How Has COVID-19 Impacted The Economy? | Islamic Finance Guru

8 min read

Published:

Updated:

Mohsin Patel

Co-founder

*Please note that the following post has been contributed by an anonymous guest writer who works for a prominent global financial services firm*

What started out as quite a local issue has rapidly escalated into a global pandemic. Its effects span widely across financial markets, commodities, employment, monetary and fiscal policy and normal day to day living.

In addition to the ongoing oil price war, COVID-19 has brought about a number of phenomena not observed since The Great Recession of 2007/9. We take a deeper look into these phenomena.

Equity Markets

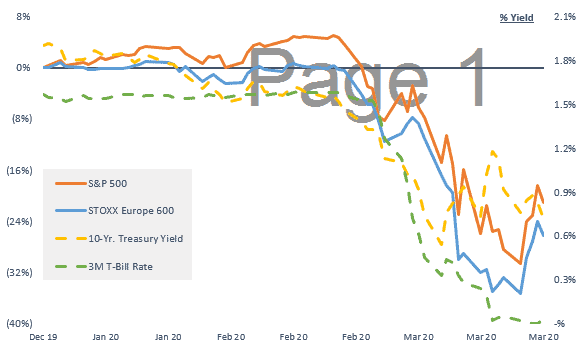

As the below chart shows, ever since the number of cases outside China started increasing we saw a corresponding sell-off in the major global stock indices.

The 10-year treasury yield declined as investors typically flock to that safe haven during times of crisis (note yields are inverse to price), however we saw a surprising period in the interim where even the US 10-year bond fell in price demonstrating the extent of the market’s distress.

To put the above into perspective, over the last month or so we have seen the second largest weekly sell-off of the S&P500 since the 1950s in the week ending 20 March of ~15%, with the worst occurring during The Great Recession being closer to ~20%.

The worst hit industries have been energy, industrials and materials as expected with the most isolated being non-discretionary consumer (or consumer staples) and healthcare. Although the energy sell-off has been exacerbated by the oil price war which we will discuss below.

| Industry (within S&P500) | % Index Share Price Decline |

| Energy | (50)% |

| Industrials | (30)% |

| Materials | (25)% |

| Healthcare | (20)% |

| Non-discretionary consumer (staples) | (15)% |

You might have guessed why consumer staples have not been hit so badly. In fact, within them there are a few stocks which have benefitted from COVID-19:

- Kroger (+15%): US grocery store benefitting from the hoard buying

- Campbell Soup (+10%): Increased self-isolation typically means more meals at home

- Clorox (+20%): Producer of bleach, sanitizers, hand wipes and other cleaning products

And as expected, large cap stocks (typically a company with a valuation of more than $10bn) appear to be slightly better insulated compared to mid caps and small caps, although the situation hasn’t fared well for any of them.

| Index | % Index Share Price Decline |

| Large Cap (S&P 500) | (25)% |

| Mid Cap (S&P 400) | (33)% |

| Small Cap (S&P 600) | (35)% |

Debt Markets

If the bear market in the equity markets is of a magnitude comparable to that seen during The Great Recession, then the debt markets are not quite as bad.

The change in spreads (difference between the risk free rate and a bond’s yield: a measure of credit risk) from peak to trough has ranged from +1% for AAA corporate bonds to +5% for B rated bonds (with the letters signifying the quality of the debt) compared to much higher values seen during The Great Recession of +3% and +13% respectively.

As expected, the new issuances both in the corporate bond and levered loan market has dried up substantially with both markets seeing substantial outflows.

Side note: recall bond prices have an inverse to their yields, so when everyone exits the market by selling their bonds it reduces the price and the yield (measured as return to par) thereby increases.

The fact that in general banks are much better capitalised and resilient today than compared to The Great Recession as well as corporate debt in general being slightly better quality (higher share of investment-grade debt) has protected the debt markets somewhat compared to what was observed during The Great Recession.

Commodities & Oil

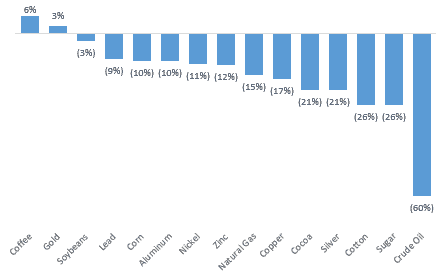

The chart below illustrates how selected commodity prices have been effected since the COVID-19 outbreak.

Coffee and gold are the only main ones to of benefited. The latter because it is, like the US treasuries, seen as a safe haven during uncertain times and the former, we assume, has something to do with the increased self-isolation lifestyle.

Oil decline

The bar you will see that stands out in the above chart is crude oil, declining by a staggering 60%. This unexpectedly large sell-off is due to a double coincident of both a demand and supply shock.

- Demand shock: Again, given the social distancing and self-isolation taking place globally but most importantly in developed countries there is less demand for fuel. The fact air travel has been banned, people are not driving as much, transport in general has been restricted to a bare minimum has led to steep decline in fuel demand. Some estimates put the global demand decline as if the US, Canada and Mexico all of a sudden stopped using oil

- Supply shock: We won’t go into detail here as it deserves a piece of itself but those of you following the news will know the price/supply war going on between Saudi Arabia and Russia. Negotiations that were originally supposed to be around cutting supply and helping the economy (by keeping oil prices in a moderate range) escalated into a price and volume war with Saudi Arabia reportedly selling to Russia’s main buyers at a discounted price and both countries reportedly increasing production

Whilst the latest news on this topic of Donal Trump tweeting the two countries might be close to a restricted supply agreement sent the crude oil price up 50% intra-day, the largest crude oil intra-day price increase in history, Russia appears to deny any such conversations are taking place.

It is perhaps worth mentioning the incredibly interconnected role crude oil prices play in the entire world economy.

Unlike other commodities they have the market caps of some of the largest public companies in the world tied to them. As the price of crude oil goes down, billions of dollars of market cap is lost, many production and exploration projects are seized as they are not viable at the new lower price and the smaller high-cost providers are forced out of business. Add to this the political sensitivities around the sector given how strategic of a resource it is and the impact it has on the fiscal budgets of many countries around the world.

A final interesting observation on this topic is the flattening of the demand curve for crude oil. Economic textbooks would describe oil as having an inelastic demand curve, meaning you can change the price as you wish, people will still buy oil as they need it.

Given the government enforced social distancing measures however, oil prices can fall to zero but you are still not going to see any increase in air travel, vehicle travel or transportation more generally – the demand curve has become more elastic for as long as this lockdown continues.

Deal-making

Uncertainty is one of the main enemies of large M&A. It is very difficult for a CEO and board to pull the trigger on a large transformative transaction when their stock price is tanking, investors are asking for new guidance and they don’t yet know how bad their next quarter is going to get hit.

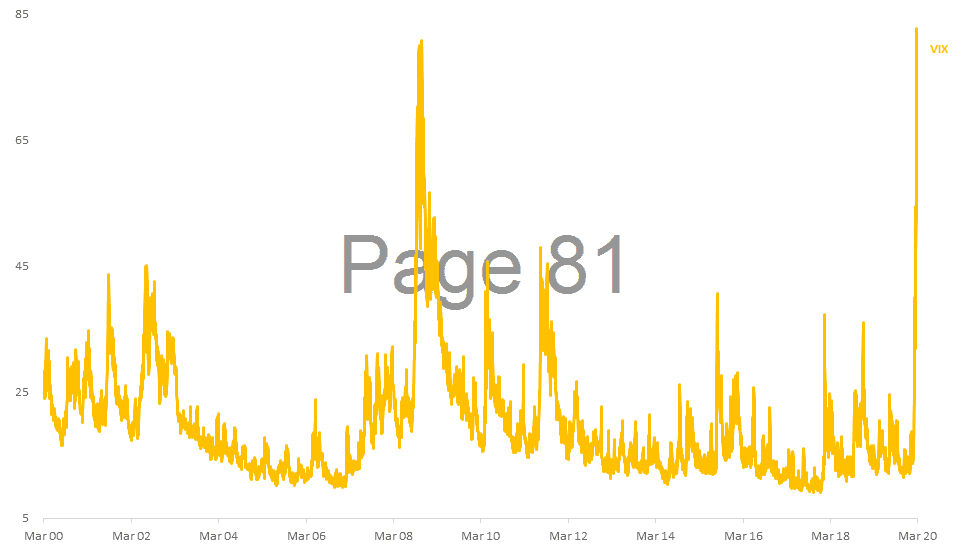

To demonstrate just how spooked the markets are, look at the volatility index below which shows we are at levels surpassing that of The Great Recession.

Add on to this the drying up of the financing markets; all-in leading us to expect M&A volume in 2020 will be down significantly.

However, as the saying goes, in crisis comes opportunity and there may be a few examples of companies merging to better tackle the crisis or for companies to take advantage of depressed valuation to pursue M&A.

Macroeconomic Indicators

To no one’s surprise, GDP forecasts have sunk with the US Q2’20 forecast falling from ~2% down to just below 0% and Q3 and Q4 currently around the ~1.25% mark, again falling from ~2%. These forecasts, based on the WSJ’s forecasting survey, seem to indicate a general view that the lockdown and social distancing should alleviate itself in the third quarter and beyond.

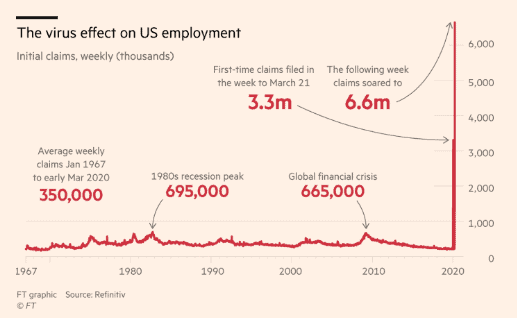

What has come as a surprise is unemployment. The number of people filing for US unemployment claims in the week ending 28th March 2020 was 6.7M, double economists’ forecasts of 3.7M. The 6.6M figure was double that of the highest before it, which was only one week ago – 3.3M in the week ending 21st March 2020. That is 10M people in the US filing for unemployment benefits in two weeks. Again, to put that into perspective, the highest this number has been since the 2000s is 0.7M.

Similarly, we see in France roughly 4M workers in temporary unemployment schemes (20% of France’s private sector employees), 800K in Spain have lost their jobs and 1M people in the UK have applied for universal credit.

Policy Making

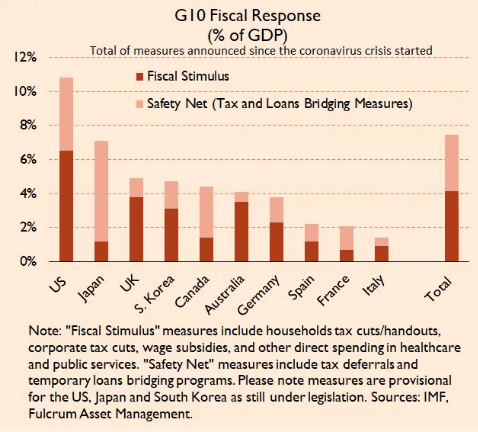

The response on the stimulus side appears to be of a scale commensurate with the magnitude of the crisis, both in terms of monetary and fiscal policy. Although on the fiscal side it seems governments have taken a “whatever it takes” approach with the US fiscal packaging of $2T, being 10% of their GDP.

Interestingly and in contrast to The Great Recession, fiscal stimulus is playing a much bigger role than monetary policy. For a few reasons, one being monetary policy cannot physically place money into the pockets of the citizens which is what is needed given the stark unemployment rates, it can only indirectly help them through increased liquidity and lower borrowing rates.

Further, and this remains a debated topic, but some may consider monetary policy as having lost part of its potency. When rates are already at all-time lows the effect of taking them down a little further seems to be muted. It is possible monetary policy now takes a supporting role whereby it will fund fiscal policy as opposed to taking a more driving role as it has done over the last decade.

The main monetary policy responses have been:

- US Federal Reserve: Rate cuts down to 0%, unlimited quantitative easing as required

- European Central Bank: Increased quantitative easing via €750B bond-buying program

- Bank of England: Rate cut to 0.1% and quantitative easing program of £645B

And the main fiscal responses have been:

- US: $2T stimulus package for direct payments, small business loans and grants and aid for distressed companies

- Germany: Pledged “unlimited” credit to businesses as required through €550B of government-backed loans

- France: €300B loan guarantees for large and small companies and €45B of tax breaks

- Italy: €25B fiscal package for small business loans and suspension of mortgage payments

- Spain: €100B in loan guarantees for businesses and €100B in subsidies for vulnerable households

- UK: £330B in loan guarantees for large and small businesses, tax deferrals and cash grants; job retention scheme whereby government covers up to 80% of certain employees’ salaries.

Concluding Remarks

Whilst the near-term disruptions have been quite stark, perhaps worse than what most people would have predicted in early February, the bigger unknowns are the further-reaching secondary consequences.

Large crises often bring about paradigm shifts, new policy measures and regulations, a different capital market environment, a potential new inflationary environment on the back of monetary loosening all of which will only unravel with time.