Is the S&P 500 Halal? A Guide for Muslim Investors

26 August 2025 7 min read

Adil Hussain

Head of Content

5 min read

Last updated on:

This is a common question among Muslim investors exploring different ways to grow their wealth. While many people invest directly in assets like stocks or commodities, others turn to financial instruments such as options contracts.

These contracts can be used to hedge risk or speculate on price movements, and they are often seen as a potentially lucrative but complex form of trading. If you’re also curious about other shorter-term strategies, you might find our guide on is day trading halal? useful.

In this guide, we’ll explain what options are, how they work, their main uses, and why Islamic scholars differ on their permissibility. Some argue that options involve excessive uncertainty (gharar) and gambling (maysir), while others believe they can serve a genuine economic purpose. We’ll also cover halal alternatives like Arbun and share the IFG view on when, if ever, options might be acceptable.

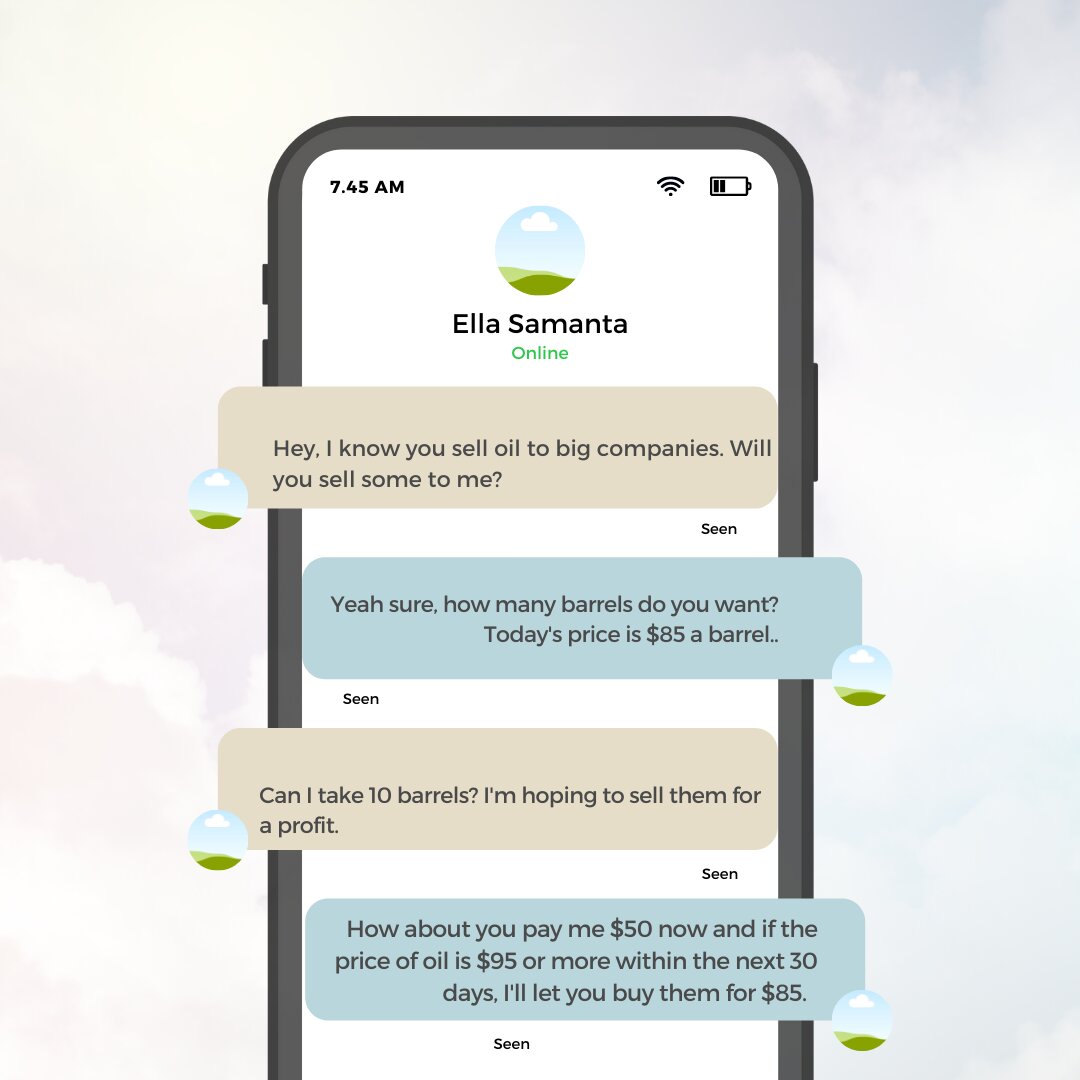

An options contract gives the buyer the opportunity to buy or sell an underlying asset for a specific price. This is known as the ‘strike price’.

For example, I want to have an option to buy oil at $85 if it reaches $95 or more within the next 30 days.

For this opportunity, the buyer pays a fee called a premium. The underlying asset can be stocks, commodities, bonds, or currencies. These contracts will also have expiration dates. It’s important to stress that there is no obligation on the buyer to actually buy or sell the asset.

The key benefit here is that if you don’t buy the asset because the strike price is not met, even though you lose the fee you paid (the premium), you are still probably better off than if you had bought the assets and then had to sell them at a loss.

Options have many use cases. In this article, we will focus on the two main ones.

Say you are an investor in Tesla stock but you are worried the price may go down. But you don’t want to sell your shares.

If the current share price of Tesla is $1000, you could purchase a put option which gives you the right to sell each Tesla share for $900 in the next year. So even if Tesla stock fell to $200 within 6 months, you would have the right to sell your shares for $900 each.

If during the coming year, your Tesla shares don’t go below $1000, then you would simply lose the premium you paid for the put option. Therefore, using options give you a way to manage your risk.

Let’s take the opposite scenario. You are super bullish on Tesla. You choose to buy an option as you only pay the premium up front and get more (potential) shares for your money.

You buy a call option that gives you the right to buy a certain amount of Tesla stock for $1200 at any time in the next 12 months.

If Tesla stock hits $1300, you might choose to exercise your option, and buy the Tesla stock. You can then sell this on the open market and make $100 per share.

Conversely, if the price stays below $1200, you will have lost the premium you paid to have the option of buying Tesla stock at $1200.

This is just a simple example to illustrate how traders can use options to speculate on price. Needless to say, it’s a lot more complex in the real world with many more variables to consider.

As with other forms of trading, it is difficult to consistently make money trading options. You would need the asset to behave exactly as you predicted before the option contract expires which is no easy feat.

Options trading is generally seen as impermissible due to three main points of contention:

This was covered on the IFG Fatwa Forum by Mufti Billal Omarjee and Mufti Faraz Adam.

Whether or not an option will be exercised is unknown at the time of agreement. Scholars say the uncertainty present in options amounts to Gharar. Here is a more comprehensive discussion on Gharar.

Furthermore options trading is said to exhibit elements of Maysir (gambling). Both parties to an options transaction enter essentially betting against the other. These scholars liken dealing in option contracts as akin to a game of chance[1].

The contention from scholars with charging a fee for option contracts is due to a promise not being a valid subject of sale. This position is supported by the likes of the OIC Islamic Fiqh Academy and Mufti Taqi Usmani[2].

Some scholars have also said there is an element of interest involved when charging a premium as this premium is added to the price of the asset[3]. This is particularly relevant when the underlying asset is a currency.

There is a minority view taken by some scholars that take the position that options trading is permissible.

They believe that options can help enhance liquidity in the market and help in hedging and therefore don’t see it as a form of gambling but something that has real utility. They also see no issue in charging for a promise[4].

Some scholars have advocated the use of Arbun as an alternative to a conventional option [5]. The key difference is in an Arbun contract, instead of paying a premium, a down payment is made.

The buyer then has the choice to complete the rest of the purchase before the contract expires or forfeit the deposit. Arbun thus gives the buyer the choice whether to proceed with a transaction but unlike conventional options, an Arbun cannot be traded.

Another alternative structure used by some Islamic Financial Institutions is a Wa’d. This is a unilateral promise to undertake something in the future but similar to an Arbun, this cannot be traded.

Some organisations charge fees along with the Wa’d structure but the permissibility of this is debated amongst scholars [6].

We have some sympathy for the opposing views – i.e. those views that deem certain options to be permissible. In cases of genuine need, for example currency exchange fluctuations for an international business with global supply chains, a more flexible, lenient approach is advisable.

If you are such a person you should check in with a scholar about your particular circumstances.

If you are speculating on options however, we would recommend against it as there isn’t a burning need and as options trading is a volatile activity that can result in substantial losses.

Options can give investors other ways to hedge risk or make money but in general they are seen to be impermissible.

Permissibility aside, most investors will be suited better by investing for the long term instead of trading. Trading is a skilled profession that takes a lot of work to become really good at and the risks are substantial compared to long term investing.

If you want to learn more about investing, check our Halal Investments information page and our Halal Investing 101 Guides. You can also check out our course on how to confidently pick out halal companies, as well as Cur8 Capital, which provides access to pre-vetted investments.

26 August 2025 7 min read

05 January 2024 8 min read

Leave a Reply