Cheapest Islamic mortgage | IslamicFinanceGuru – IslamicFinanceGuru

4 min read

Published:

Updated:

Haider Saleem

You want to take out an Islamic mortgage to purchase your home. Naturally, you’re looking for the best deal. So, where can you find this?

In this article, we’ll look at a range of purchases and products:

- The UK (average house price)

- London (average house price)

- Buy-to-Let

- £1 million houses

We’ll use the latest figures from the Office for National Statistics (ONS) to determine the average prices in these areas.

How we’ll compare the mortgages

Using the IFG mortgage calculator, we can calculate the best offering out there.

We’ll use a 30-year term using different deposit amounts.

The minimum deposit available for an Islamic mortgage is 20% (i.e., you can receive a max of 80% funding of the purchase price). We’ll also check out what a 30% deposit will get you if you can afford that.

If you’re looking for 10% to 5% deposit rates that you might hear in the press, you’ll struggle to get one with an Islamic bank right at this moment due to COVID. But do check our comparison engine as things do change rapidly.

We recommend you try to get to a 20% deposit as a minimum generally in any case as under that things get pretty unaffordable pretty quickly.

Gatehouse has a max FTV of 70% for finance exceeding £1m (i.e., you need a 30% deposit or more).

Average UK House Price

According to the Land Registry, As of November 2020, the average house price in the UK is £249,633 and has risen by 7.6% compared to the previous year.

Where can you get the best deal? Let’s look at the options after putting down different deposit amounts.

Purchase Price: £249,633.

30% deposit = £74,889.9, borrowing £174,743.

20% deposit = £49,926.6, borrowing £199,706.

30% deposit

Borrowing £174,743, Gatehouse clearly coming out on top here. However, you’ll need to put down a 30% deposit, which is £74,889.9.

If you can’t afford this, consider if you could afford a 20% deposit instead.

20% deposit

A 20% deposit will require you to have £49,926.6 to fund the purchase. Therefore, you’ll need to borrow £199,706.

| Bank | Deal term | Initial Rate | Initial monthly payment |

| Gatehouse | 2 years | 3.19% | £862.57 |

| Gatehouse | 5 years | 3.49% | £895.65 |

| Al Rayan | 2 years | 3.89% | £940.81 |

| Al Rayan | 5 years | 3.99% | £952.28 |

As with a 30% deposit, Gatehouse again comes out on top, with an increase of £86. Al Rayan’s cheapest option increases quite a bit – by £142.2.

10% deposit

N/A. Remember, you can only finance a purchase with an Islamic mortgage right now if you can afford at least a 20% deposit.

London

According to the ONS, the average price of a home in London was up by 9.7% in the year, to a record of £514,000. This was the first time it reached over the £500k mark.

As you can imagine, there are big differences in price depending on where you do ultimately purchase, for example, Inside London, Kensington and Chelsea recorded annual growth of 28.6% and an average price of £1.5m.

Further out of the capital, the London borough of Brent likewise saw 20%+ growth. However, the ONS said this partly reflected a decrease in prices between Oct and Nov 2019.

Let’s take the average London house price and see what you’ll get with a 30% and 20% deposit.

Purchase price: £514,000.

30% deposit = £154,200, borrowing £359,800.

20% deposit = £102,800, borrowing £411,200.

30% deposit

A 30% deposit requires you to have £154,200 available to fund the purchase, requiring a loan of £359,800.

20% deposit

You’ll need £102,800 of your own money to fund the purchase, borrowing £411,200.

| Bank | Deal term | Initial Rate | Initial monthly payment |

| Gatehouse | 2 years | 3.19% | £1,776.06 |

| Gatehouse | 5 years | 3.49% | £1,844.18 |

| Al Rayan | 2 years | 3.89% | £1,937.14 |

| Al Rayan | 5 years | 3.99% | £1,960.76 |

Buy-to-Let

This is a great investment option. You can use the rental income to pay off the mortgage and there are Islamic banks that offer BTL mortgages.

Let’s use the average UK house prices and see who has the best deal if you were to use the rent and acquisition repayment type. Just to note, the rent only repayment type has cheaper monthly fees.

Purchase Price: £249,633.

30% deposit = £74,889.9, borrowing £174,743.

30% deposit

A 30% deposit requires you to have £74,889.9 of your own money, borrowing £174,743 from the bank.

| Bank | Deal term | Initial Rate | Initial monthly payment |

| Gatehouse | 2 years | 3.69% | £803.32 |

| Gatehouse | 5 years | 4.05% | £839.29 |

| Al Rayan | 2 years | 3.89% | £823.21 |

| Al Rayan | 5 years | 4.39% | £874.01 |

Gatehouse again comes out as the cheaper option.

It’s important to note the fees are much higher on a BTL. Al Rayan charge set up fees of £1,747.43. Gatehouse charge an application fee of 1% (min £999).

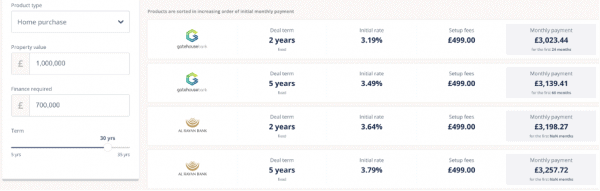

£1 million

There are now 563,240 homes worth more than £1 million in Britain according to The Times. Interestingly, most of them are outside of London, just 6,657 were in the capital.

As we mentioned at the start, Gatehouse has a max FTV of 70% for finance exceeding £1m (i.e., you need a 30% deposit or more).

30% Deposit

If you have a spare 300k, below are the best deals for a £1m purchase.

Conclusion

Gatehouse is clearly the cheapest provider in a number of categories right now. Their follow-on rate is also cheaper than Al Ryan’s. However, you may want to consider other factors, such as customer service before you lock yourself in. Also bear in mind that rates change rapidly in this market.

If you want to check for yourself, use the IFG Mortgage Calculator.

Related Articles

View all

Can I enter into a contract with haram clauses?

29 September 2023 7 min read

5 Reasons Why Your Rizq Isn’t Increasing

10 August 2023 4 min read