Review of the legal documentation

Gatehouse have done the paperwork in a different way to Al Rayan.

There is basically one crucial document called the “HPP Diminishing Musharakah Residential Financing Product Terms & Conditions” (the “T&Cs”) which contains all the legal action. All the other documents in the list below point to this document and are themselves quite short documents.

I think I ultimately like this approach better as it makes it easier to sign a bunch of short documents rather than have to sign 5 quite bulky documents – but not a big deal. The important thing though is that you must remember to properly understand the T&Cs (by reading this article and by reading the T&Cs yourself too). You don’t have to sign the T&Cs so it is easy to forget that this is the document that you’re actually signing up to.

Having said all that, the actual legal documentation is very similar between the two banks, to the point that, amusingly, the clause references are very similar too.

1. Bank signed offer

This is the initial offer letter the bank sends confirming that it is in principle signed off on you, that you can go ahead and make an offer on a property and start the conveyancing process with a solicitor. The Bank Signed Offer also contains an important checklist at the back of things that will need to be completed/sorted-out before the bank can pay the money.

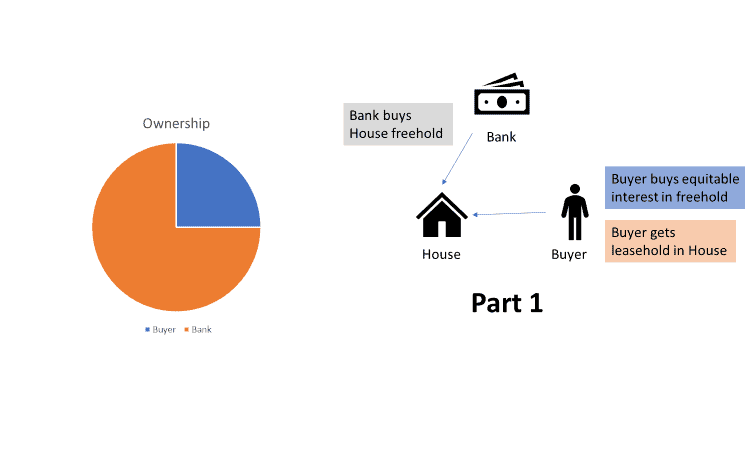

2. HPP Diminishing Musharakah Agreement

A short agreement that governs the duties and obligations of each party in the initial purchase of the property and the gradual buy-back of the property. It is separate from the lease agreement. It only covers the acquisition cost of the bank, i.e. the initial amount they pay to the seller alongside your deposit.

Issues/points to note:

- (Costs & Expenses, 5.3): though Gatehouse advertises that it does not charge you for their legal fees – and indeed that has been our personal experience as well – the contract does allow for them to charge you for all legal and other expenses they reasonably incur whilst preparing your mortgage documentation. Ultimately not a big issue – as long as Gatehouse continue to stick to what they are advertising!

- (9.2) Just like Al Rayan, Gatehouse have passed on all their risk back to the buyer. All the risks mentioned in this clause have been insured against in any case (e.g. any damage or defect in or to the property) but Gatehouse also want to make sure that even if not insured against, they are not on the hook for this stuff. They also don’t pay for the insurance (the same as Al Rayan). We think that this hypothetically extremely remote risk should be either insured away itself by Gatehouse or the bank should take that risk. They should really have at least some ownership risk exposure to each property they mortgage.

- Schedule 3 (3(ii)): note that if you do eventually decide to rent out you home, you will need to inform Gatehouse of this or you will be breaching the agreement.

3. HPP Service Agency Agreement

This is the agreement through which the bank requires you to maintain and insure the property. This is to make sure that their secured asset (which they can sell in case of default) is kept up to a standard such that it maintains its value. Additionally, it requires you to insure the property so that in the case of an unforeseen disaster, you and the bank are covered for that loss.

Issues/points to note:

- (3.1): Once you have your home, just make sure you keep well on top of your insurance every year. Having insurance is key in mainstream and Islamic mortgages as it is a way for banks to shift the majority of the catastrophic risk to an insurer. But if you don’t have valid insurance then the banks will start gunning for you.

4. HPP Lease

This is the agreement through which the bank charges the equivalent of “interest” under a conventional mortgage structure. In other words, this is the agreement that governs the varying rate that the bank charges each month, depending on LIBOR.

Issues/points to note:

- The overall setup is such that you are basically taking on all of the bank’s burden of being a landlord to you. So in the case of you being in a flat, a landlord typically has to deal with the building management on various points, but these are assigned to you to sort out. That’s not really a bad thing – you don’t really want Gatehouse to actually be your landlord. The arrangement you want with an Islamic mortgage is that you now own that building.

- (6.1)(b): you don’t have to pay rent if your home is destroyed. This is a good thing and a genuine difference between Gatehouse and a conventional lender who would continue charging interest.

- (8): The bank can get rid of you after 90 days of you not having paid rent. Understandable really.

- (10): The bank has excluded liability for pretty much everything in the case of an accident, loss or damage. While we understand why the bank has done this, we think it would be more in keeping with the spirit of Islam to get rid of these blanket carveouts and instead deal with the matter by way of a robust insurance policy instead – and one that the bank actually contributes towards.

5. HPP Legal Charge

This is the agreement through which the buyer charges the property against the sums owed to the bank under both the Diminishing Musharakah Agreement and the Lease Agreement.

6. HPP Diminishing Musharakah Residential Financing Product Terms & Conditions

These are the T&Cs. You don’t have to sign this document itself, but it is the document that contains the bulk of the legal action.

Issues/points to note:

- A general point to note is that each of these agreements has hard-baked into them that you have accepted the sharia-compliance of these agreements and will not question them afterwards. Makes sense really, as Gatehouse don’t really want to get into a dispute about the sharia-compliance of the agreement afterwards (given there is a real diversity of views when it comes to Islamic law!).

7. HPP Terms & Conditions Acknowledgement

This is a short acknowledgement that you have read the T&Cs.

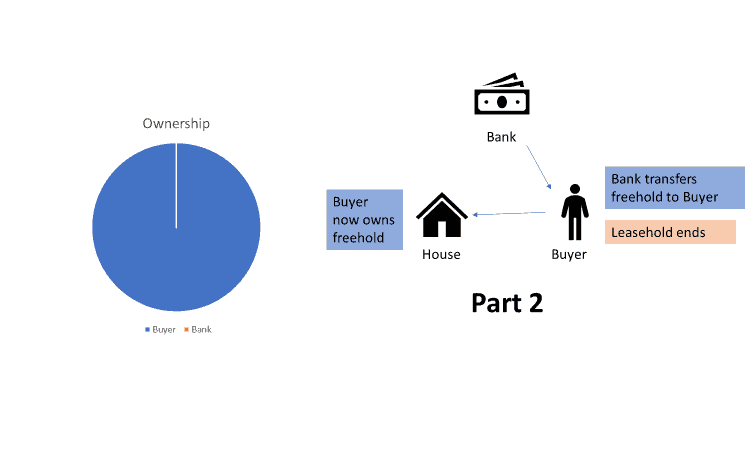

Time passes, the Buyer continues paying rent and buying further equity in the house until eventually he owns 100%.

Time passes, the Buyer continues paying rent and buying further equity in the house until eventually he owns 100%.