Sizing the Muslim Market for Islamic Economy Startups

Ibrahim Khan

Co-founder

8 min read

Last updated on:

$2.7 trillion Islamic economy. £20 billion UK Muslim contribution. 1.8 billion Muslims.

We’ve all heard those numbers and at IFG we have seen these numbers used multiple times to scope the size of the Muslim market in start-up pitch decks.

But here’s the thing: these numbers are often unhelpful, and, in some cases, very misleading. There is a big difference between (a) general market size (i.e. revenue generated in a particular industry) (b) addressable market size (i.e. revenue that your particular sector generates); and (c) your target market share of the addressable market. There’s also a big difference between assets-under-management within a sector, and the actual profit one can make within that sector.

All that is not to say that those who use the numbers I started with have malign intent. The reason why they use them is because these are the only “official” numbers out there for them to use.

You see, in the true academic spirit, people want to quote from sources they can footnote. So they use the following:

- The MCB’s Muslim Pound Report;

- The Thomson-Reuters Islamic Finance Development Report;

- The Thomson Reuters/Dinar Standard: The State of the Global Islamic Economy Report;

- The Gatehouse Islamic Finance Consumer Report 2019;

- The Deloitte Sustainable Finance Report;

- The IIFM Sukuk Report;

- Mapping the Global Muslim Population by Pew (see also here);

- Crescent Rating’s Global Muslim Travel Index 2019;

[I will references these sources variously throughout this article by number. E.g. [1] for the MCB’s Muslim Pound Report.]

But these resources – while invaluable as a starting point – are written for wide variety of purposes and are themselves limited by the paucity of Islamic-economy-specific data available for them to rely on. They are also restricted in that they sometimes talk of the Muslim community as a homogenous whole. This then wraps up into one number, for example, all the revenue generated by Islamic finance and Islamic fashion – but that’s not always useful.

There’s also the slight problem that there is an implicit benefit to the writers (unconscious though it is) if the Islamic economy is made out to be massive – as it attracts more business their way. (I’m aware we’re also part of this ecosystem!)

Some of these resources also a bit limited by the general focus of the Islamic finance industry on the corporate world this past three decades (as opposed to the lives of ordinary Muslim consumers).

Now, thankfully that is all changing. See here for a recent Financial Times report on the emerging new breed of Islamic fintechs. But for these new entrants into the market, they need new data specific to them.

So we thought we’d have a rough-and-ready crack at sizing the real scale of the Islamic economy in a way that actually captures what the true size of the market is for the average Islamic start-up. This is a work in progress and meant as a conversation starter – so do share your thoughts below.

Assumptions

Firstly, some assumptions we’ve made for the purposes of this article (there are other assumptions too, but these are the big ones we thought worth spelling out).

- Muslim countries/communities are going to be the predominant users of Islamic start-up products.

- The Muslim middle class is the primary user of Islamic start-up as it will have the necessary money to use it.

Side note: if an Islamic start-up comes up with a product that it can message and place correctly in the market to reach a non-Muslim audience too, then it will challenge assumption (1) and massively increase its reach. Similarly, if an Islamic start-up comes up with a product that even working-class folk and people on the breadline need to use, then that again increases their market.

What building blocks to build from?

-

Muslim population size.

The first and obvious one is to start from the biggest number possible and work your way down.

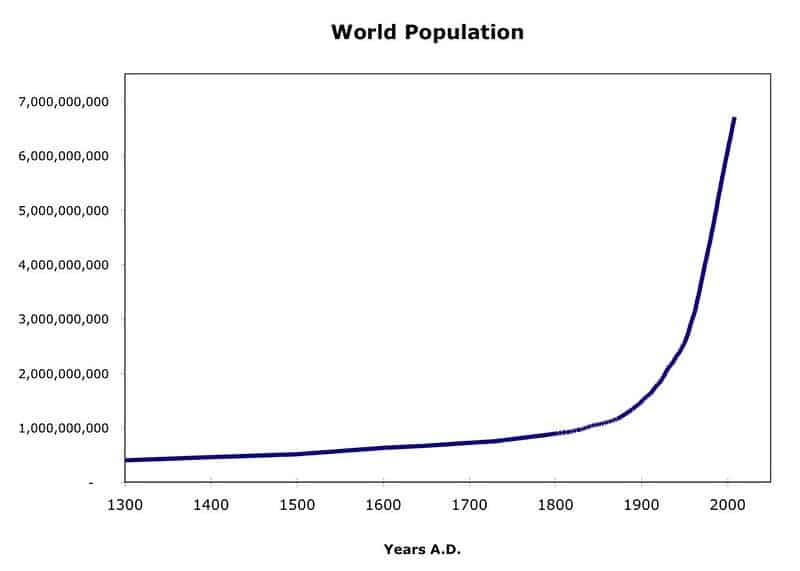

Pew have done some great work in [7] and estimate that over the next 30 years Muslims will go from a population of around 1.6bn in 2010 to 2.8bn in 2050. That’s a helpful statistic as it helps us worth backwards and project numbers. More specifically, if we model the Muslim community to be growing exponentially (as opposed to in a linear fashion) then the growth rate every year is 1.25%. Here’s an exponential growth graph of the human population for last few hundred years as an example of the graph shape we’ll end up with.

You can use this calculator to plug in the right numbers (the right numbers are “1.6” for the initial value, “1.25%” for the growth rate and whatever you’d like to model for set as the time value). So now, rather than saying, there will be 2.8bn Muslims in 2050, you can say, “there will be 1.92bn Muslims in 2025”. The latter is much more relevant for you as who knows where you will be by 2050!

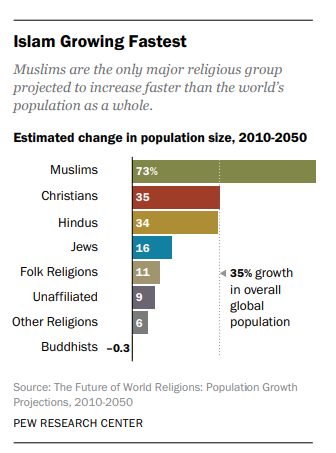

Another interesting snippet to throw in here is that the Muslim population is growing much faster than the rest of the world. Here’s a graph from [7]:

-

Muslim population size above $16,000 annual family income.

But working out that there’s 1.9 billion Muslims in the world is not enough – as the vast majority of these will likely be too poor to be able to spend, save or transact with you in any meaningful way.

So in other words, we’re looking for the size of the global Muslim middle class.

Using the ranking tool on this website we can rank the OIC (a good proxy for all Muslim countries) according to gross national income (“”GNI”) per capita. Lets assume that the average family has 4 people in it. Lets also assume that a middle class family on average will earn at least $16,000 per annum. So any country with less than $4000 GNI per capita should be excluded. That excludes the bottom 36 countries and only leaves 21 countries remaining.

These countries are:

| Rank | Country | Value (USD) | Population(m) |

| 1 | Qatar | 63305.19 | 3 |

| 2 | United Arab Emirates | 40994.31 | 10 |

| 3 | Kuwait | 33485.39 | 4 |

| 4 | Brunei | 30057.2 | 4.3 |

| 5 | Bahrain | 22476.09 | 1.5 |

| 6 | Saudi Arabia | 21238.99 | 34 |

| 7 | Oman | 14611.34 | 5 |

| 8 | Maldives | 11346.88 | 0.5 |

| 9 | Turkey | 10408.6 | 82 |

| 10 | Malaysia | 9684.14 | 32 |

| 11 | Lebanon | 8771.9 | 7 |

| 12 | Kazakhstan | 8004.71 | 18 |

| 13 | Gabon | 6664.17 | 2 |

| 14 | Suriname | 6596.92 | 5.7 |

| 15 | Turkmenistan | 6340 | 6 |

| 16 | Iran | 5690.22 | 81 |

| 17 | Iraq | 4838.28 | 38 |

| 18 | Guyana | 4581.98 | 1 |

| 19 | Albania | 4573.91 | 29 |

| 20 | Jordan | 4108.6 | 10 |

| 21 | Algeria | 4003.74 | 42 |

The combined population size of these countries is approximately 400 million.

400 million is not a bad approximation quite frankly of the target market, given the overall Muslim population is 1.9 billion.

But this method is a bit too rough and ready in our opinion, because of the countries we have cut off, are some massive markets such as Indonesia and Pakistan – and we know for sure that there are rich people in those countries who would be real targets for Islamic start-up. And of the countries listed above, there will be very poor people who won’t be target audiences for this.

So we need to come up with some way of working out relative concentrations of wealth in all Muslim countries and then work backwards from that to work out roughly how much your average middle-to-upper-class family has in annual income.

The GINI coefficient is one such metric that we can use to get a sense of concentrations of wealth in a society. See here and here for good introductions.

Using some great data from SESRIC (which is the OIC’s data and statistics organisation), we have worked out that the following countries have a GNI per household (assuming 4 people per household) of $20,000 or more:

| Country | Middle Class Households | GNI per Middle Class Household |

| Qatar | 486,793.48 | £343,216.91 |

| United Arab Emirates | 1,685,417.83 | £228,639.11 |

| Kuwait | 724,029.08 | £191,308.96 |

| Brunei | 75,068.35 | £171,649.35 |

| Bahrain | 274,651.83 | £122,145.38 |

| Saudi Arabia | 5,897,490.73 | £118,622.38 |

| Oman | 845,159.53 | £80,152.93 |

| Turkey | 11,956,939.91 | £70,289.12 |

| Malaysia | 4,650,466.29 | £65,854.46 |

| Maldives | 79,417.18 | £62,341.50 |

| Suriname | 61,055.05 | £60,874.86 |

| Lebanon | 1,167,741.71 | £45,689.75 |

| Kazakhstan | 3,312,615.44 | £43,586.76 |

| Turkmenistan | 865,934.38 | £42,158.14 |

| Gabon | 328,487.63 | £41,084.81 |

| Iran | 12,270,040.35 | £37,639.16 |

| Guyana | 107,892.05 | £33,034.23 |

| Libya | 1,669,641.75 | £29,202.85 |

| Iraq | 6,773,922.00 | £27,337.67 |

| Albania | 508,781.74 | £25,832.17 |

| Jordan | 1,650,208.82 | £24,156.40 |

| Indonesia | 41,420,916.57 | £23,742.36 |

| Palestine | 757,326.17 | £21,773.97 |

| Algeria | 7,643,345.65 | £21,643.30 |

| Azerbaijan | 1,824,418.29 | £20,993.04 |

| Tunisia | 1,942,954.27 | £20,042.01 |

This translates into the following overall population size:

| A | total middle class ≥ $9000 per household | 943m |

| B | total middle class ≥ $20,000 per household | 436m |

| C | total middle-class equivalent to UK GNI per household | 12m |

Figures (A) and (B) are comforting, but (C) is particularly worrying for UK Islamic start-ups as it would suggest that the number of Muslims globally who are roughly as rich as Muslims in the UK, is a pretty small number. However, that number is a sum of all the middle-class population in each of the following countries: Qatar, UAE, Kuwait and Brunei.

Importantly though, that number ignores the large target middle classes in places like Saudi Arabia, Turkey and Malaysia. Each of these countries will have millions of people who are as rich or richer than your average Brit.

Further, Nigeria, Bangladesh and Pakistan – three of the most populous and growing Muslim populations – are not in the list above as they had a GNI per middle-class household lower than $20,000. But in reality, they are still markets very much worth targeting as they have such large populations, that even the small segment within their middle class who have over $20,000 will still be a large market.

Let’s take Pakistan as an example. Let’s assume that the general statistic that 10% of the world’s population owns 84% of the world’s assets is true and applicable to Pakistan. With a population size of 212 million, the top 10% alone will add up to 21 million, amongst which a good proportion will be as rich as your average Brit.

Conclusions

So as a very rough-and-ready market-sizing, we would suggest that the 400 million figure is about right and the number is likely a little larger than that. That is a sizeable target audience (given that the USA’s population is only 320 million) but it does homogenise a wide variety of varying cultures, languages and markets.

So a better way to think about it might be to break up that 400 million into four separate target audiences:

- The Middle East

- The Western expats

- The Subcontinent

- The Far East

Each of these audiences have different needs, sharia standards, modes of communication and language, and levels of religious observance. It would be a mistake to try a one-size-fits-all approach to them for an Islamic start-up product.

But there’s no need to be disheartened. Yes, we’ve chopped down a 1.9 billion number to just 400m – but that is 400m quality targets. Bear in mind, the USA has a population size of 320 million as we mentioned above, and only a subset of that will be part of the target audience middle-class – but the USA is still the world’s largest economy. The 400m we’re pointing to doesn’t need to be chopped down further. It is the Muslim middle class. So plenty to work with for the next Muslim economy unicorn.

However, please do note that there are a bunch of other very important considerations that we have not factored into our analysis, including:

- Muslim minority communities in non-Muslim countries or non-OIC countries (this will increase the numbers)

- The relative religiosity of Muslims, and what proportion of them will use Islamic finance as opposed to conventional finance (this will decrease numbers, we suspect, by about 50-60%)

- The varying price points for Islamic start-ups (so for some the entry point will be much lower than middle class, while for some it will be much higher).

This analysis is intended to be a conversation-starter, not the final word on the matter. If you have tussled with this issue yourself and approached it in a different way – we’d love to hear from you!

Some further interesting resources:

https://inequality.org/research/unequal-americas-income-distribution/

https://data.worldbank.org/indicator/ny.gnp.pcap.pp.cd

http://www.sesric.org/cif.php?c_code=41

http://www.sesric.org/oic-ranker.php

http://hdr.undp.org/sites/default/files/briefing_stat_oic_full.pdf

https://news.gallup.com/poll/166211/worldwide-median-household-income-000.aspx

You can access the excel used to calculate the numbers in this article here.

Comments (0)

Related Articles

View all

Wahed Invest – A Detailed Review & How to Use It (2025)

24 July 2025 15 min read

The Fall of Riba in the New York of Ancient Arabia

21 March 2025 4 min read

Leave a Reply