The £150bn Investment Wave Creating Jobs and Wealth (And How To Get Ahead)

23 September 2025 4 min read

Ibrahim Khan

Co-founder

8 min read

Last updated on:

Worrying news broke this week that Russia has launched an attack on Ukraine. This has already caused loss of life in the region affected, but has had significant wider ramifications as well.

In this article we unpack:

As ever, please note that this is not financial advice, this is journalism. Please do your own research. If in doubt, talk to a financial advisor. And with investments your capital is at risk.

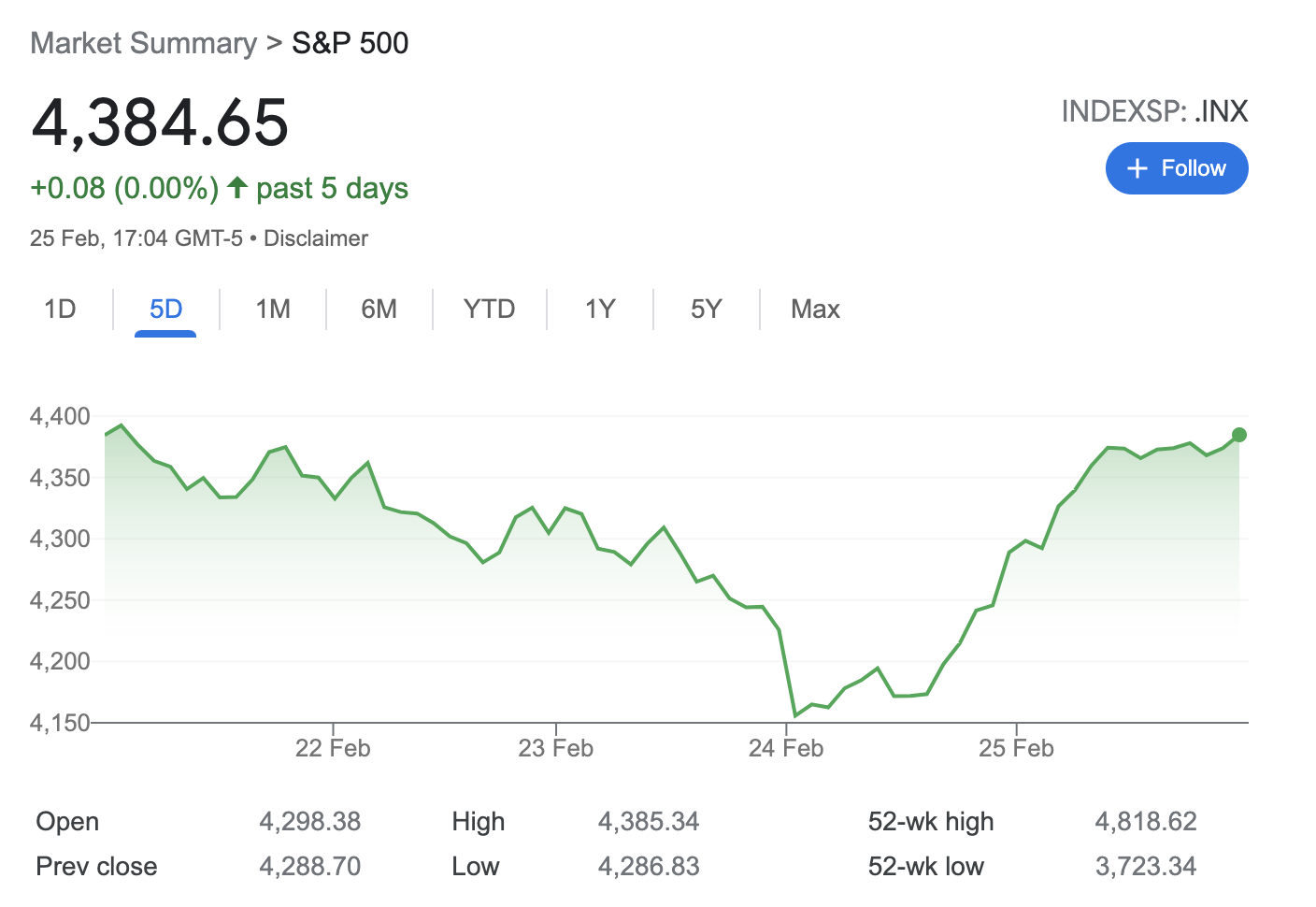

Predictably, markets responded badly at the initial news. European markets dropped 4% while the S&P 500 dropped 0.9%, the Dow Jones by 2% and the Nasdaq stayed even. Over the next two days they have all largely come back to even keel.

This is partly as certain companies’ stocks have actually gone up quite significantly in response.

Defence companies have benefited. BAE systems was up around 4.8%, Germany’s Rheinmetall was up around 5%, while Lockheed Martin and Raytheon in the USA were both up by 2%.

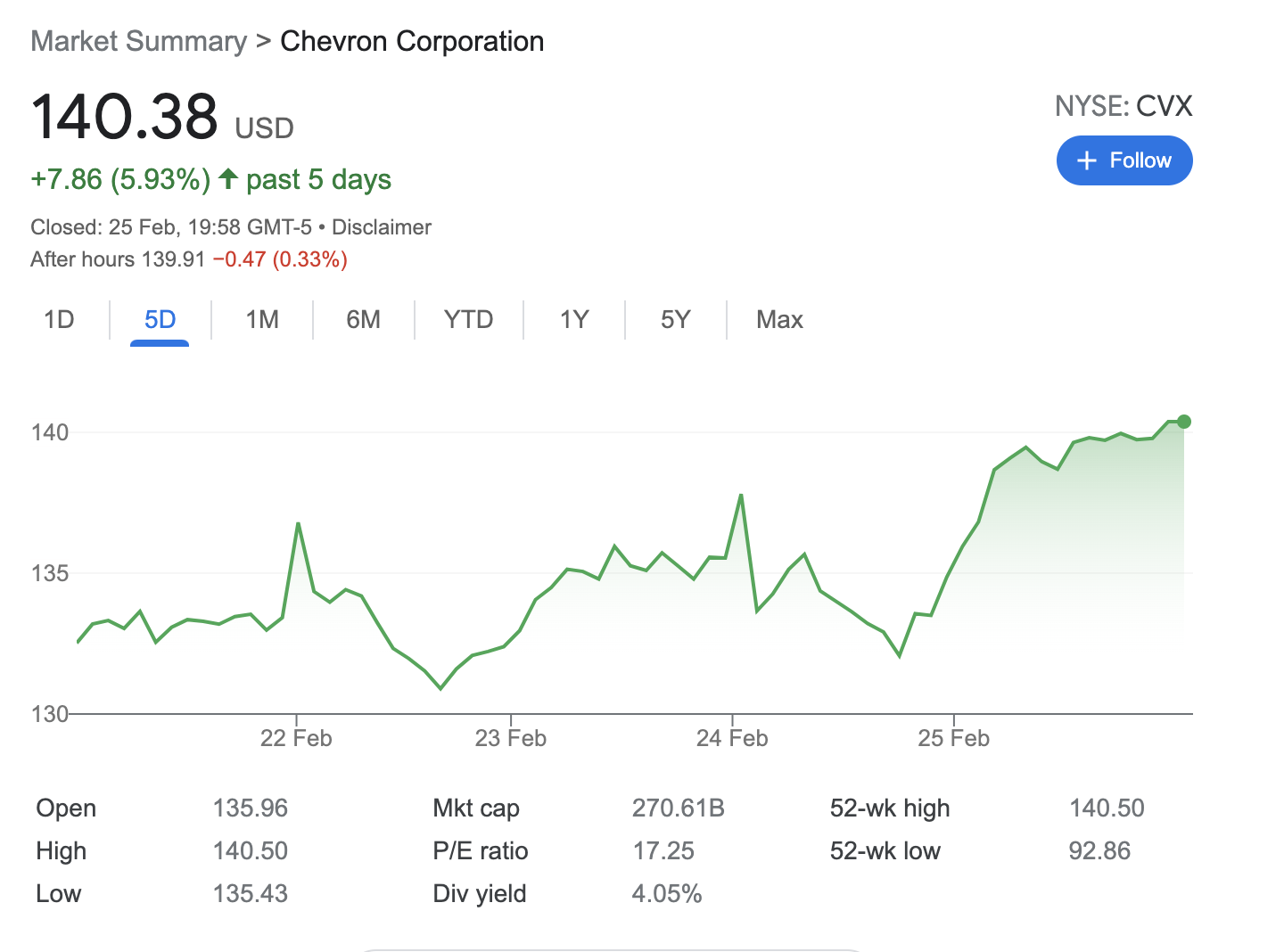

Oil companies have also fared well with Shell, Chevron, BP, ExxonMobil, Total and others all enjoying significant bumps.

Russian companies listed in the UK fared particularly badly, with Sberbank falling Okay 72%, and miners Polymetal and Evraz down 38% and 30% respectively.

Tech stocks initially plummeted, but have since largely regained their position. Though, the overarching shift from “growth” investing to “value” investing continues as prominent hedge funds highly focused on growth strategies have recently been posting significant losses and making adjustments accordingly.

I’ll use Bitcoin as a proxy for cryptocurrency generally for the purposes of this article. As you can see from the graph, BTC suffered a significant dip at the news of the war breaking out, but has since largely recovered from that.

Overall, rather like with the stock market, the general sense is that there is a lot of turbulence in the air, and investors are still weighing up their choices but haven’t pulled the plug.

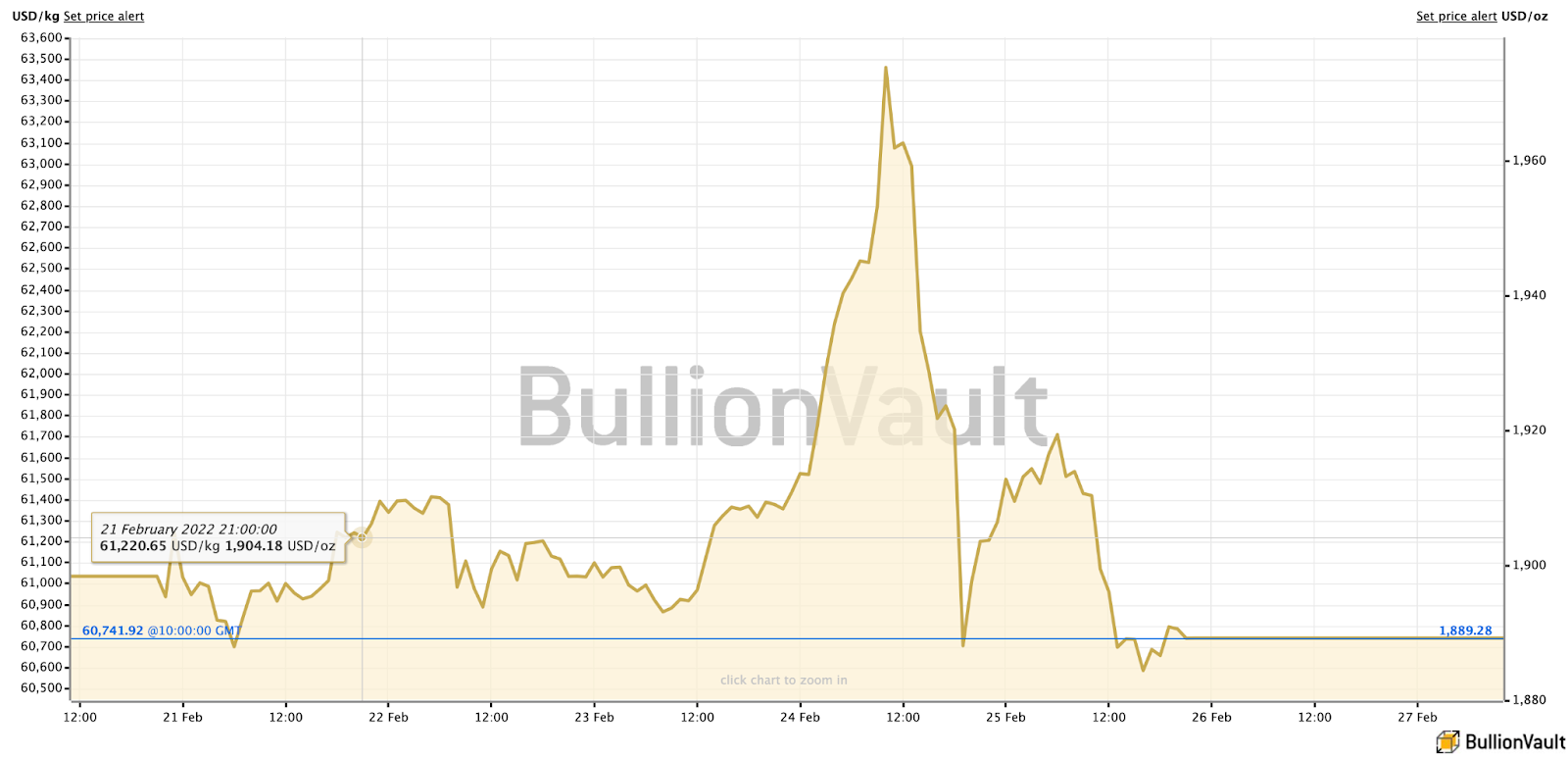

Gold unsurprisingly shot up in value at the announcement of the war, but has interestingly settled down once more. The expectation however is that gold will trend upwards over the next few months – especially if the conflicts deepens. This is partly down to investor sentiment but also because Russian produces around 9% of the world’s gold.

We could either see a quick resolution to the war, in which case things could quickly return back to normal.

However, the reality is that we’re likely looking at either a long-term conflict, or a modern Cold War scenario. Either of those outcomes will significantly affect markets.

Wars immediately cause supply chains disruptions, particularly around oil and gas. Already we have seen oil spike up above $100 per barrel and gas shoot up 30%. Russia is a top 10 producer of oil and gas and so the supply chain disruption is particularly exacerbated.

This supply chain disruption and commodity price increase causes inflation – so prices go up.

Government spending by NATO countries will also increase and that too will be an inflationary pressure.

The reality is also that we are just coming off the back of a global pandemic and so governments are in a pretty bad shape to respond effectively to another crisis.

Central Banks are already operating at near zero in terms of interest rates; we already have significant inflation to contend with; and we are also set to experience stagflation (slow economic growth at the same time as increasing prices).

Bottom line is, there is an incredible amount of uncertainty in the air, as Mohamed El-Erian explains, and investors want to retain as much optionality and resilience in their portfolio as possible at this early stage in the crisis.

Later on, once we start seeing the chips fall into place, investors should then turn to thinking about long-term readjustments of their portfolio.

There are certain sectors that will be most affected in a negative way, others in a positive way, and others expected to remain uncorrelated with the conflict.

Relatively unaffected sectors are likely to include real estate, IT, health care and professional services. These sectors typically do not have a direct input cost related to energy costs.

Negatively affected sectors include airlines, consumer staples and manufacturers.

Positively affected sectors include energy, utilities, infrastructure, defence, and some commodities.

Russia controls 45.6% of the world’s palladium trade and its prices have hiked up with the war. The metal is also a key component of your car’s catalytic converter. So if you own a Prius or similar vehicles where the catalytic converter can be stolen – be careful and get a cage installed as soon as you can.

We’re like a broken record at this point, but diversification of your portfolio into different buckets is a good idea specifically for unexpected shocks like this one.

Right now the chips are in the air and it is impossible for anyone to call it with any degree of accuracy. In absence of that certainty what you can do is prepare your portfolio to be robust in multiple scenarios, and agile enough to adapt it as things clarify.

Make sure you diversify across assets – stocks, property, commodities, crypto, private markets, etc.

Make sure you diversify across geographies – the UK, USA, Middle East, emerging markets etc.

Make sure you diversify across investments within asset classes and geographies too – e.g. property in the USA and the Middle East, stocks in emerging markets and the UK, crypto in stablecoins and altcoins.

You can compare between various investments on IFG Wealth.

Commodities generally, and gold specifically, are expected to go up.

There is nothing wrong with a portion of your portfolio being allocated to commodities and gold (we have done a detailed review of gold investing here) however be wary of overindexing on gold as well.

It is a nice hedge against inflation over a short-term period for a portion of your portfolio, but it isn’t an “investment” as such. Gold doesn’t add value to the world like a company does, and so its upside is not in the same category over several decades.

Warren Buffet describes in his 2018 shareholder letter that he bought his first stock aged 11, at the height of WWII.

If he had taken his $115 and instead invested it in the S&P 500, reinvesting all dividends, he would have made $607k, a 5288x return.

If on the other hand he had invested it in gold, he’d have made $4200.

The point is a simple one: invest in stuff that adds value to the world for the long-term.

If you have to hold cash for whatever reason, then consider holding USD, as it is typically seen as a safe haven in times of strife.

Additionally, if the Fed does announce interest rate rises as it is expected to this year, that will further strengthen the USD.

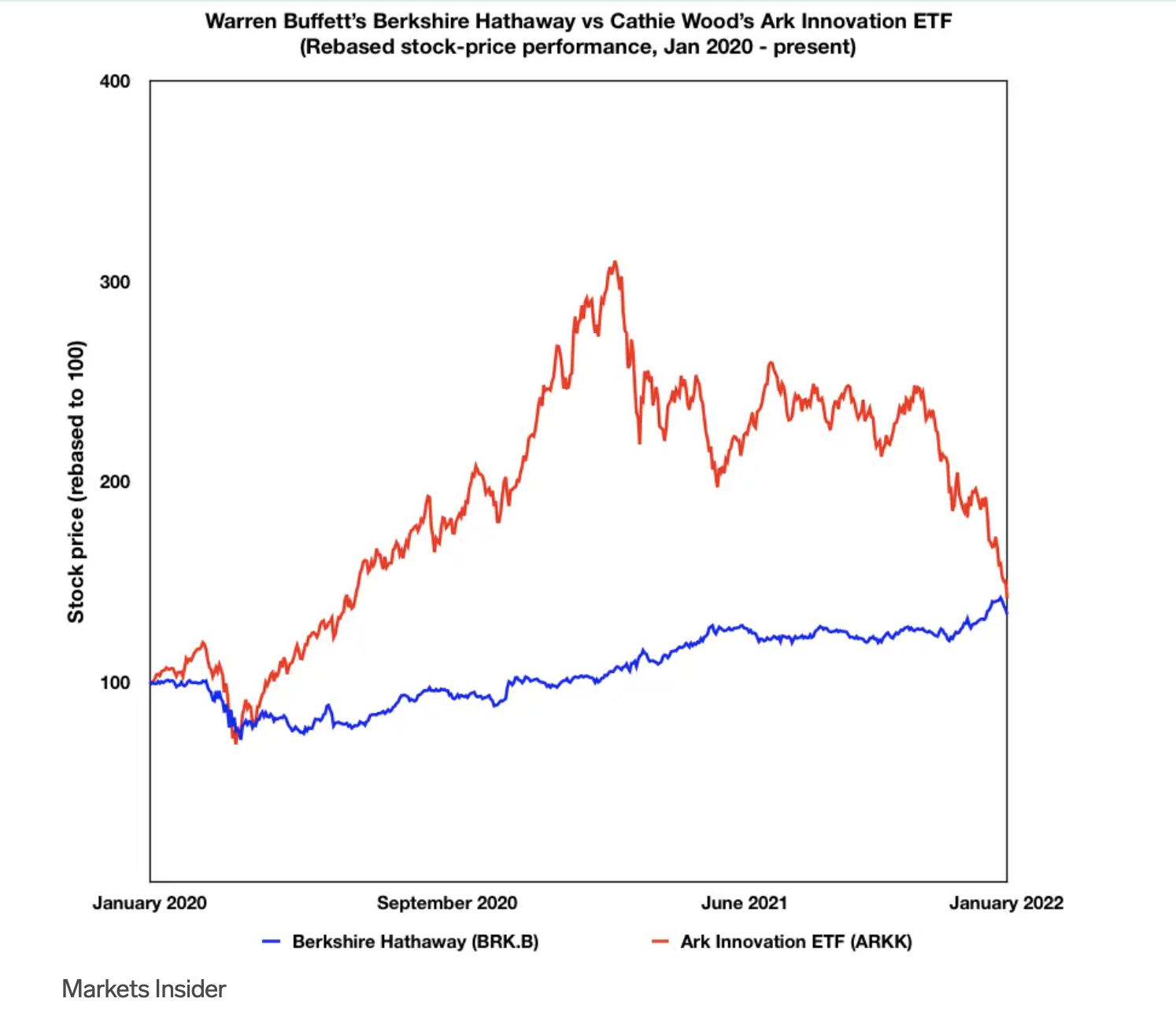

As we mentioned above, the shift from growth investing (tech-focused) to value investing continues to gain momentum.

A snapshot of that shift is nicely summarised in this graph by Business Insider:

Cathy Woods is the poster child of tech investing while Buffett’s Berkshire Hathaway is the equivalent for value investing. The graph shows how the their fortunes have fared over the last two years.

This is not to say by the way, that you should not invest in tech stocks. The point is one of approach and attitude.

Attitude 1: “I am really optimistic about this company’s future and so I am going to pay a premium on its price right now.”

Attitude 2: “I am a value-based investor and look for underpricing in an asset. I do like the long-term growth story too, but the price needs to be realistic.”

Value investing will have its place in every investor’s toolkit this decade, so invest in your education around this. This book is a nice starting point.

Property is seen as relatively uncorrelated to the wider stock market, and a more stable asset class. As such, it is a category to consider.

There is a twist here too though. If you are investing in London, then beware that there is a major crackdown in operation against Russian oligarch money invested in UK property.

Around 85,000 properties are owned via offshore entities, and at least £1.5 bn of property has been bought by Russians with links to the Kremlin or accused of corruption.

So for a certain class of property – zone 1 mostly – there could be a short-term drop or pause in price rises. This may also percolate out to the wider market.

This has to be a good thing though for property investors buying now as it will make property a more affordable asset class.

We have already mentioned a few interesting opportunities above, but here are 3 other ideas to get your investment juices flowing:

Amidst all this talk of investment, let’s not forget that there are Muslims who live in both Ukraine and Russia who are significantly affected by all this turmoil. Let’s make sure we remember them in our duas.

Let’s also make sure we protect our wealth, as that is one of the 5 wider higher purposes of the Sharia and sympathy for the suffering can go hand in hand with upholding that principle.

23 September 2025 4 min read

02 July 2025 6 min read

Leave a Reply