Murabaha: Alternative Way of Financing Your Business

Ibrahim Khan

Co-founder

5 min read

Last updated on:

There remains a dearth of sharia-compliant financing for SMEs in the UK (if you know anyone, please let us know in the comments!) however one model that could be used by Muslims SMEs which does not involve giving away equity, is the murabaha model.

One of the key challenges as a Muslim business in the UK today is keeping pace with your competitors who have access to conventional finance. They have the ability to leverage their business to grow rapidly; they can use invoice factoring to smooth over cashflow issues and generate more sales; and they don’t have to resort to giving away equity in order to raise money.

Murabaha is a fairly simple transaction which is ideal for businesses who regularly need to make quite expensive purchases. However, even if that is not the case, innovative solutions are still possible using murabaha.

What is murabaha in Islam?

Murabaha was traditionally a transaction designed to assist those who needed an item from a fairly specialist market, but who didn’t have the experience or knowledge to be a discerning buyer in that market. They (Jim) would consequently reach out to another, more experienced buyer (Bob), and agree that Jim would buy from Bob at a pre-agreed mark-up after Bob had bought it from the market. There is therefore a degree of trust between Jim and Bob in order for this transaction to work, and that is why in traditional textbooks this transaction is referred to as one of the “trust sales”.

So let’s say Jim wanted to buy a specialist computer for his business, and Bob was an expert in this technology. Jim and Bob would conclude that Jim would buy from Bob at a 10% mark-up of the cost price. Bob buys the computer for £1000, and subsequently sells to X for £1100. This £1100 can be paid either on-spot, or on a deferred-payment basis. Today, Islamic banks will always make that payment a deferred payment and consequently create the economic equivalent of a loan of £1000 with 10% interest (though, crucially, with a different risk profile – and that is what makes murabaha halal – see next section).

Is murabaha not just the same as a loan?

One could argue that the same economic effect is created and therefore murabaha is really just a disguised loan. However, the crucial difference is that at the end of the process, Jim ends up with a computer, not £1000. The whole transaction is structured as two purchase agreements over a computer, as opposed to simply a loan of money.

This comes with a different risk profile. Bob takes on the risk of ownership of the computer during the time the good is in his ownership (this could be for quite a while in some murabaha structures we have seen). So for example, if the computer is destroyed, Bob has to take that burden. Bob may decide to purchase insurance to deal with this risk – that is fine – but then Bob should pay for that insurance. Further, Bob has the obligation of accepting a return of the computer if Jim discovers a defect in the good. (Bob could then subsequently return the good himself back to where he bought it, but that is his decision to make).

Key Shar’i considerations

The key conditions of a murabaha contract are:

- The cost price of the good and the mark-up must be known to both parties;

- The initial transaction (where Y buys from the market) must be a valid contract in order for the subsequent murabaha transaction to be a valid sale;

- The buyer must be exposed to the risk of the good having a defect or being destroyed following the buyer’s purchase; and

- The buyer has the obligation to accept returns if a concealed defect is discovered in the item.

The Malikis make a promise legally binding (so long as it doesn’t seek to permit what is forbidden) especially if the promise results in another party taking on a financial obligation. For instance, if X promises to buy Y’s car on the condition that Y has an expensive paint job done on it and, in preparation for the sale, Y takes on financial obligations in the form of getting that paint job done. The other schools make a promise religiously binding, but not legally binding.

In the modern context, most Islamic banks are happy to adopt the Maliki position in relation the initial promise. Others get to the same conclusion by saying that the promise is not legally binding in the Sharia, however, as the promise document is an English law document, and that document is binding under English law, the seller (Bob) still gets peace of mind that he will have recourse to the English (or whichever jurisdiction the document is under) courts (rather than a Sharia court). As a side note, proper and correct legal advice for the jurisdiction you are in is also critical to ensure that the sharia and national legal considerations dovetail.

Key commercial considerations

One of the most important commercial considerations to think about is what assets the SME will use as the basis for murabaha. If the SME is a factory that regularly needs to buy in heavy machinery, then that is ideal. The seller also can take comfort by potentially taking security over that machinery in case the buyer defaults.

Where one does not have a business with regular assets, then the solution is not as straightforward. One can use a carefully crafted structure which uses shares in a company as the basis for murabaha however – but this has regulatory, tax, and corporate implications so needs to be handled carefully and will be bespoke from company to company.

Under Islamic law, the machinery bought by the buyer need not be retained by the buyer, as ultimately it is the property of the SME now, to do as it wishes. However, were it to sell, the debt on the SME to the seller would remain regardless.

From this intuition, a new Islamic finance model has arisen. Tawarruq (or commodity murabaha) is another permutation of the murabaha transaction. Under this model, once Jim gets hold of the computer from Bob, he immediately sells that computer at market price and raises £1000 liquidity. He does still have to pay back Bob £1100 in a few months’ time, but for now he has the money he needs. Islamic banks do something similar to this, but involving commodities (steel, usually).

However I am uncomfortable with this model (as are a number of Islamic scholars in this field). In reality, in these transactions, the good underlying the transaction is not actually the purpose of the transaction. The purpose of the transaction is to raise liquidity with a deferred obligation to pay it. In many cases the company doesn’t even take physical delivery of the steel, and the steel may not even move from its place during the entire transaction (as Bob buys from the steel broker, then sells to Jim, who sells back to the broker).

We’d be interested to hear your thoughts and experiences as a Muslim SME navigating this space – so please do comment below, or get in touch with us via our Contact Us page.

Comments (0)

Related Articles

View all

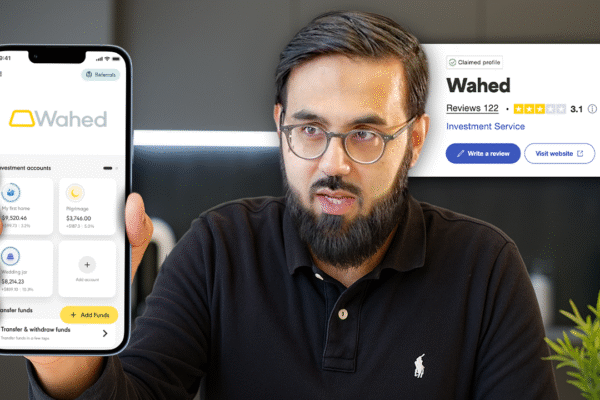

Wahed Invest – A Detailed Review & How to Use It (2025)

24 July 2025 15 min read

The Fall of Riba in the New York of Ancient Arabia

21 March 2025 4 min read

Leave a Reply