Investing in land has always been the reserve of the ultra-rich. At least in the UK (we all know that stories about successful land purchases “back home”!). It’s also notoriously difficult to buy the good stuff unless you truly understand the market. Then there’s having to compete with the big housebuilders who typically have the contacts and the capital to buy up the good stuff.

That has changed now. Today, we’re reviewing a platform that allows you to invest in land for as little as £5,000. That’s not a small amount, but it’s much smaller than was possible in the past.

Introcrowd has been externally certified as sharia-compliant (by Mufti Faraz Adam), hence our review on this website as a potential investment opportunity for Muslims to be aware of.

What is land investing?

Most readers – if not all – will be very familiar with property investing. Typically buy-to-let properties, but also some development where you build from scratch and sell on at a profit. There’s money to be made in property at all levels of the building stage. From before a brick is laid, to when it’s fully completed and lived in by a tenant.

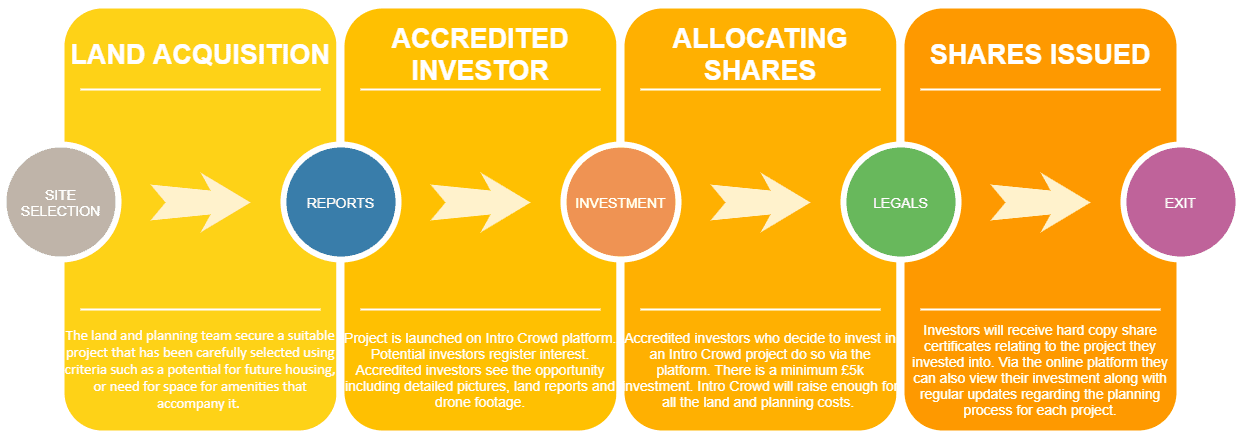

But there’s a bit before that that goes virtually unnoticed. That is the strategic land acquisition and obtaining permission on that land to even build the house.

How difficult is land investing to do yourself?

I know from personal family experience that it’s extremely tough to do land investing solo. First you have to acquire the right land. This is fine if it’s in your home town and you know the lay of the land (pun intended). But as soon as you start trying to do it across the UK, it becomes very risky. You don’t know the area, you probably aren’t willing to spend the money to commission full diligence on the area, and you probably do not have the expertise to digest or spot the opportunity.

Next, you have to be able to obtain planning permission on that land. That involves thinking strategically about the best use of the land to maximise value out of it. It also involves thinking about how best to design your plans to help obtain planning permission. It’s a real skill, and I’ve seen first-hand how you need to be able to rely on a wide team of experts and a stroke of luck (and possibly a few attempts and not being able to recover the full amount of your original investment) to obtain the planning permission you need.

This is not an easy game at all. And that probably explains why there are so few strategic land crowdfunding platforms out there. This is the first we’ve seen which is certified sharia-compliant.

The team behind Introcrowd

Introcrowd was founded by Gregory Baker. Gregory has a background in investments and spotted a gap in the market for crowdfunded land investing.

He brought Chris Merriman on board, who is a land and planning director with 30 years’ experience. Chris has experience in taking so-called “dirty” land (e.g. old coalfields or contaminated land etc) and obtaining planning permission on such sites. Introcrowd doesn’t acquire such sites, but Chris’ experience in this area helps.

All of this means that the team has solid experience in not just sourcing deal flow, but also in delivering planning permission on sites which are much more complex than the ones Introcrowd acquires.

Legal structure

The legal structure is pretty straightforward. The land is acquired by a company that is incorporated for the sole purpose of acquiring the land.

Once the fundraise has happened, the land gets transferred into this company which has been incorporated. Investors then receive a proportionate share of the company that holds the land according to their investment amount in the form of unlisted equity.

Can you sell shares before the exit?

Can you sell shares before the exit?

Although Introcrowd don’t have a dedicated secondary market for selling shares, they operate on a matched bargain trade basis. How does this work?

When an investor needs cash relatively quickly, Introcrowd may be able to act as a facilitator when one investor wants to sell or buy shares and another investor wants to sell or buy the same quantity at the same price. Their order will match and the transaction can be made. In light of this, this cannot be relied upon as a substitute for liquidity. Although Introcrowd maybe able to help if an investor needs to free up some cash, there are no guarantees.

I think the mentality to adopt here is that your money will be locked away until exit. If you do end up needing the money for some reason, Introcrowd have stated that they have managed to find buyers in the past, but this isn’t always guaranteed.

So the short answer to the question is: in theory yes, but there needs to be a buyer to take the shares.

Is Introcrowd FCA-regulated?

Although Introcrowd is a trading name of Falcon International Finance Limited which is regulated and authorised by the Financial Conduct Authority with Firm Reference Number investments such as these are NOT and you will not be protected by the Financial Services Compensation Scheme.

You can see their registration here.

Minimum investment amount

The minimum investment amount into a project is £5,000. After that, you can buy anything in £500 increments. So you could, for instance, purchase £5,500 worth of shares in a project, but nothing below £5,000.

Fees

The fees are refreshingly straightforward (we hate having to write about complex fee structures!). 2% is taken on the way in as a fee and 5% of the total amount on the way out.

Who is this suitable for?

The Introcrowd platform is only suitable for self-certified sophisticated investors or high net worth investors, as defined under COBS 4.12.8R and COBS 4.12.6R respectively. Full details of the criteria are here.

What does that mean? Well you’re a sophisticated investor if one of the following applies. You:

- are a member of a network or syndicate of business angels and have been so for at least the last six months prior to the date of signing;

- have made more than one investment in an unlisted company (i.e. a company not on the stock market) in the two years prior to the date of signing;

- are working, or have worked in the two years prior to the date of signing, in a professional capacity in the private equity sector, or in the provision of finance for small and medium enterprises; or

- are currently, or have been in the two years prior to the date of signing, a director of a company with an annual turnover of at least £1 million.

You need to self certify that one of the above applies in order for you to be considered a self-certified sophisticated investor and be allowed on Introcrowd’s platform.

Alternatively, you are a high net worth investor if you:

- had an income of £100,000 or more throughout the financial year preceding the date of signing; or

- had assets worth £250,000 or more throughout the financial year preceding the date of signing (not including your primary residence and other exceptions).

Full details of the criteria are here.

Land Investing % Returns

Ah, the bit you’ve been waiting for. Without wishing to get splinters from the fence I’m sitting on, it’s hard to put a value on the amount of returns one might expect from land investing. That’s because no two projects are the same.

I’ve heard of returns of almost 50% over a period of 6 years for one project; I’ve also heard 700% returns (admittedly over a 16-year period). It all just depends on the project.

What I like about Introcrowd is that you get a report at the outset which helps you to understand the potential so you can decide for yourself if you want to invest in a particular project or not with all the info given.

Comparison with other types of investment

So let’s have a think about how an opportunity like this stacks up against other types of investment:

Shares

Because land investing is, by its nature, illiquid (i.e. you can’t easily sell it and get your cash out) it’s not fair to compare it to stuff like shares. That being said, because you can easily buy and sell shares, you’d expect that if you are going to tie up your money, you’d want a better return than the stock market.

Typically a decent return from the stock market would be around 8% per year. This does depend on wider market conditions though, just like any investment. We’d want land investing to offer higher potential returns given that land investing is illiquid.

Property

Property is a good comparison here because not only is it also illiquid, but you also have crowdfunding property platforms like Yielders. For property 5-8% is typically seen as the range of a decent annual yield. Although land investing doesn’t necessarily get you the same tidy dividends per year, you can compare the return over the course of say 3 years to decide whether you’d typically be better off going for property of land investing.

Conclusion

We’re excited to be reviewing Introcrowd because it offers something very different in the halal investing space.

As with any investment, there are a substantial number of risks involved. As a potential investor, it is important that you aware of these capital risks associated with an investment of this nature. It may be beneficial to seek independent advice from a suitability qualified independent advisor as this can provide you with customised guidance on your medium term investments.

If this sounds like your cup of tea, hit the button below!