Autumn Budget 2025: What This Means For UK Muslims

26 November 2025 6 min read

Adil Hussain

Head of Content

10 min read

Last updated on:

Every year, the UK government gives you a golden opportunity to build wealth completely tax free. No income tax. No capital gains tax. No dividend tax. It sounds too good to be true, but it’s real. It’s called an ISA.

The issue is, many Muslims either don’t know how to use one properly or they avoid it altogether because they’re unsure if it’s halal.

To fix that, in this guide, we’ll explain what ISAs are, which ones are halal, and how to use them to grow your money in a way that aligns with your values.

Whether you’re just starting out or looking to optimise your existing investments, this is the practical, plain-English guide every UK Muslim needs.

If you’d rather watch than read, here’s our full breakdown in this YouTube video:

Key points at a glance

An ISA (Individual Savings Account) is a UK government scheme that lets UK residents save or invest money without paying any tax on the returns. That means:

Each year, UK residents can contribute up to £20,000 across various ISA accounts (Cash, Stocks & Shares, IF-ISA, etc.) as long as the combined total doesn’t exceed £20,000.

If you invest outside of an ISA, HMRC can eat into your gains through dividend tax and capital gains tax. Over decades, that adds up.

Let’s say you invest £20,000/year for 40 years with a 7.5% return:

| Scenario | Tax rates | Final amount |

| Inside ISA (tax-free) | N/A | £4.37 million |

| Outside ISA (taxed) | 24% capital gains tax, 33.75% dividend tax (higher-rate taxpayer) | £1.7 million |

That’s up to £2.6 million lost (assuming a 50/50 split between dividends and capital growth for a higher-rate taxpayer).

All because you didn’t use a free wrapper.

And this has only become more important in recent years:

That means even modest portfolios now trigger tax bills, unless they’re inside an ISA.

ISAs are halal as long as the money is invested in Shariah-compliant assets. The ISA itself is just a tax-free wrapper. Whether it is halal or haram depends entirely on what you put inside it.

Think of an ISA like a shopping basket. The basket is not haram, but if you fill it with pork or alcohol, the contents are impermissible. The same idea applies to ISAs.

If you fill your ISA with halal investments like Islamic ETFs, sukuk, or screened stocks, it remains halal. If you include interest-based savings or haram companies, it becomes problematic.

In this section, we’ll go through each type of ISA, explain what it is, and clarify whether it’s halal or haram. We’ve also included a summary table so you can quickly compare your options and find providers that offer Shariah-compliant choices.

| ISA type | Description | Halal status | Example permissible providers |

| Cash ISA | Same as a regular savings account | Haram if it pays interest, halal if offered by an Islamic bank that pays a target return based on profit-sharing. | Gatehouse Bank |

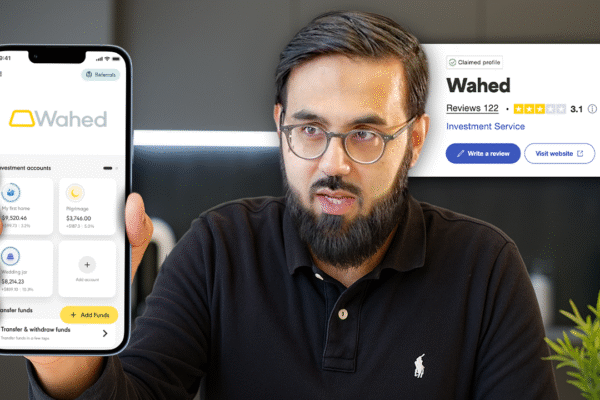

| Stocks and Shares ISA | Lets you invest in shares, ETFs, and funds | Halal if underlying investments are Shariah-compliant (e.g. screened ETFs and stocks, sukuk). | Islamic providers such as Wahed and Simply Ethical Any mainstream broker such as AJ Bell, HL or Trading212 (just make sure to avoid receiving interest on cash balances) |

| Innovative Finance ISA | Invests in peer-to-peer lending or asset-backed finance | Most are haram. Look for shariah-certified IFISAs that use asset-backed deals | Cur8 Capital, Nester |

| Lifetime ISA | Helps save for a first home or retirement, with a 25% government bonus. Available as either a Cash LISA or a Stocks & Shares LISA. | Follows the same ruling as Cash or S&S ISAs, depending on the type of LISA. | AJ Bell, Hargreaves Lansdown (just make sure to avoid receiving interest on cash balances) |

| Junior ISA | Long-term savings for children under 18. Available as either a Cash JISA or a Stocks & Shares JISA. | Follows same ruling as Cash or S&S ISAs, depending on the type of JISA. | AJ Bell, Hargreaves Lansdown (just make sure to avoid receiving interest on cash balances) |

Cash ISAs are the same as regular savings accounts, where you deposit money with a bank and earn a return.

For mainstream conventional banks like HSBC and Halifax, this return will be in the form of interest. However there are Islamic savings accounts offered by Islamic banks such as Gatehouse Bank, that pay out a target return instead of interest.

Cash ISAs are suitable for people with short term savings goals (<5 years) and can be a good place to store emergency funds due to their easy access nature. It’s low risk but also low returns.

If it’s a regular saving account that pays interest, then it would be impermissible. If it’s a cash ISAs offered by Islamic banks such as Gatehouse Bank that pays profit, then it would be permissible.

A stocks and shares ISA is a tax-free investment account that lets you put your money into things like individual stocks, ETFs (exchange-traded funds) and sukuk. Unlike a Cash ISA, where your money just sits in a savings account, a Stocks and Shares ISA gives you access to long-term investment growth.

A Stocks and Shares ISA can be halal if you only invest in Shariah-compliant assets. The ISA itself is just a wrapper, so the halal status depends entirely on what you put inside it.

You have two options:

This means building your own portfolio of individual halal stocks or ETFs. You’ll need to avoid companies involved in haram sectors like alcohol, gambling, or interest-based finance.

Tools like Zoya and Islamicly can help you check if a stock is halal. We’ve also put together a list of halal investment ideas on our Halal Investments comparison page.

If you prefer not to do it all yourself, there are platforms that offer ready-made, Shariah-compliant investment options such as Wahed and Simply Ethical.

Both options can work. It just depends on how much control you want and how involved you want to be.

When used correctly, this ISA is one of the most powerful halal wealth-building tools available to Muslims in the UK.

An Innovative Finance ISA (IF-ISA) lets you invest in alternative investments, such as peer-to-peer (P2P) lending and asset-backed investments. These are typically platforms where your money is lent to individuals or businesses without going through a bank.

These ISAs are less well-known but can offer higher returns than traditional savings, with more diversification beyond the stock market. However, they usually carry higher risk and are not protected by the Financial Services Compensation Scheme (FSCS).

Most IF-ISAs on the market are not halal, because they involve interest-based lending (riba). However, there are 2 Shariah-compliant options structured around halal asset-backed financing:

As always, make sure to review the underlying structure and terms before investing.

A Lifetime ISA (LISA) is designed to help you save for a first home or for retirement. You can put in up to £4,000 each year, and the government adds a 25% bonus, up to £1,000 annually.

You must be aged 18 to 39 to open one, and you can use the funds either to buy your first home (up to £450,000) or withdraw it after age 60 for retirement.

There are two types of LISAs:

It depends on the type of LISA:

So the ruling follows the same logic as a regular Cash ISA or Stocks and Shares ISA. If you’re going for a halal option, stick to a Stocks and Shares LISA and make sure it’s invested in halal assets. We go into more detail for Lifetime ISAs in this article.

A Junior ISA (JISA) allows parents or guardians to save or invest money for their child’s future, completely tax-free. You can contribute up to £9,000 per child per tax year. The money is locked away until the child turns 18, at which point the JISA turns into a regular ISA in their name.

Like adult ISAs, there are two types:

The halal status depends on the type:

The ruling is the same as with adult ISAs. If you want to save for your child in a halal way, choose a Junior Stocks and Shares ISA and ensure you only invest in screened investments.

Choosing the right ISA depends on your goals, how long you plan to invest, and your comfort with risk.

Here’s a quick cheat sheet to help you decide:

| ISA type | Suitable for | Annual deposit limit | Providers |

| Cash ISA | Short-term funds | £20k | Gatehouse Bank |

| Stocks and Shares ISA | Long-term growth (5+years) | £20k | Islamic providers such as Wahed and Simpy Ethical Any mainstream broker such as AJ Bell, HL or Trading212 (just make sure to avoid receiving interest on cash balances) |

| Innovative Finance ISA | Higher returns via alternative investments (P2P lending) | £20k | Cur8 IF-ISA, Nester |

| Lifetime ISA | Saving for first home or retirement | £4k | AJ Bell, Hargreaves Lansdown |

| Junior ISA | Parents saving for child’s future | £9k (per child) | AJ Bell, Hargreaves Lansdown |

No, they do not. Your annual ISA allowance only covers the amount you contribute each tax year. Any growth, dividends or profits you earn inside the ISA do not count towards that limit and are completely tax free.

No. ISAs operate on a use it or lose it basis. If you don’t use your full allowance in any given year, then it’s gone forever.

No. Your ISA allowance is individual and non-transferable.

You can’t give or share your ISA allowance with a spouse, child, or anyone else. However, your spouse has their own separate £20,000 allowance, so as a couple, you can invest up to £40,000 per year tax-free.

Additionally each child has a £9,000 allowance so a couple with 2 kids could theoretically contribute up to £58,000 a year tax-free.

Yes, you can transfer your ISA to a different provider at any time without losing your tax-free benefits. Make sure to use the official transfer process through the new provider. Do not withdraw the money yourself and try to redeposit it, or you may lose the tax benefits.

Yes, zakat is due on zakatable assets inside your ISA, such as cash, shares or sukuk. The ISA’s tax-free status under UK law does not affect the religious obligation to calculate and pay zakat annually on your qualifying assets.

If you’ve made it this far, well done. Most people never take the time to understand how ISAs work, let alone how to use them in a halal way. But now you do.

ISAs are an incredible vehicle for long-term wealth building, and Muslims need to seize this opportunity. Whether you’re saving for your first home, planning for retirement, or putting something away for your kids, there is an ISA that fits your goals.

Start small if you need to. Be consistent. Use as much of your allowance each year as you can. And be intentional about what you invest in.

If you want more support on that journey, we’ve put together a free email course called The 5 Money Mistakes Keeping Muslims Poor (and How to Fix Them). It’s packed with practical tips to help you build better financial habits, avoid common traps, and grow your income the halal way.

And if you found this helpful, share it with a friend or family member. Halal investing doesn’t have to be complicated. We just need to talk about it more.

26 November 2025 6 min read

26 August 2025 7 min read

24 July 2025 15 min read

Leave a Reply