Islamic Mortgage Remortgage Guide: What to Do When Your Fixed Term Ends

02 December 2025 8 min read

Mohsin Patel

Co-founder

12 min read

Last updated on:

Editor's note 2025: Please note that Al Rayan have stopped offering a home finance product. You may want to instead check out our review of Gatehouse Bank instead. To find the latest information, check out our Islamic mortgages page.

We have written extensively on Islamic mortgages at IFG (see here and here for example and definitely also check out our cool Islamic mortgage comparison tool), but we have previously kept the discussion generic. In this article, for the first time ever, we exhaustively go through Al Rayan’s Home Purchase Plan ( the “HPP”) in particular.

We are confident that nothing as detailed as this has been done for the Al Rayan (formerly Islamic Bank of Britain) HPP. In this article we examine the legal, Islamic, commercial and practical aspects of the HPP informed by:

Yes, we’re starting with a summary (there’s nothing worse than trawling through 4,000 words to find a one-paragraph summary tucked away!).

Our conclusion is that, given the current UK context, the HPP is the best Islamic mortgage option out there for those who qualify under the Al Rayan eligibility criteria. However we do have some bones to pick on both the commercial and Islamic side with the HPP as it currently is. We believe the HPP could be better from both a commercial and Islamic perspective if a few tweaks were made to it. We hope this article will help pave the way to making these changes.

From our personal perspectives, Ibrahim has an Al Rayan mortgage, while Mohsin has opted for Heylo Housing (but plans to shift to Al Rayan in the coming years). You should definitely also check our our Islamic mortgage comparison page. It is the only one of its kind in the UK.

The Al Rayan Islamic mortgage is structured as a Home Purchase Plan. This is a regulatory structure that was specifically created through legislation to assist the Islamic finance industry in being able to provide an Islamic alternative to mainstream mortgages.

For a product to be a legal HPP structure, the bank must hold the buyer’s beneficial interest on trust to be delivered over to the buyer once he has paid off the amount necessary to buy the full interest in the property. At this point the buyer will be transferred over the legal title and will hold complete legal and beneficial interest in the property.

“Hang on, what’s all this beneficial v legal gobbledygook?” you might be saying.

Simply put, a legal owner of a property is the “formal” owner of the property, i.e. the one whose name is on the freehold title at the Land Registry. A beneficial owner is someone who has the right to enjoy or benefit from the property, and this can include the right to any income from the property or to reside in the property.

To complicate matters further, an interest in a house can be a freehold or a leasehold. A leasehold interest is different from a freehold in that it is necessarily time-restricted. A leasehold could be for a few days, or many hundreds of years, but eventually it will expire. When it does expire, the freehold owner will be able to step in and take possession of the property.

The Al Rayan HPP uses a combination of freehold and leasehold to deliver a diminishing musharakah/ijarah model (N.B. that musharakah means “partnership” and “ijarah” means rent). This Islamic finance model goes thus: the buyer of the property slowly buys more and more of the house over time, and his rental payment on the amount he does not own slowly decreases at the same proportion. Eventually he owns the entire house and is no longer paying any rent.

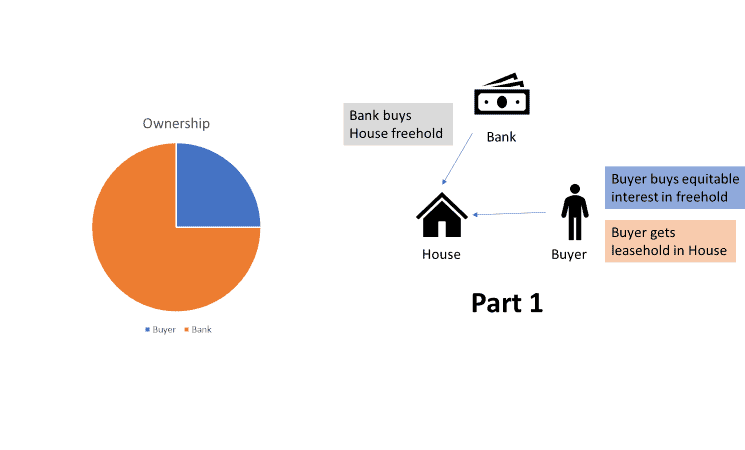

This is a little diagram of how the whole thing works:

So the situation is that the Buyer wants to buy the House, but he doesn’t have enough money to buy outright. But he does have enough for a 25% deposit. So he approaches Al Rayan bank – and this is what happens:

Al Rayan buys the freehold title in the house at the closing of the transaction, and it is its name that appears on the title. But the buyer gets an equitable interest in the freehold by way of the contract (the DCA – more on that below) and also gets a leasehold for 99 years alongside Al Rayan. This leasehold can only be sold or ended by the consent of Al Rayan, but it does put the buyer on a more secure and long-term footing than a shorter lease would.

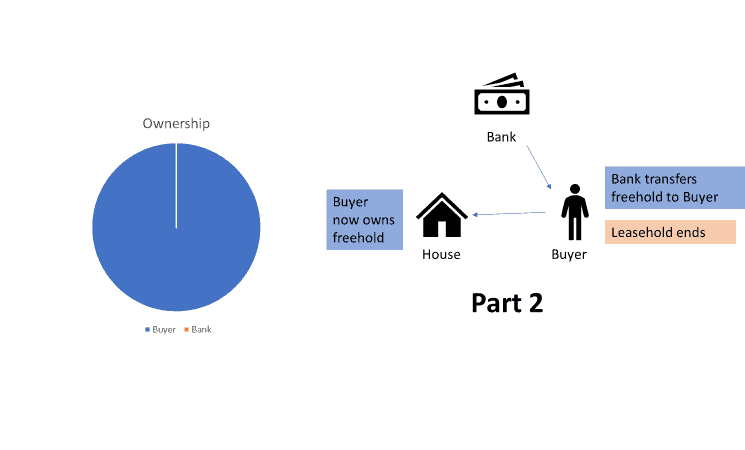

Time passes, the Buyer continues paying rent and buying further equity in the House until eventually he owns 100%.

At this point the Bank transfers over the freehold interest in the property to the Buyer, the leasehold ends, and all charges in favour of the Bank are removed from the charges register.

HMRC is thankfully agreeable to only charging Stamp Duty Land Tax (“SDLT”) once, and so SDLT is only payable upon the initial purchase of the house, and not on the final transfer of the freehold by the bank.

Incidentally, this is one area where Al Rayan has an advantage over Heylo.

This is held at the Land Registry in favour of Al Rayan, with a note on it indicating the existence of a leasehold interest on the property too.

This is jointly held by Al Rayan bank and the Buyer and notes the existence of a charge in favour of Al Rayan in the Charges Register associated with this leasehold title.

This is the crucial document that governs the duties and obligations of each party in the initial purchase of the property and the gradual buy-back of the property. It is separate from the lease agreement. It only covers the acquisition cost of the bank, i.e. the initial amount they pay to the seller alongside your deposit.

Here’s a few quibbles we had with this document:

This is the agreement through which the bank charges the equivalent of “interest” under a conventional mortgage structure. In other words, this is the agreement that governs the varying rate that the bank charges each month, depending on LIBOR.

Here’s a few quibbles or notes we had on this document:

This is the agreement through which the bank requires you to maintain and insure the property. This is to make sure that their secured asset (which they can sell in case of default) is kept up to a standard such that it maintains its value. Additionally, it requires you to insure the property so that in the case of an unforeseen disaster, you and the bank are covered for that loss.

The main quibble we had with this document was:

This is the agreement through which the buyer charges the property against the sums owed to the bank under both the DCA and the lease agreement.

| Scholar | Opinion | ||

|---|---|---|---|

| Shaykh Haitham Al-Haddad | The Al Rayan HPP is not Islamic; it is too much like a debt instrument (i.e. the buyer is locked into purchasing the entire finance amount back from Al Rayan from day one). | ||

| Shaykh Akram Nadwi | Get a conventional mortgage if necessary, as Islamic finance is just like conventional finance dressed up in a religious garb. | ||

| Shaykh Suhaib Hasan | (at least in particular cases): get a conventional mortgage if necessary. | ||

| Shaykh Abu Eesa | The Al Rayan HPP is fine | ||

| Sheikh Dr Abdul Sattar Abu Ghuddah | The Al Rayan HPP is fine | ||

| Sheikh Nizam Muhammed Saleh Yaqoobi | The Al Rayan HPP is fine | ||

| Mufti Abdul Qadir Barkatulla | The Al Rayan HPP is fine | ||

| Sheikh Muhammad Taqi Usmani | The Al Rayan HPP is fine (though we note he is retired from the Al Rayan Shariah Supervisory Committee) |

| No. | Risk | IFG Commentary | Risk borne by |

|---|---|---|---|

| 1 | House damaged or made defective by an insured risk | This liability has been excluded pursuant to clause 9.2(a) of the DCA. | Insurer |

| 2 | House damaged or made defective by an uninsured risk | This liability has been excluded pursuant to clause 9.2(a) of the DCA | Buyer |

| 3 | Cessation of rent payments if a house gets destroyed/uninhabitable | This liability has not been excluded. Al Rayan is on the hook for this | Al Rayan |

| 4 | Insurance money not being enough to cover damages and/or exceed the maximum finance-to-value ratio | The bank has got the right to not rebuild the property but to simply sell the property further to clause 6.1 of the DCA | Buyer |

| 5 | The buyer doesn't insure the property | The bank has got an indemnity from the buyer in clause 7 of the Service Agreement which means the buyer pays | Buyer |

| 6 | Bank has to get work done to the property and damage is caused by its employees or agents to the property in the process | The bank has excluded this liability in clause 12 of the Lease Agreement | Buyer |

| 7 | The value of the property decreasing | Al Rayan simply won’t sell at below market value – or to the extent you would like to, then you need to pay off the remaining amounts due with Al Rayan receiving the acquisition payment they made initially | Buyer |

Leave a Reply