Autumn Budget 2025: What This Means For UK Muslims

26 November 2025 6 min read

Ibrahim Khan

Co-founder

9 min read

Last updated on:

Election season is upon us with its full might and fury. The media, marketing agencies and politicians are in overdrive. This is the month in which literally hundreds of billions are being bought and sold in exchange for votes.

As Muslims living in the UK, we need to be clear about what are thing things that we should be asking politicians for.

Mend are a great NGO who have developed a whole raft of policy positions to put to politicians. You can access their full election manifesto here. One particular pledge we like is name-blind recruitment. This has the potential to have massive impact on Muslim employment rates – given that a Muslim-sounding name is 3 times less likely [6] to be called for interview otherwise.

But at IFG our domain is much narrower: it is the economic and finance realm. We focus on this as it is what we know best, and we believe that wealth creation is essential for our community’s overarching advancement.

And we got thinking on what is the one thing, that would materially change the economic position of Muslims? For context, Muslims are statistically amongst the poorest in society: almost half of the UK Muslims live in the top 10% poorest local authorities.[1] Globally, Muslims are about 20% poorer than the rest of the world.[2]

What is that simple, but tangible and achievable one thing that a politician can do which will help to lift a certain number of Muslims out of poverty over time?

How can we frame that ask so that it comes across as reasonable, achievable but also meaningful? And crucially, how can we as a UK community really get behind it and stand firm on it?

Before we got into the numbers, we had a brain-dump of all the potential “one things” that we could think of:

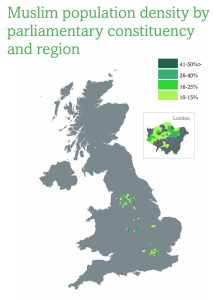

(assumption being that as there are large pockets of poor Muslims in the North and Midlands, connectivity helps them to reach areas of economic activity and business. See this following great heatmap showing where the majority of Muslim-heavy constituencies are in the UK geographically, which illustrates the point nicely)[3]:

(assumption being loans help businesses to grow and this helps communities – but that sharia-compliant loans not being available is a deterrent to people setting up or growing their businesses. Anecdotally, we know there are plenty of small, family-run shops for example. But not many of these go on to be big. There do however appear to be some sharia-compliant financing available from the government right now.)

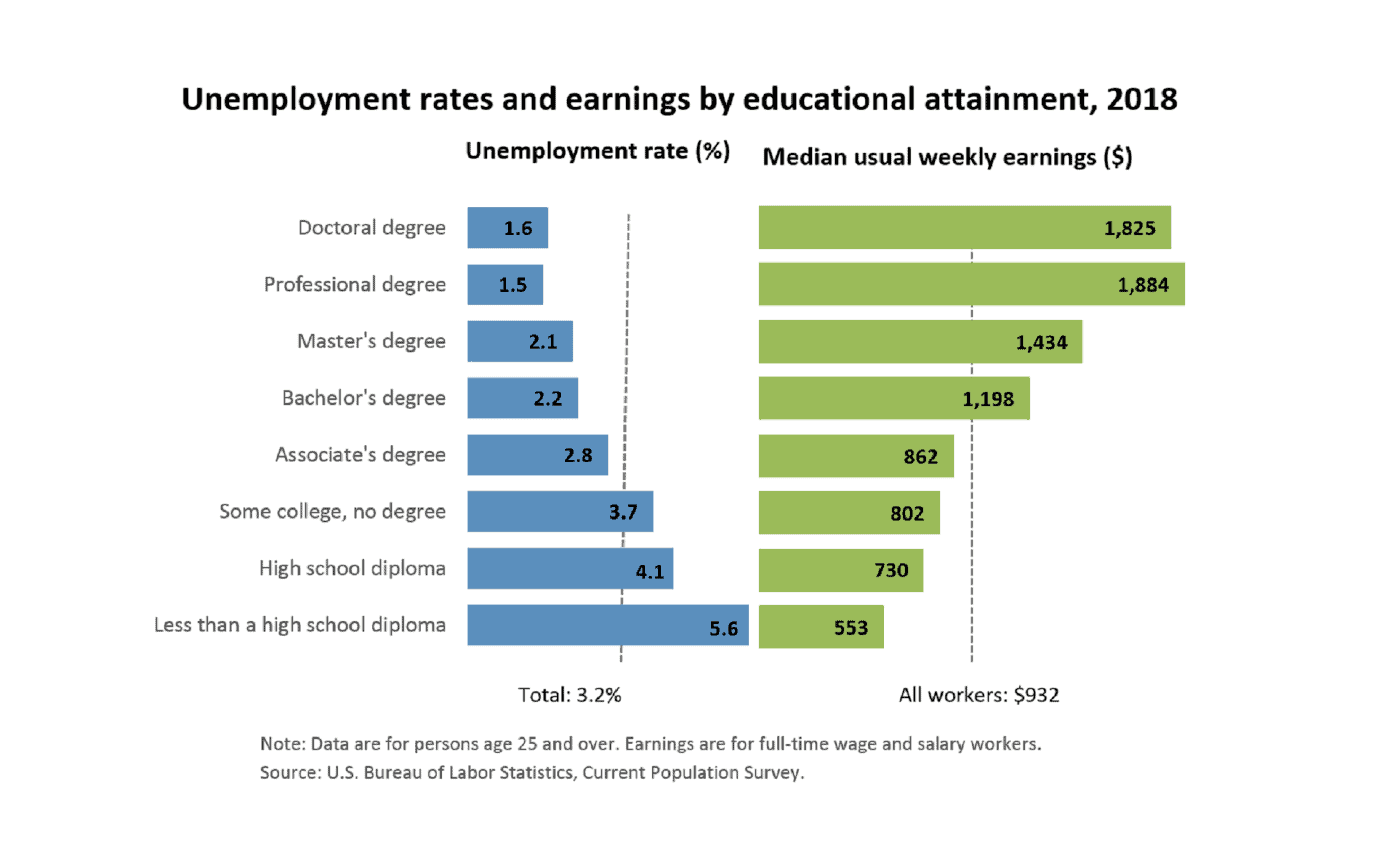

(assumption being that education is low and higher education leads to better economic outcomes. Here is a U.S. government graphic showing the unsurprising effects of more education on median wage and unemployment):

(assumption being that in places like London there are so many jobs you’ll find something, but in somewhere like Blackburn, it might be easier if you can access the global online job market instead)

(assumption being that higher education leads to better economic outcomes)

(assumption being that Muslims who can save and invest better will have better economic outcomes.

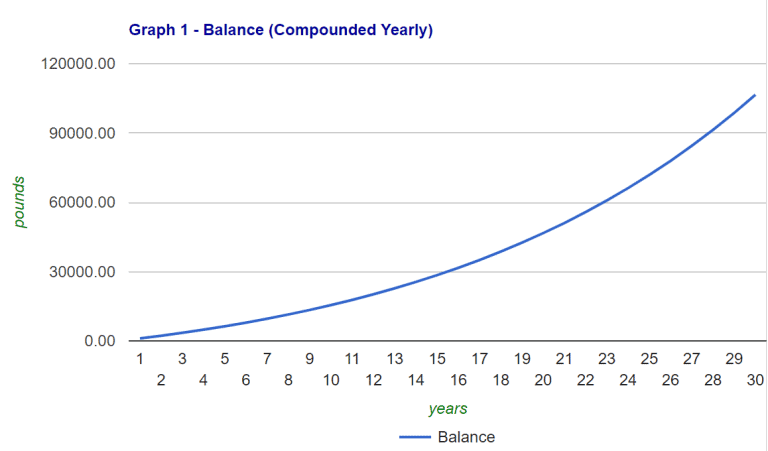

The average advertised salary in the UK in 2019 is £35,000 and each employer has to contribute a minimum of 3% of that, which is £1050. This is literally free money you get as part of your pension and Muslims who don’t get this will lose out around £105,000 over 30 years, assuming no further increase in salary and a 6% year-on-year return on the invested amount.

Here is a graphic that shows the amount of money someone who doesn’t have a workplace pension is leaving out on the table):

(assumption being that massive transformative change can be brought about in regions through the success of just a handful of companies from that area, and the venture money that goes into the failures also helps grow the economy, the talent-pool ecosystem, and trains up future successful start-up founders.

Unfortunately, current private equity and venture capital firms do not effectively meet demand outside of London. Reporting on some research, the FT said, “the research showed that equity gap was greatest in the East Midlands. There were enough eligible companies there to benefit from as much as £560m of private equity, according to the researchers, but they received just £59m of investment.” This same research pointed to £6.5 billion in unmet private equity investment demand across the UK.)

Okay, so we have a bunch of potential one-things Muslims should focus in on. But what is the metric that we are trying to maximise should the “one thing” succeed?

For each idea, we have accorded it 1 point for each of the above criteria it ticks. The results are as follows:

Idea 1: Connectivity Infrastructure Projects

Score: FP, MA, M, WA – Total: 4

Notes: We feel that this will be championed by so many people anyway, that there’s no real strategic value-add to Muslims specifically calling for this as the “one thing”.

Idea 2: Sharia-compliant business loans

Score: FP, I – Total: 2

Notes: This is, as we intimated, happening already to some extent. A lot more needs to be done, and this is genuinely impactful as an idea, but probably not one most Muslims know enough about to properly campaign for.

Idea 3 : Improve education standards

Score: FP, MA, M, I, WA – Total: 5

Notes:This is a really impactful “one thing” but the issue we have is that it will, like the infrastructure projects, be well-campaigned for by many others anyway.

Idea 4: Online skills training in low-job areas

Score: FP, WA – Total: 2

Notes: Implementing this will could be difficult, it doesn’t affect the majority of Muslims, and, frankly, there are plenty of free learning options available these days.

Idea 5: Sharia-compliant student loans

Score: FP – Total: 1

Notes: As discussed in this article, we think you should avoid a student loan as much as you can, but ultimately, if you’ve tried to avoid it as much as you can, you can take it as a necessity. And very practically speaking, we don’t know of a huge amount of Muslims who have decided not to go to university solely due to this reason.

Idea 6: Sharia-compliant workplace pension

Score: FP, M (0.5), I – Total: 2.5

Notes: Muslims might struggle a little bit to get up to speed quickly to effectively campaign for this point, and many Muslims have companies with providers who do provide sharia-compliant pension options, so we’re not sure this will affect as many Muslims as some of the other options.

Idea 7: Promote investing outside of London and in ethnic minority pockets

Score: FP, MA, M, I, WA – Total: 5

Notes:

Based on the above analysis, we believe that the single most impactful thing Muslims should be calling for is “promote investing outside of London and in ethnic minority pockets”.

More precisely, we should ask for a £10m pot to be put aside by the British Business Bank and, perhaps, The Ministry of Housing, Communities and Local Government to invest outside of London into ethnic-minority dense areas.

These are the sort of soundbites we need to be using:

The impact of increasing start-up and private equity investment into ethnic minority communities in the Midlands and North of the UK will have massive positive effects. Here are some of them:

Do you agree with our analysis?

If you do, please comment below to say so and share this article, so that we can add momentum this campaign. Please also raise this point at every opportunity you get this election.

If you do not agree, please let us know why, and what you would pick instead. This “one thing” is so important to get right that it needs all the voices in the room to speak up.

[1] https://www.mcb.org.uk/wp-content/uploads/2015/02/MCBCensusReport_2015.pdf

[2] Refer to GNI statistics for OIC countries vs other countries here: https://data.worldbank.org/indicator/ny.gnp.pcap.pp.cd

[3] https://www.mend.org.uk/wp-content/uploads/2015/03/MEND-Muslim-Manifesto-GE2015_LowRes-1.pdf

[4] http://www.diversity.vc/wp-content/uploads/2019/07/DiversityInVC_Report_10.07.2019_for_Web.pdf

[5] https://www.ft.com/content/51ba7fa6-56d7-11e9-91f9-b6515a54c5b1

[6] https://www.bbc.co.uk/news/uk-england-london-38751307

26 November 2025 6 min read

23 September 2025 4 min read

Leave a Reply