What IFG will do to help bring about a truly Islamic economy

05 January 2024 8 min read

6 min read

Published:

Updated:

Ibrahim Khan

Co-founder

This is the story of how I helped my mother-in-law beat the market consistently over 4 years and made a total return of 108%.

In July 2016, I started investing £3,200 for my mother-in-law. On 9 March 2017 I withdrew £1,000 and gave that back to her. Then on 21 October 2020 I took out another £2,050 and gave that back to her.

So my mother-in-law gave me roughly £3,000 and has since withdrawn £3,000 in cash. And she still has £4k invested. Any returns she now makes will be completely risk-free.

This amounts to roughly 27% returns annualised while in the same period the stock market declined on average 3% every year. So consistently, over 4 years, I have outperformed the market by 27%.

In this article I share with you:

If you are into stock investing you should check out our helpful forum where you can share insights, ask questions and just generally chat about all things stocks.

If you’d rather watch the story, here’s the video:

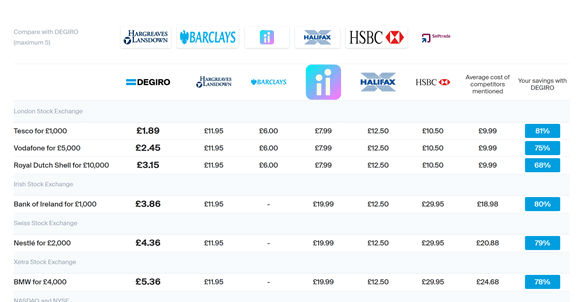

I invested using DEGIRO* as my stockbroker for this portfolio. The reason why was because DEGIRO fees are ridiculously low. Roughly around 60-80% cheaper than mainstream brokers. This was actually super important for me as I knew that, with a small amount of money to invest, I couldn’t accord big fees in the brokerage as that would just kill my portfolio. I’ve also heard good things about Trading212 who offer zero brokerage ISA accounts.

Here’s a comparison from the DEGIRO website of their rates against others:

However, I would still have used a mainstream broker if I was planning to invest larger sums of money and there was the potential that I would have crossed the £12,300 Capital Gains Tax allowance for the year.

The reason I would have used mainstream brokers is because they give you access to ISAs – which are a tax wrapper that protect any capital gains that you make from investments held within the ISA. You can invest up to £20k into an ISA every year.

If you’re in that position and you’re investing over £15,000, then I would suggest checking out AJ Bell* or Hargreaves Lansdowne*.

I invested mainly in UK stocks, but these days you can easily get exposure to international markets too via most of these stockbrokers.

In total, I invested in 13 stocks over the course of the 4 years.

Of these I’ll talk about three of these stocks.

The one at the top is a stock that me and Mohsin (my co-founder at IFG) have followed since around 2017. I personally invested through another portfolio when SQZ was around 30p and we enjoyed the ride up to 90p.

But with my mother-in-law’s portfolio I invested during the mid-2018 period when the stock came down to about 60p. I then followed the stock up as it more than doubled in price and sold it.

The thinking behind this investment was that SQZ had a bunch of solid revenue generating oil wells plus it had about £30m+ in cash in its bank ready to be deployed and to buy some great assets at a time when large players like BP were exiting North Sea assets. We reckoned it was only a matter of time before SQZ deployed effectively and picked up a bargain or two. And that’s what happened.

Ideagen is another great stock that I am still invested in even after 4 years. They make regulatory and compliance software and are simply an extremely solid and robust business that has been growing year-on-year in a growing sector. Just look at their stock chart below. That is exactly the kind of chart you want to see as a growth investor.

But let’s not just focus on the best performers. Let’s also focus on the losers. KOOV is the biggest one. They were supposed to be the ASOS of India. They are now in administration having gone down from 50p when I bought them to recently down to 3.5p.

I sold KOOV within 3 months having taken a 30% hit. I am grateful I did that, as otherwise I’d have waved goodbye to the remaining £340 too.

All the above analysis is well and good but what does this actually teach us to inform our future success? Here are 4 lessons I learned.

First, I ran a pretty concentrated portfolio throughout this period – roughly 5 stocks at any point, and often less than that.

The reason I did that was because my mother-in-law told me she didn’t care about losing the money if it gave her the chance of significantly increasing it. If I wanted steadier growth I would perhaps have run a portfolio of around 15.

That’s still pretty concentrated but I like that approach as my natural investing style is one of high conviction and bigger positions.

For Serica, Ideagen and Hotel Chocolat I was very high conviction and took larger positions in them. All three have done incredibly well for me. The table below doesn’t really reflect how well HOTC has done for me as I recently trimmed that down by about half (in terms of returns it is up there with SQZ and Ideagen).

Running a concentrated portfolio is great for small sums of money where it doesn’t affect you too much if you lose it all (as there wasn’t much to start with anyway) but you could really improve the range of things you can do if that £3k turns into £10k over 3-5 years.

Second, if you noticed, I had massive successes whilst my losses were relatively contained. I thankfully didn’t make the mistake many beginners make. I let my winners run and ruthlessly cut my losses.

Think of stock investing a bit like taking bites to try to pick a really sweet cherry. The worst thing to do is to discover a sweet cherry and then not eat it all. Even worse still is to find a bitter cherry and eat it all to the bitter end.

Third, I cut my losses in a disciplined way. KOOV was sold as soon as it hit 30% below what I bought it for. You should set yourself rules like this when investing because otherwise your emotions can get the better of you and make you hold on to a stinker for far too long.

Fourth, if you noticed, I didn’t trade very much. That would have been a mistake as it can rack up the brokerage fees and not let your thesis play out.

So in total I made around 22 trades in this period, which amounts to around £44 in total fees. If I had made considerably more trades, that cost would have been significantly higher.

So the lesson is – make a good decision, have a thesis, then let that thesis play out.

Obviously have some triggers set up in case something suddenly drops or rises dramatically, but otherwise let things be and just check in every few months and make sure your thesis is still correct.

Boring investment styles like this ultimately do pretty well.

This is what my mother-in-law’s current portfolio looks like:

Don’t read into it too much though as its been a while since I revisited my stock picks and I may be making some tweaks.

If you found this helpful and would like to keep in the loop of how I invest over 2021 and receive detailed research notes on each new stock I invest in, please do join the IFG Forum and subscribe to our mailing list.

Investing involves risk of loss. DEGIRO is deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.

* DEGIRO, AJ BELL and Hargreaves Lansdown are sponsored links but I have used each of these brokers previously for different portfolios and continue using them for these portfolios.

05 January 2024 8 min read

21 July 2023 6 min read