How Much Should I Invest into My Investing Education? – IslamicFinanceGuru

4 min read

Published:

Updated:

Haider Saleem

You want to get started investing in a way that is profitable, safe and optimal for the long-term. But you don’t know how to.

Some resources are free, paid-for, or come in the form of an expensive financial advisor.

So how do you choose between them? What budget should you allocate for your investing education?

Let’s go through each option that you might consider. Below, we’ll discuss options that are:

- Free,

- Paid-for, and

- Bespoke to your needs (e.g. a financial advisor)

Free

This is a great place to start.

See a list I made below for some good free investment educational resources.

Resources like these will give you a general gist of what you need to know. There are even stock market simulator/games out there for you to practice on.

But here’s the thing about only relying on free resources. Yes, you can learn everything that you would on a paid course, just like you can learn everything in a medicine degree online. However, there’s a big difference between learning in a classroom or going solo.

You wouldn’t risk being treated by doctors who taught themselves, so why would you invest your hard-earned money in the same way? If you’re new to investing, there’s a mountain of information to learn.

Check these free resources out:

Some places to start within IFG:

- IFG Halal Investing Checklist

- Halal Investing 101 Guide

- IFG explainer on start-up investing

- IFG explainer on the differences between venture capital / angel investing / startup investing

- IFG YouTube Channel

External resources I’d recommend:

- Khan Academy – has been a personal favorite of mine for many years.

- Talk Money has two free comprehensive courses on investing and angel investing.

- Yale University has free online business/finance courses on Open Yale, and on Coursera (Yale Home).

- Coursera – lots of free courses to learn about investing from different universities and companies.

- A free MBA by Quantic – this would be a big-time investment for you, but you’ll get structured learning for free.

- Investopedia – used by uni students and investors for financial education and research. Check their education and investing essentials section out.

- Financial Times and The Times – should be read daily. Try not to rely on social media or friends for commercial awareness.

- Stock market simulator/games – get comfortable trading by practicing with virtual currencies on the real market. Trade212 allows you to trade virtually, as does Investopedia. There are loads out there.

With such an overwhelming amount of resources what will really help you is curated guide/course that takes away painful hours of doing all that reading yourself.

Paid-for

We’ve gone through the free options. To help you progress, consider enrolling/paying for a course.

The crucial thing with paid is it needs to have the following crucial ingredients:

- The person teaching needs to know what they’re on about, others should give feedback on it,

- Ideally, you should use an established brand not a fly by night operation,

- The course content is available in advance.

- It shouldn’t promise the world (as that’s a red flag),

- It shouldn’t cost you more than 1% of your total 10-year budget.

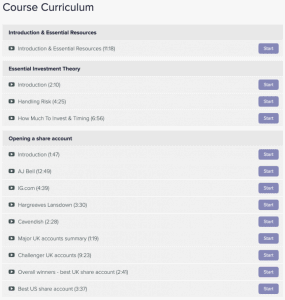

A snippet of our Halal Investing For Busy Professionals course

I would recommend that you save 100s of late nights by investing money in a proper course. The quality education you get will reduce your level of risk when investing, you’ll get access to the right information and find that answer to that burning question.

As you can see with an outline I’ve provided, you’ll know:

- Precisely what you’re going to learn

- Be told the absolute essentials of what you need to know.

- Have the opportunities to ask questions

Please be aware, courses and resources on investing is a huge target for scammers. I can’t strongly recommend you using someone trusted. Do some googling, look at the instructors’ Linkedin, and check out reviews.

Bespoke/Financial Advisor

The role of a financial advisor is comprehensive. They’ll tell you not just about the best deals but use their knowledge to tailor their advice to your specific needs. You’ll also be advised on the best tax strategies and help you tailor/adjust your financial plans.

The catch: You’ll be charged about £2-5k plus an ongoing fee. Realistically they’re not worth it if:

- You have assets less than 100k to invest in, and

- You are willing to put in a bit of time to learn how to do this stuff yourself.

If you do not have money for a financial advisor, then you have the combination of free resources and paid courses. That will be good enough for anyone to be honest.

If you have a large amount of assets and would like to be connected with a financial advisor – drop us a line here.

So, What Should I do?

- Start with free resources. Spend some time thinking about if you feel like taking it to the next step.

- Once you’re hungry for more (I know you will be), enroll in a structured paid course with a person who’s experienced in the field – either as an investor or an academic.

- Finally, learn by practicing and making mistakes.