Is the S&P 500 Halal? A Guide for Muslim Investors

26 August 2025 7 min read

Mohsin Patel

Co-founder

6 min read

Last updated on:

If you had bought shares in Microsoft at the start of 2023, you’d be up 40% right now.

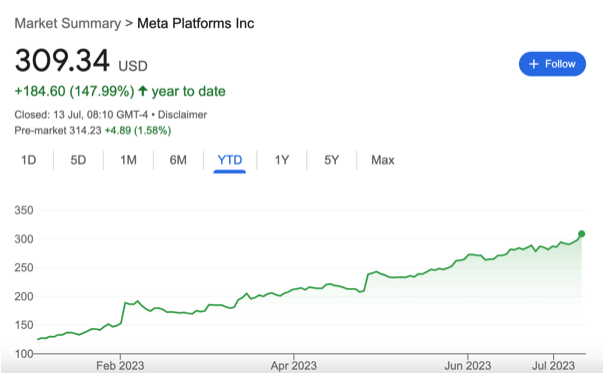

If you had done the same with Meta (formerly Facebook), you’d be up 147% right now.

If you had bought gold, you’d be down 2%.

Conclusion? The stock market is back with a roaring vengeance. The bull was wounded when the post-covid, high inflation (and high interest rates), recession-facing mood set in and stocks generally plummeted.

But since the turn of 2023, investors have voted with their feet and the results are clear to see. Confidence is high and (some) share prices are soaring.

In this article, I’m going to explore why confidence is so high in the stock market, where we might be going in the future, and what all of this means for you and your investment portfolio.

It does seem rather odd that at a time when me and you are being told at the supermarket checkout that our money is worth about 15% less than what it used to be, there is literally a war going on in Eastern Europe, and unemployment has ticked up, that Wall Street is buzzing and stock market investors are making lots of money.

Some commentators are of the view that the reason for this is that the market is clearly signalling that the worst is behind us. With interest rates having been raised so high so quickly, there is only so much further they can go. And with all the bad news having been reflected in the market before, it’s like a coiled spring ready to bounce.

Another reason for general confidence could also be supply-related. Remember that the stock market is just a collection of trading businesses. During COVID and beyond, many of these businesses had issues actually getting hold of raw materials and goods. Prices were driven up due to the short supply, and many commentators (this one included) are of the view that this was one of the main drivers for the high levels of inflation that we saw.

One of the economic indicators I regularly keep an eye on is the cost of shipping a 40ft container. This is how many businesses get their stock over from places like China. Increases in the price of this can indicate supply-side issues.

(Source: https://fbx.freightos.com/)

Prior to the pandemic, it was fairly normal to be paying around $2,000 to ship everything over. At the height of the pandemic, this rose 10x to $20,000.

This has now eased again, along with other supply-side issues, and the hope is that this will feed into lower or stagnant prices at the checkout. As far as the stock market goes, all of this leads to higher confidence since everybody is, in theory, no longer feeling doom and gloom.

Investors are saying: the bad times are behind us and the good times are ahead.

But if you dig a little deeper, I would argue that things are a little more nuanced.

You see, if I am going to argue that the bull market is back, it’s important that I consider what is actually going on. For those of you who have lived through bull markets, you will know what it feels like. You literally cannot lose. Pretty much every stock you pick will have its day and you will feel like a genius.

I’m not sure that is going on here.

There are two key reasons to actually believe that this newly-found confidence is just an anomaly in an otherwise rocky road.

If you look at the S&P 500 index, you will see that we are still a little way off the all-time highs. Even at individual stock level, Meta is the same.

At the time of writing, Microsoft is testing its all-time highs and it will be interesting to see if it can break through.

For a little more context here, the all-time high share price or index price is often seen as a “ceiling” that needs to be broken through, following which there is clear sky. What often happens is that investors get a little nervous when previous all-time highs are being poked at and it needs an awful lot of confidence to break through an all-time high.

If all-time highs are breached then that is a clear sign of confidence. If they are not, however, then share prices will likely stagnate or trend downwards for a little time before investors rally up the confidence again to try and break through those all-time highs.

The point remains though that we are not in the territory of having “broken out” from all-time highs and when it comes to the stock market, momentum is everything.

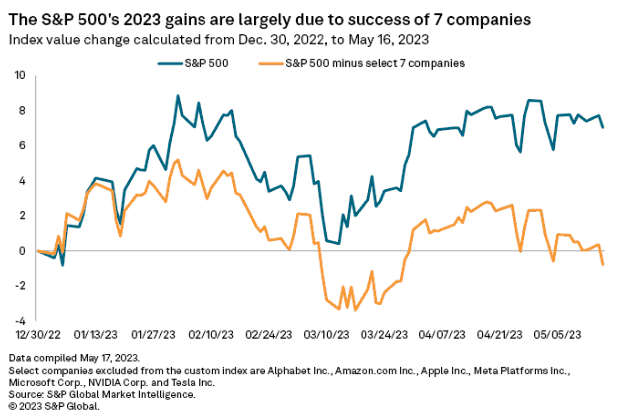

The most convincing argument that this rally is not real is that if you look at what companies are driving the index up, it is a concentration of a small number of mega companies like Microsoft and Meta.

Since the index is just a collection of companies, when a few really outperform it can skew the perception of how the whole market is doing.

The current rally is being driven by just SEVEN companies: Amazon, Meta, Alphabet, Apple, Microsoft, Tesla and Nvidia. Remove those, and actually the S&P 500 is flat for the year.

That doesn’t feel very bull market-y to me.

In fact, it feels exactly like the kind of environment that might lead people into making rash decisions and go all in on the stock market when confronted with nice headline figures.

That’s not to say that the stock market is not in a bull market: the truth is that I don’t know, and nor does anybody else. But our job is to look at the wider signals in order to assess what we should do with our portfolio.

(Source: https://ofdollarsanddata.com/)

Okay let’s get practical now.

The chances are that if you have been investing for a while, you likely have a mixture of asset classes in your portfolio. A mix of real estate, stocks, fixed income, savings accounts and perhaps some private equity.

I will keep my views really simple and actionable and of course this is NOT investing advice, it’s just how I see things right now.

If you’re looking to get your investing life sorted then you should check out our investing platform, Cur8 Capital. We don’t offer stocks, but we do have a high quality selection of private funds across other asset classes like real estate and fixed income which might tickle your fancy.

26 August 2025 7 min read

24 July 2025 15 min read

16 July 2025 5 min read

Leave a Reply