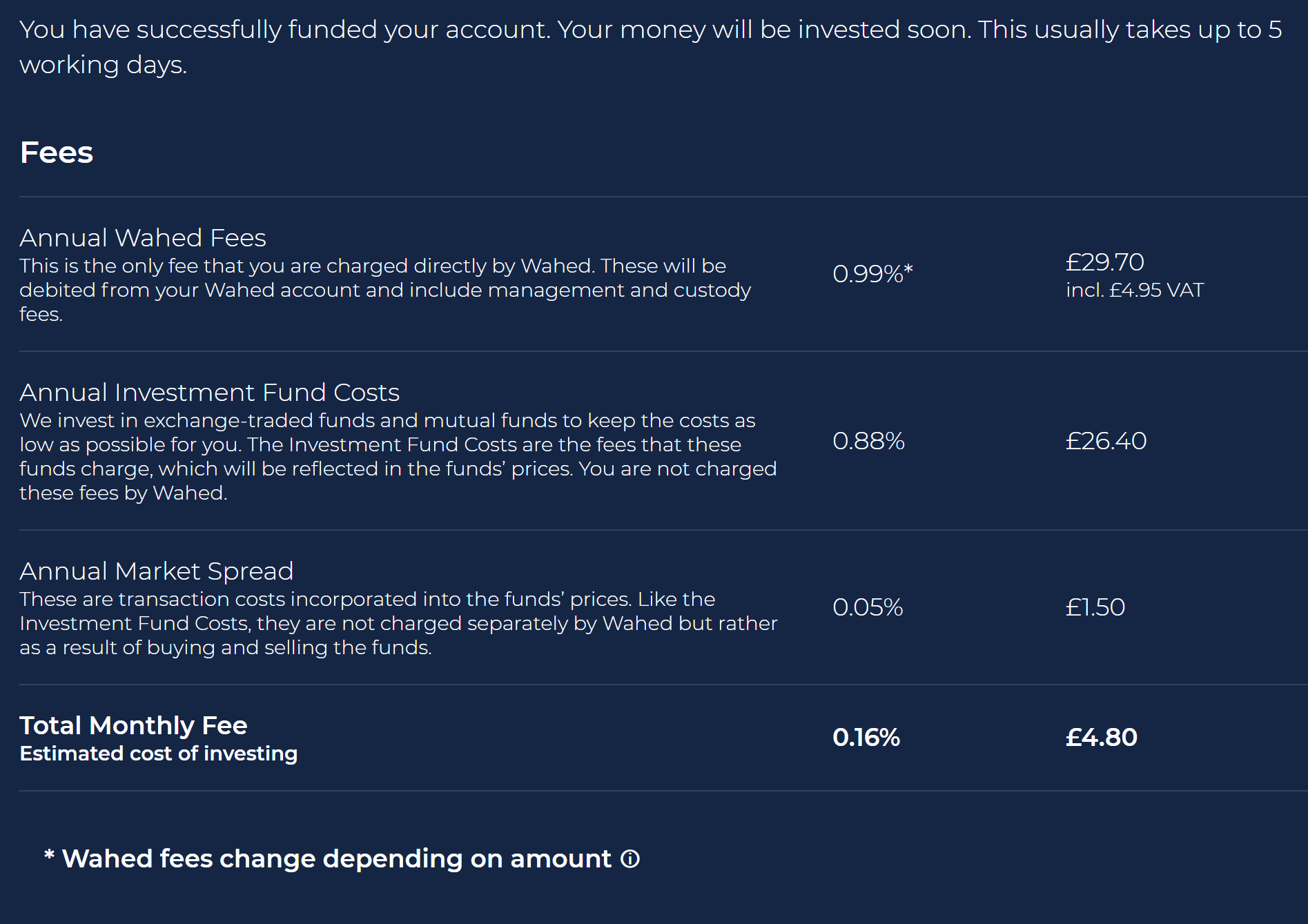

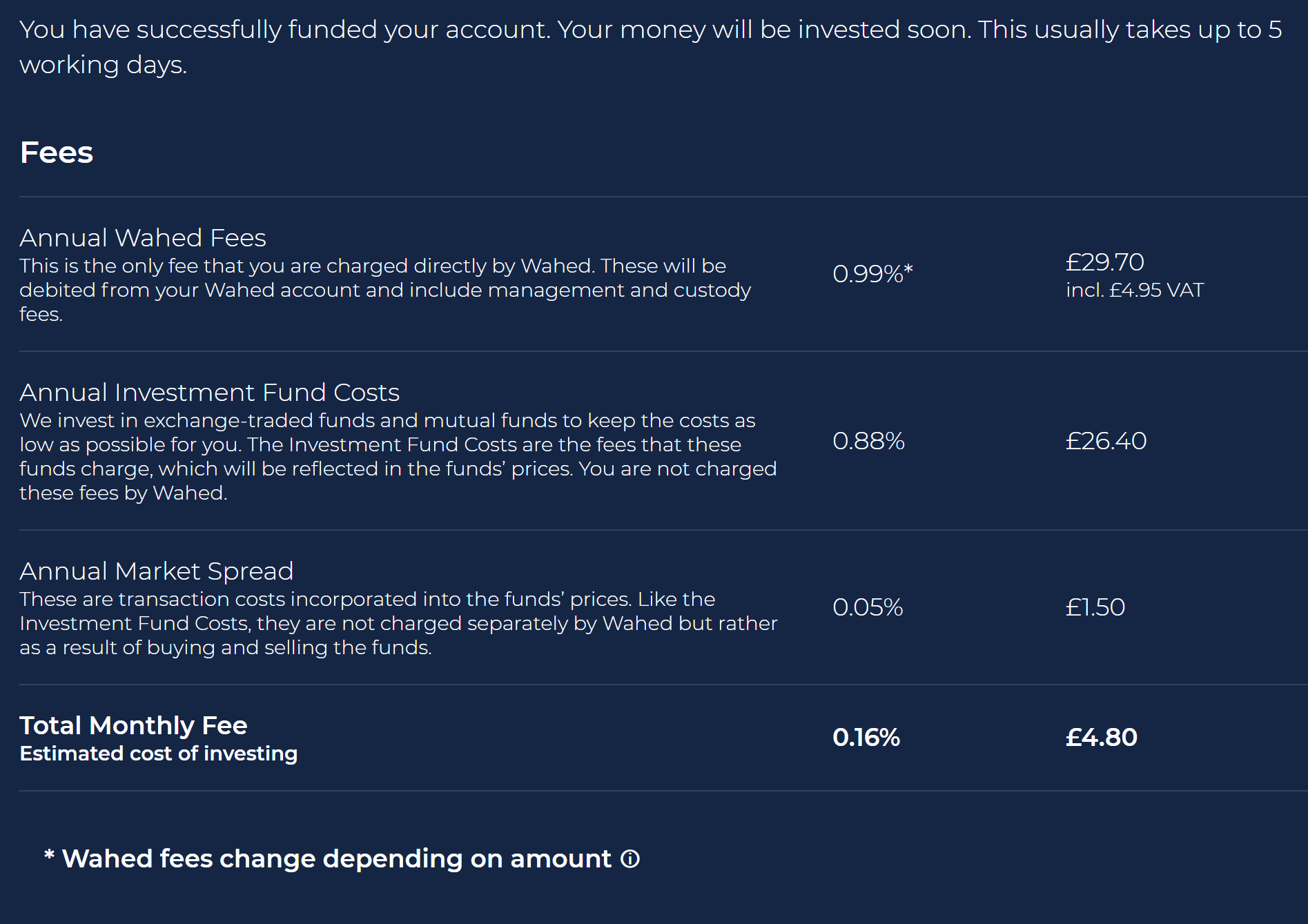

So how does Wahed’s fee structure work? Well for the UK it is as follows (for someone like me who has invested below £250,000):

So for the year, I’m looking at 1.92% all in (0.16% x 12) which I’ll be paying.

So the question is, can I beat that going elsewhere?

I’ve picked a couple of instruments from the ones Wahed offered and ran them through Hargreaves Lansdowne.

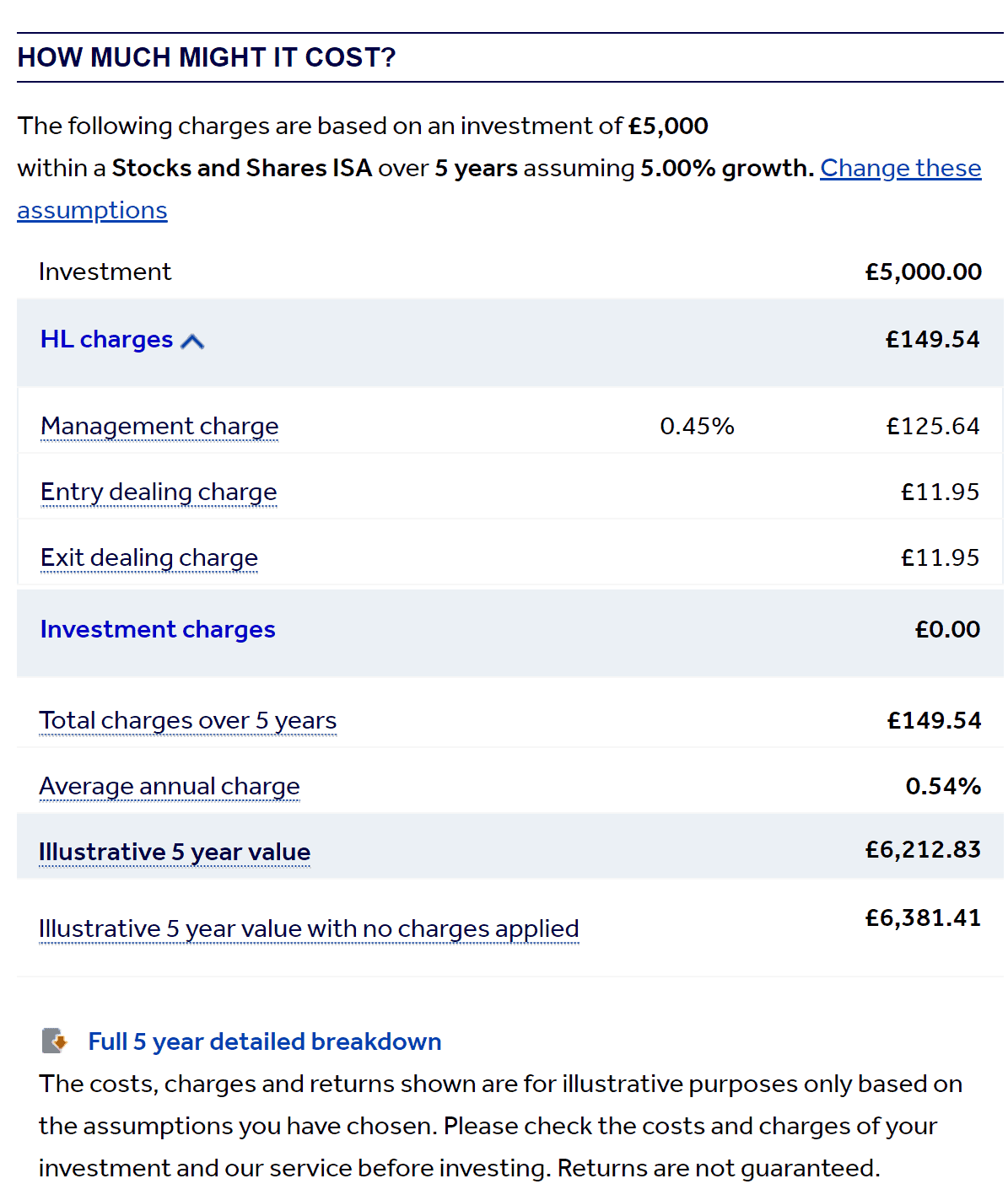

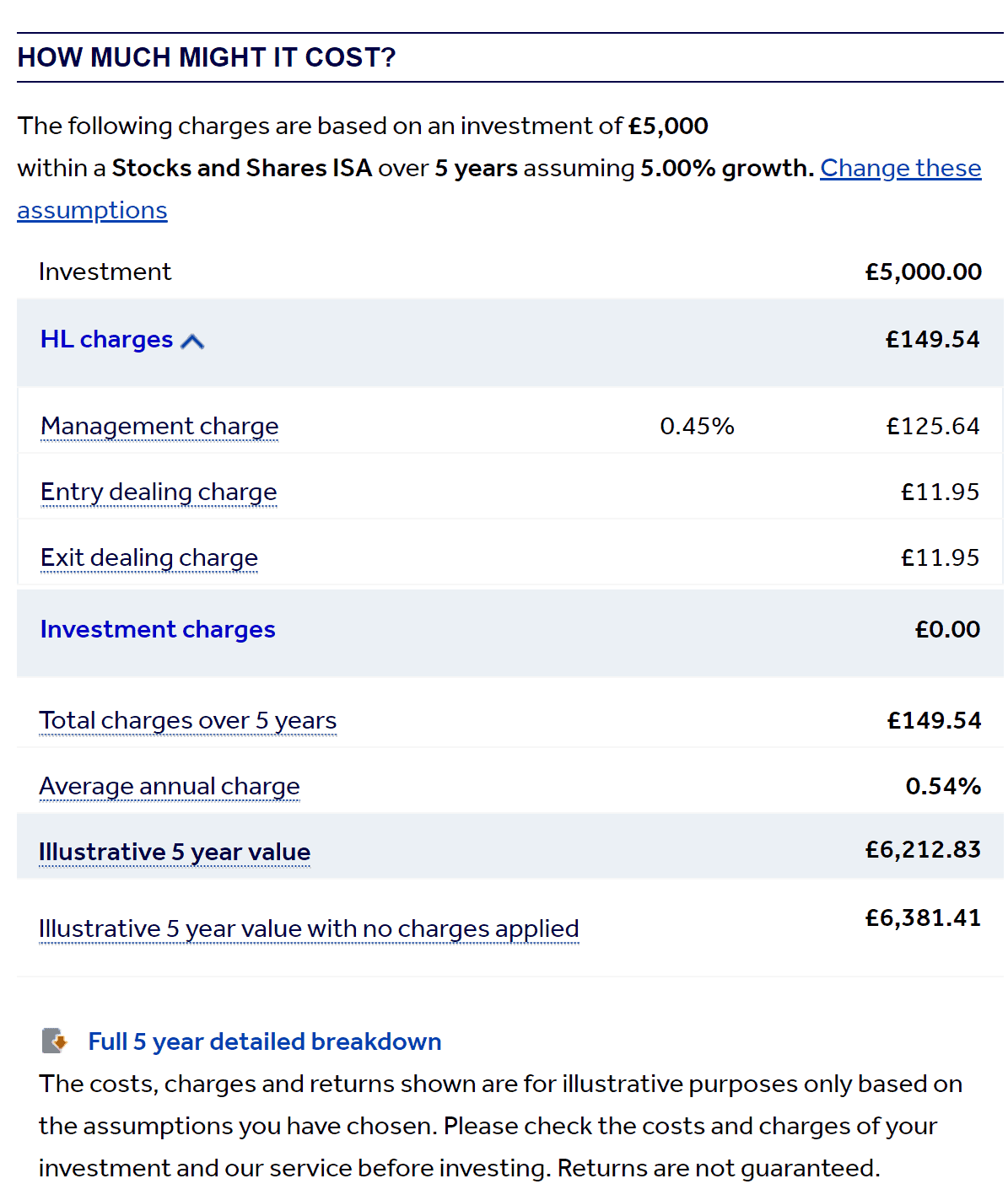

Here is a snapshot from Hargreaves Landsdowne on the costs associated with you investing in “iShares MSCI EM Islamic UCITS ETF USD (Dist)” through them:

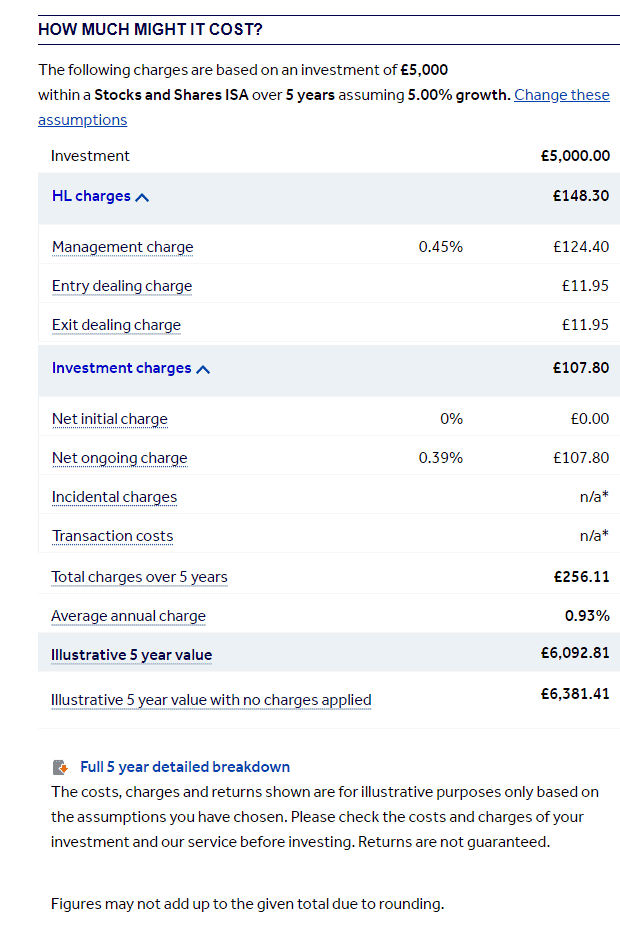

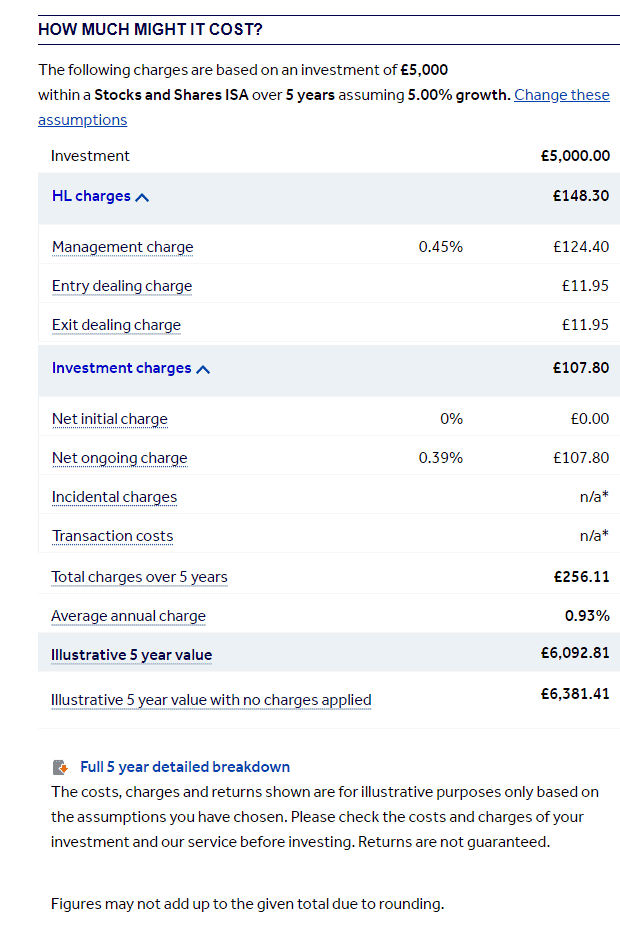

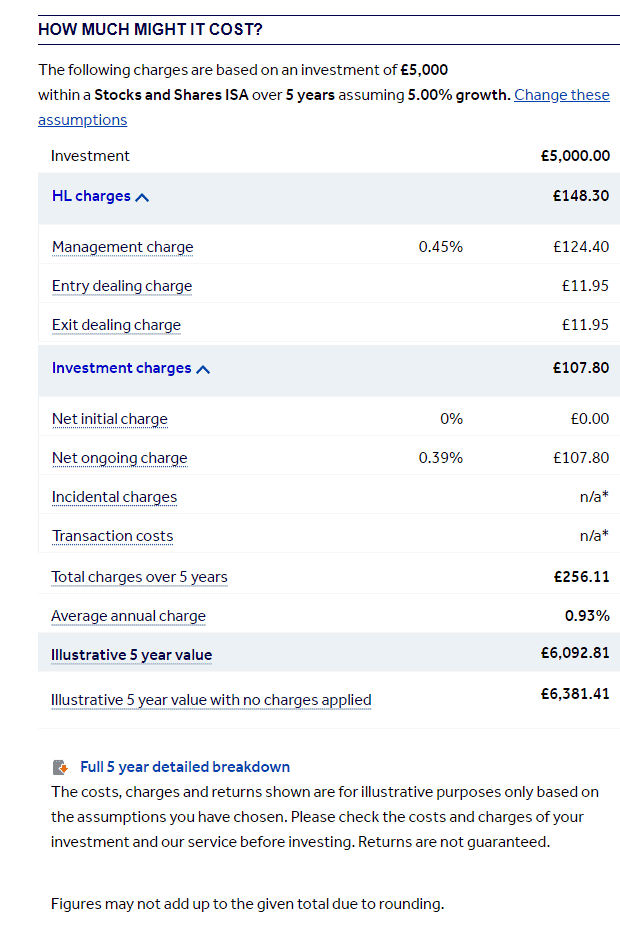

Here is another snapshot for “ETFS Physical Gold (GBP)”:

So lets say for the sake of argument that Hargreaves had all 5 instruments offered by Wahed and we are going to create a like-for-like portfolio over 5 years investing £3000.

HL would charge per annum:

- HL management fees: 0.45% [£67.50 over 5 years]

- HL transaction fees: £120 (each instrument will need to be bought and sold once, and there’s 5 of them. One trade costs £12.)

- HL: Fund costs – these are the same so I won’t analyse these.

HL total over 5 years: £187.50

Wahed would charge per annum:

- Wahed management fees: 0.99% [£148.5 over 5 years]

- Wahed transaction fees: £7.50 [£1.50 per year for 5 years]

- Wahed Fund costs – there are the same so I won’t analyse these.

total over 5 years: £156

So on test 2 Wahed also passes.

However, do note that if you are a high net worth and looking to invest in excess of £250,000, this whole analysis needs to be rerun, because then, the transaction fees (which is where Wahed steams ahead of others at smaller scales) will make up a relatively small percentage as it will stay fixed for Hargreaves at £12 but go up for Wahed as it is a percentage amount. So numerically, £120 is a tiny fraction of £1m, while it is a large fraction of £100. However 0.05% of £1m is £500 – which is what the Wahed amount would be.

Can I open an account with just £100?

In short, not really – however I do caveat that I have only analysed for two big brokers. I am sure there will be others (though not sharia-compliant) who will allow you to invest for less.

The minimum amount to open an HL Fund and Share Account is just £1, however the minimum lump sum investment into a fund is £100. Direct Debits can be set up from as little as £25 per investment per month. So if you want to invest in 5 funds, you’ll be looking at a minimum starting amount of £500.

For IG, there is a minimum investment of £500 for each portfolio you create. IG will not invest any funds into your portfolio until you have deposited at least £500.

Does the account automatically update/rebalance with competitors?

In short, yes.

Both IG and Hargreaves have their own versions of managed portfolios. IG has its Smart Portfolio while Hargreaves has its Portfolio+.

There are a number of other investment managers who provide this service as well, so here Wahed is not unique.