UK Islamic Fintech 2020 Gaps Analysis | Islamic Finance Guru

13 min read

Published:

Updated:

Ibrahim Khan

Co-founder

Islamic fintech has come an incredible way in the last decade and this should be celebrated. But there are some gaps that have still not been met for the Muslim consumer. Our hope is that this report encourages entrepreneurs to fill those gaps.

This report presents our findings and is informed by analysis of three main sources:

- Usage data of our Halal Investment Comparison engine;

- Deal-flow received by our angel syndicate; and

- Data from our traffic and queries received.

We also feed in our qualitative read of the market into this.

This data is as organic as it gets. We haven’t gone out to our audience with a survey – we’ve just observed what they’re actually doing and saying.

For context, every month we receive:

- over 50,000 unique visitors to our website a month;

- sift through dozens of pitch decks from businesses every month; and

- receive over 600 queries.

The report is structured into 3 key sections:

- What do consumers want?

- What is the current state of play?

- Where are there gaps?

Executive summary:

What do consumers want?

- Stock funds, property-based investing, startup investing and roboadvisors are all the preferred investor choices.

- Muslims prefer investing in high-risk high-reward investments over low-risk low-reward investments.

- There is no Islamic insurance product currently available in the UK market and there is a real appetite for such a product.

- SME financing products are in their embryonic stage and there is a very strong demand for such products. There are people attempting to address working capital and revenue-share finance, but no one currently actively working on invoice financing, long-term revolving facilities, acquisition finance or car/asset finance.

- Personal finance and Islamic credit cards currently do not exist and there is demand for such.

State of Play

- Property-sharing startups exist but none are active right now. They need significant patient capital over £30m to launch effectively.

- There are a number of digital banks but they are all at an early stage/not launched and relatively equally-matched. Consequently, there is a risk of market fragmentation which could mean that none succeed in the medium term given the tough unit economics in this sector.

- Within equity funds, there are now established funds that are designed to give overall macroeconomic exposure to global, US, and UK stocks. However, to our knowledge there are few accessible ones that actively deploy a particular focused investment strategy. There is a demand for this.

- There is currently no Islamic pension provider, though there are SIPP providers. We understand this is shortly about to change.

- On the VC side, there are only three main players in the UK. Hambro Perks is an early investor in Muzmatch and has said the Islamic economy is a focus. The IE5 accelerator is also focused on the Islamic economy and there is IFG’s own angel syndicate IFG.vc that invests ~£500k a month into 1-2 startups. There are no dedicated funds raised yet to invest primarily in Muslims/Islamic economy.

- Property crowdfunders like Yielders and Igloocrowd exist, and within land investment, there is Intro Crowd. The major next step for these operators is to scale their operations significantly so as to be able to offer more products and opportunities to their audience on a consistent basis. There is also space for Islamic REITs to emerge.

- On the Islamic real estate financing side, bridge financier Offa has emerged, backed by Gatehouse. However there remains a significant gap in funding of projects in the sub-£5m category, as neither Gatehouse nor Al Rayan have historically shown much appetite for this category. We welcome Nester’s impending entry into the market as it aims to solve this issue.

Gaps

- Insurance products

- A working shared-ownership product

- Credit card and personal finance products

- Acquisition finance for SMEs

- Revenue share finance for SMEs

- Invoice financing for SMEs

- An Islamic EIS/VCT Fund

- Bespoke investment strategy public equity funds

- Islamic REITs

- Islamic pension provider

- Commercial property finance for sub-£5m projects

Part 1: What are people interested in/talking about?

Traffic data

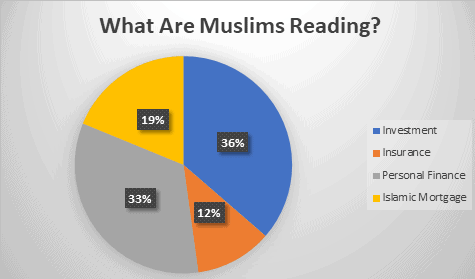

An analysis of our most recent monthly data gives the following breakdown in terms of areas of interest for users.

The large share of attention received by investments and personal finance topics is unsurprising. What is surprising however is that insurance-related topics are also well-read. This suggests that insurance is a pain point for many Muslims, and one that is not being adequately fulfilled. Once there are options out there for Muslims we would expect this traffic to increase.

Within the personal finance traffic there are a plethora of articles covering Islamic legal analyses and Muslim-specific saving and money tips. This suggests that the Islamic aspects of their personal finance remain important to Muslim consumers and this is reflected in the nature of the questions received too (see below).

The Islamic mortgage traffic dipped over the COVID-19 peak, but has now quickly returned to normal percentages. We would expect the percentage traffic to increase as a share of overall traffic in coming months as more Islamic mortgage providers and shared-ownership providers enter the market.

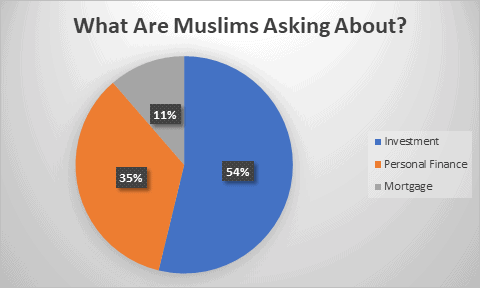

Query data

Looking over our query data over the last month, we have the following breakdown:

The data suggests that investment needs a lot more bespoke, technical input, and hence it has increased its percentage relative to our overall traffic.

The personal finance interest remains fairly stable relative to overall traffic, and this coheres with our observation that Muslims like to get bespoke answers to personal finance queries, especially those of an Islamic legal nature.

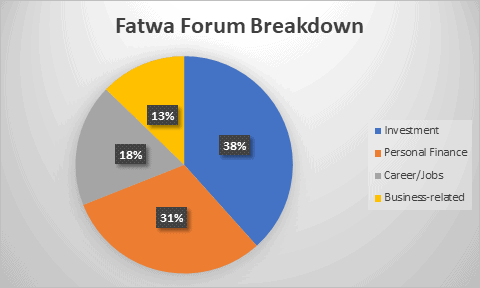

The personal finance queries percentage share is slightly masked however as a large number of these are now being diverted to the IFG Fatwa Forum where users have posted 677 times in the last month and created 171 new topics.

This breaks down to:

Increasingly we see queries related to careers and people’s businesses going to the Fatwa Forum, as people require definitive guidance on these matters as opposed to a steer (which is what we can offer via our email queries).

Within the investment section, forex attracts a lot of questions. This suggests there is a strong appetite in the Muslim audience for higher-yielding shorter-timeline investments.

The majority of the investment questions focus on the public equities space. There are often questions about specific investment strategies and screening criteria. This coheres with our view that the Muslim consumer wants to invest in public equities but demands more than the limited options available right now.

Startup pitch data

Over the last six months, 11% of the deals we have seen looking for funding have been from Islamic fintechs. We have seen a much larger number of deals relating to the Islamic economy generally but focus here on the Islamic fintech segment.

In that time we have seen deal flow in the following sectors:

- Neobanks – 27%

- Home financing – 9%

- Property Investment – 18%

- Wealth management & Investing – 18%

- SME financing – 18%

- Other – 18%

Given the nascent nature of the Islamic digital banking sector, we fear that there might be a few too many players in this space in the UK relative to the available Target Addressable Market (“TAM”) and the unappealingly high breakeven user numbers.

We would have expected more insurance, personal credit, and investing startups. We think there is an opportunity and need here and not enough people working on it.

It is promising to see startups working on catering for the sharia-compliant SME market however much more needs to be done given the relative blue ocean nature of this market and the clear need for these solutions.

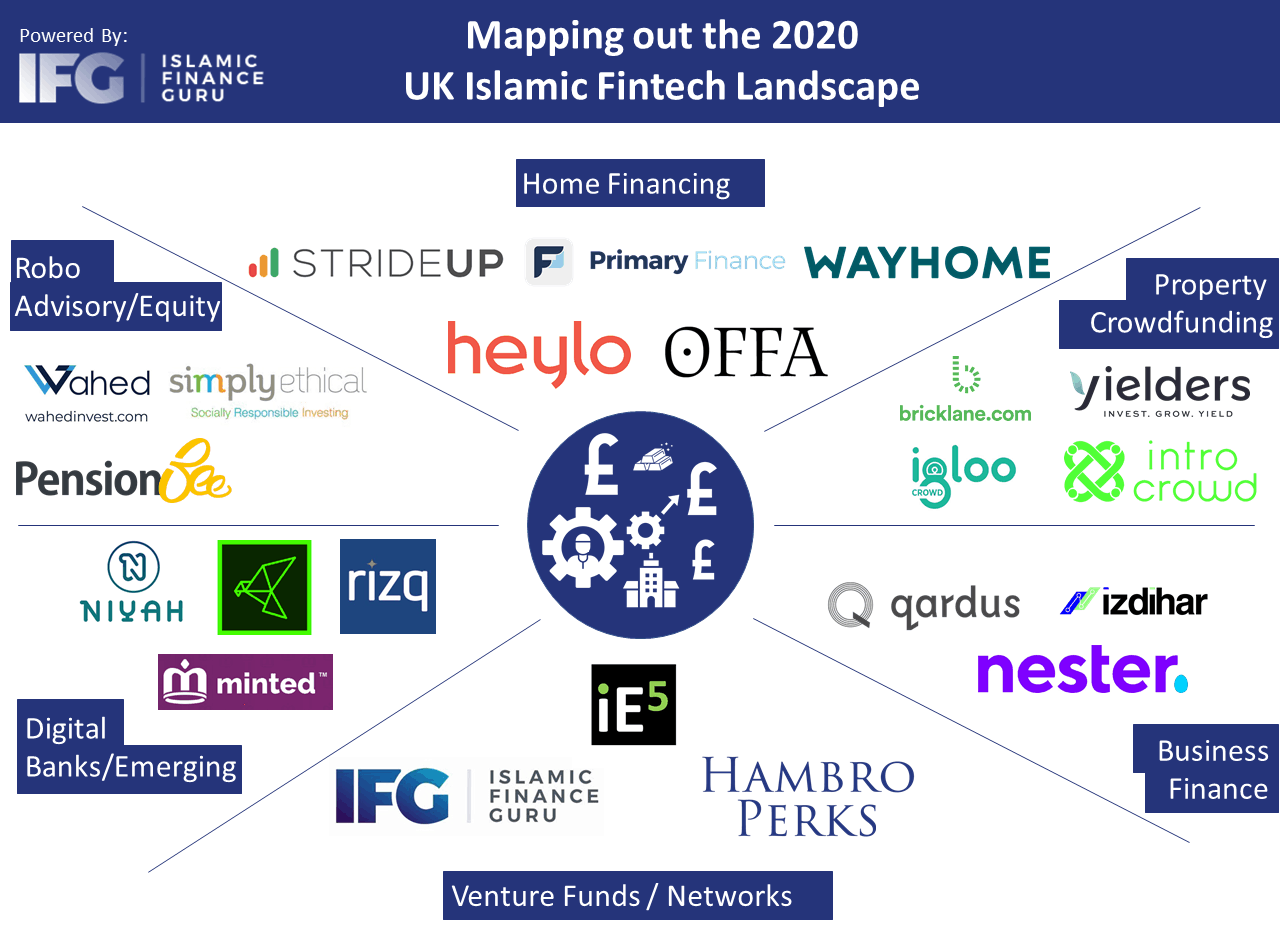

Part 2: What is the State of Play Right Now?

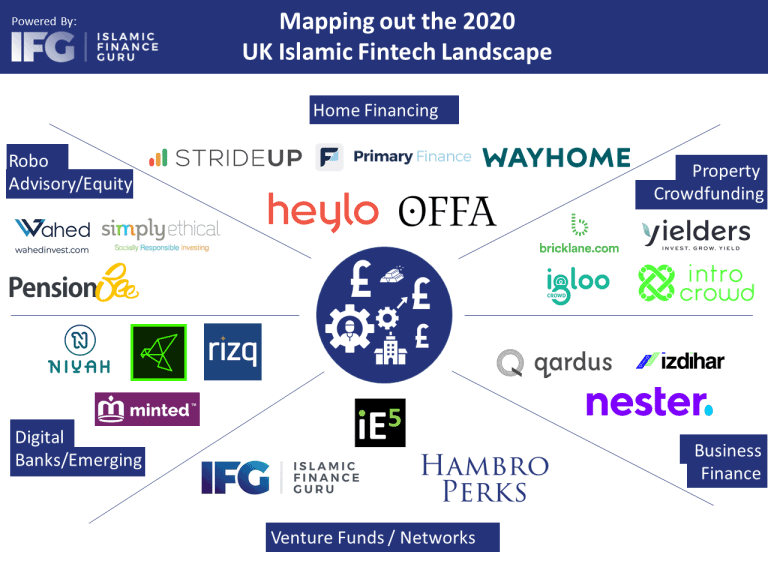

The Scene

The UK scene is thriving thanks to the UK’s relatively straightforward legal and regulatory regimes as well as a ready supply of services needed for a fintech to get going.

These include banking-as-a-service providers, plug-and-play crowdfunding platforms, sharia advisors, law firms, regulatory and compliance advisors and a developing angel and VC investor community.

Websites like ours also enable to Islamic fintechs to more easily get in front of their target audience which dramatically reduces the go-to-market spend that such companies have heretofore had to foot.

Real Estate

There has been a historical discomfort with the Islamic mortgages that Al Rayan and Gatehouse offer for two key reasons: (1) being seen as not truly sharia-compliant; and (2) being more expensive than their mainstream counterparts. We have covered our views on this topic here.

The response by startups has been to deal with (1) through a shared-ownership structure and attempt to deal with (2) by trying to get to scale.

Property-sharing startups like Strideup, Primary Finance, and Wayhome all exist now but none are active right now (and haven’t ever been in 2 of the 3 cases). The key issue to resolve here is access to significant patient capital over £30m that is needed to get started, and closer to £100m that is needed to properly thrive.

Such patient capital attracting relatively lower returns is hard to obtain, particularly for a startup with no proven track record.

We are hopeful that one or all of these operators cracks this puzzle but until then the incumbent Islamic banks rule the roost.

Property crowdfunders like Yielders and Igloocrowd exist, and within land investment, there is Intro Crowd. The oldest and most established among these is Yielders and they regularly bring around 1 deal to market a month.

However, given the scale of appetite for property investing in the Muslim audience, our view is that the major next step for these operators is to scale their operations significantly so as to be able to offer more products and opportunities to their audience on a consistent basis. This, coupled with an auto-invest functionality, then allows the average consumer to regularly invest in property.

There is also space for Islamic REITs to emerge as a way to move away from the deal-by-deal investment approach and allow Islamic property investment companies such as Yielders to have a ready pool of capital to be able to tap into.

On the Islamic real estate financing side, bridge financier Offa has emerged, backed by Gatehouse. This is a welcome addition to the market and allows for the first time Muslims to use bridge finance to buy property off auctions for example.

However there remains a significant gap in funding of projects in the sub-£5m category, as neither Gatehouse nor Al Rayan have historically shown much appetite for this category and bridge financing isn’t always suitable for such investment. We are therefore excited to hear that Nester will be launching shortly and will be catering for this segment.

Digital Banks

There are a number of Islamic digital banks such as Insha, Niyah, Rizq, Kestrl, MyAhmed, Moneemint, Minted (though their focus is more on gold investing) and others but they are all at an early stage/not launched and relatively equally-matched. Consequently, there is a risk of market fragmentation which could mean that none succeed in the medium term given the tough unit economics in this sector.

For context, Revolut, Monzo and other mainstream digital banks have always been loss-making, despite reaching much larger scale than the Islamic banks. Ultimately the hope is that these banks figure out a monetisation strategy for their large audience and start turning a profit.

But in order for this uncertain economic model to be a worthwhile pursuit in the first place, there needs to be a large TAM to play with. All but one of the Islamic digital banks mentioned are primarily focused on the UK market with a Muslim population of around 3m.

For one digital bank to be successful it will need to take significant market share of this target audience. That is a difficult ask as Al Rayan has only managed around 1% penetration of that market with its current accounts in that time. So Islamic digital banks are not only competing with each other, they are also competing against HSBC, Natwest and Al Rayan as current account providers.

But we are where we are now. For digital Islamic banks to have a chance at surviving our view is that five things need to happen:

- Mergers need to be considered;

- The banks need to have an international outlook to increase TAM;

- The banks need to consider a branding that is not purely “Muslim” focused in order to wider their TAM;

- The banks need to consider focusing on a particular product that will uniquely attract audiences to its platform and that makes them stay there too. This will allow them to improve cashflows and USP; and

- The banks need to focus on adding a functionality that is technically unique and difficult to emulate. The one that achieves that not only takes the Islamic market, but will be able to take mainstream market share too.

Public Equity Investing

There are now established public market funds such as the HSBC, Aberdeen, and iShares (Blackrock) and Oasis Crescent funds. But these are global, income or US focused funds that give a broad-brush exposure to overall markets.

There are not, to our knowledge, many funds that actively deploy a particular investment strategy such as technology, growth, country-specific, and smaller company funds. We would expect there to be a demand for this. To give context, in a typical pension a Muslim consumer can choose from hundreds of mainstream funds, and one Islamic fund.

There are also no workplace pension providers but we understand that Wahed Invest are planning to launch this in the coming days. Wahed Invest and Simply Ethical both provide Islamic self-invested pension plans, which you can read about here.

Venture Capital

There are three main players in the Islamic venture community in the UK.

Hambro Perks is a venture fund, an early investor in Muzmatch and have recently invested in Sarwa, a Dubai-based roboadvisor. They are also actively looking to invest in more Islamic fintechs, particularly those emerging out of the Middle East.

iE5 is an accelerator led by Islamic finance veteran Harris Irfan. They have included among their inaugural intake, Rihaala, Salam Planet, Primary Finance, Kestrl, Rabt Tech and Muslim Assistant. Their role in the ecosystem is important to upskill new founders.

We run IFG.VC, an angel investor syndicate that invests ~£500k a month into 1-2 startups. IFG.VC regularly co-invests alongside tier one VC funds in the UK and Europe. We have previously invested in Funding Souq, a Dubai-based SME financing company and would like to invest in more Islamic fintechs. We are actively looking for, and would love to hear from Islamic insurtech and SME finance startups. More broadly, IFG.VC invests in diverse and ethnic minority founder teams, with around 85% of our portfolio coming from minority and Muslim backgrounds.

More broadly, mainstream VC firms like Ada Ventures, Included.vc and Impact X are doing important work in investing in diverse founders, and are actively seeking startups from these communities to pitch to them.

Part 3: Where are there gaps?

In light of the above, we see the current gaps in the market as follows:

- Islamic insurance products – following the failure of Salam insurance, there have been no major attempts to launch an Islamic insurance product. We think that the Islamic model has compelling aspects to it which would be appealing to a mainstream audience as well and therefore see this as a scaleable opportunity.

- A working shared-ownership product – there is a demand for this kind of product among Muslims who might be doubtful over existing Islamic mortgages, as well as from the wider market from people who may not have as strong a credit history or a large a deposit as is needed for an Al Rayan or Gatehouse.

- Credit card and personal finance products – no such products exist but there could be interesting opportunities for an Islamic equivalent of Klarna to emerge.

- Acquisition finance for SMEs – nothing like this exists and we receive many emails requesting this every month.

- Revenue share finance for SMEs – we understand that Clearbanc is currently developing a sharia-compliant solution, and there are now startups like Izdihar working on this problem too. We would love to see more.

- Invoice financing for SMEs – There is a clear demand for this but nothing currently exists.

- An Islamic EIS/VCT Fund – an established venture-focused fund that allows Muslim investors exposure to this exciting asset class would be great.

- Bespoke investment strategy funds – there is a lot of room in the market to soak up Muslim public equity investment money. Investors would welcome it too as it will provide some nice diversification and choice.

- Islamic REITs – there are a number of Islamic REITs already in existence but they are not branded as such. A REIT branded as Islamic would be interesting to a Muslim investor keen to get exposure to property but who doesn’t have the time or technical ability to sharia-screen existing REITs.

- Commercial property finance for sub-£5m projects – there are a vast number of such projects both in the mainstream market and Muslim market and currently those developers who require Islamic finance cannot find any viable option.

Part 4: Conclusions

The main conclusion from this report is that there are a whole ranging of really interesting problems for entrepreneurs to work on solving. Two further notes on this though.

What we think the best Islamic fintechs do

The best Islamic fintechs survive.

That means they have the unit economics needed to make their business work – either now or foreseeably soon.

That means they do a bunch of things, most important among them being:

- They make sure their TAM is large enough for them to hit break-even. Therefore, they may either need to cater for a global Muslim audience or they may need to brand neutrally to attract mainstream customers too.

- They nail their niche and specific product. They do it so well that they make it a very hard job for a competitor to enter that space. They resist the temptation to go into a blue ocean tangential product when they haven’t yet cracked their first product.

What are the most vital gaps to plug

Everything we do at IFG goes back to one thing: Muslims are around 20% poorer than the rest of the world, and we need to change that by making Muslims better-off economically. We care about this because an economically prosperous Muslim community has better political and media representation, health, education, and cultural presence among other things.

In light of that mission, the two areas we think can move the needle on that goal are Islamic insurance and Islamic SME finance. The former allows risk management, and creates a ready pool of sharia-compliant investment money, while the latter allows small Muslims businesses to become large Muslim businesses.

Anything we’ve missed? Let us know!

Related Articles

View all

What IFG will do to help bring about a truly Islamic economy

05 January 2024 8 min read