What IFG will do to help bring about a truly Islamic economy

05 January 2024 8 min read

KC

Kashif Choudhury

11 min read

Last updated on:

| - Introduction - The Fundamentals - Stock Screening Breakdown - The Top 5 Debt Free Stocks on the NYSE |

The following is a guest post from Kashif Choudhury. We think it’s a great sharia and commercial analysis coming at it from a perspective that it is best to just go for zero-debt companies. We are personally happy with the 33% debt allowance that most Islamic scholars allow but have sympathies with the zero-debt school. Enjoy!

In the modern debt and riba-ridden world, investing your money can seem like an all-or-nothing proposition. You either disregard the teachings of the Quran and Sunnah and go all out on riba-based investments, or you don’t invest at all, trying to adhere to the restrictions.

In this article, I argue that you can stick to the teachings of Islam and still invest your money in stocks that will grow over time and give you a competitive return on investment.

I do this by sharing my list of the top 5 stock picks on the New York Stock Exchange that have zero debt on their books and run their operations solely from their retained earnings and cash reserves.

|

But before we get into exactly how, let’s start with:

Our stock investing principle follows a three pronged approach. That is,

“We invest in shariah compliant companies, with great business performance, at fair prices.”

So let’s unpack that a bit.

The first criteria that the stock has to pass through is the Shariah compliance screen. You can learn more about this in our exhaustive article on how to invest in halal stock. Moreover, in terms of texts, Mufti Taqi Usmani’s books on Islamic Finance are a great foundational resource for both those new to the field and veterans alike.

Once a stock passes through the Shariah compliance screen, it moves on to the Business Fundamentals screen. This is where we deal with the latter half of our investment philosophy, “Great business performance at fair prices”.

For the foundational methodology, we use the popular value investing methodology pioneered by Benjamin Graham in his book the Intelligent Investor and for the actual stock picks and execution, we use concepts like the magic formula which you can read about in Joel Greenblatt’s The Little Book That Beats the Market.

Now let’s look at what each of the two screens, the Shariah screen and the Business Fundamental screen actually consist of.

Here is a brief overview of each of the criteria used.

Business Permissibility: This screen ensures that the primary business of the company does not fall under any prohibited categories. These may include, but not be limited to dealing in riba, gambling, spreading nudity/lewdness, selling intoxicants, pork etc.

Non Shariah Compliant Income: This criterion deals with how much non-halal (e.g. interest income) the company generates from its investments. The cap used is 5% of gross revenue. This should ideally be 0%.

Interest Bearing Debt: This is how much interest bearing debt that the company has taken out to conduct operations. The cap is 33% of Total Assets. This should ideally be 0% – and for the 5 stocks that are discussed in this article, they are.

Illiquid Asset Requirement: There is a minimum amount of illiquid assets that a company should have. The minimum amount used in the screen is 20% of Total Assets.

Net Liquid Asset Cap: There is a maximum amount of liquid assets that a company is allowed to have. If this is too high, then the concept of “exchanging money for money” comes into play, which falls under the category of Riba al-fadl. The criterion is that the Net Liquid Assets should be less than the Market Capitalization.

[NOTE: These screens are elaborated in detail in the How to buy halal stocks article]

Business Overview: This screen looks at the holistic business case to discern whether the company’s track record, current standing and forward trajectory set it up for future success.

Product Resilience: Here we look into the company’s products and whether they have a meaningful edge over the competition. A strong showing in this category means that the company has increased chances of weathering external shocks than it otherwise would have.

Business Model: This screen analyzes whether the company can take its products and market it in a way that gives it good margins, recurring revenue and customer loyalty. These are all crucial factors behind the consistent growth of a company.

Industry Outlook: The last screen in this category looks into the industry’s overall growth prospects to paint a macro picture for the company in the medium to long term.

Revenue Growth: This screen looks at the year on year revenue growth of the company. Good past growth is often a lagging indicator of strong business performance. The target rate is determined based on the industry that the company operates in.

Return on Assets: This screen looks into how effective the company is at generating income from its assets. The higher this number, the better it is at utilizing its assets to turn a profit.

Net Profit Margin: The last ratio analyzes how good the company is at turning its revenue into profits. Again, just as with the ratio above, the higher the number the better.

P/E Ratio: There are a lot of metrics that can be tracked and analyzed to determine the best buying price of a stock. But for our purposes, we used the Price to Earnings ratio. It signals how much investors are willing to pay for each dollar of current earnings. If the number is too high compared to the industry average, it indicates that the company may be overpriced. This however is not always the case as high P/E ratios are sometimes justified by the growth prospects of the company.

[BONUS] 200 Day Moving Average: This is a basic metric that can act as an indicator of what a good price to enter a particular stock may be. This is a technical metric and is a complementary tool, not a fundamental one.

Now that the Shariah and Business Fundamental screens are taken care of, let’s get to the meat of the article!

Below are our top 5 picks for debt free Shariah compliant stocks in the NYSE.

| Name of Stock | Industry | Listed in S&P 500 |

| Intuitive Surgical, Inc [Ticker: ISRG] | Healthcare – Medical Instruments | Yes |

| Abiomed [Ticker: ABMD] | Healthcare – Medical Devices | Yes |

| Axon Enterprise, Inc [Ticker: AAXN] | Industrials – Law Enforcement | No |

| Fortinet Inc [Ticker: FTNT] | Technology – Cybersecurity | Yes |

| CrowdStrike Holdings, Inc [CRWD] | Technology – Cybersecurity | No |

NOTE 1: All the screens below are available in this Dashboard if you want to dig into them further

NOTE 2: The data, screens and analysis are based on the 2019 calendar year unless otherwise stated

Intuitive Surgical (ISRG) is an established company, whose main product lines are minimally invasive surgical robots. They sell one of the most renowned such devices in the world – The da Vinci Surgical System.

This system allows doctors to operate on patients thousands of miles away with millimeter precision using 3D vision and extremely nimble wrist extensions.

A unique characteristic of the company is that it has operated without any long term debt for all of its around 15 year history.

| Shariah Screen | Intuitive Surgical |

| Business Permissibility | |

| Is the Main Business of the Company Halal? | Yes |

| Riba Transaction Profile | |

| Interest Earnings | |

| Non Shariah Compliant Income | 127,700,000 |

| Total Gross Revenue | 4,478,500,000 |

| Non Halal Revenue/Gross Revenue [Less Than 5%] | 3% |

| Interest Bearing Debt | |

| Debt to Asset Ratio [Less Than 33%] | 0% |

| Liquidity Profile | |

| Illiquid Assets | 4,645,000,000 |

| Total Assets | 9,733,200,000 |

| Illiquid Asset to Total Asset [More Than 20%] | 48% |

| Net Liquid Asset Cap | |

| Net Liquid Asset | 4,662,600,000 |

| Total Market Capitalization | 68,220,000,000 |

| Net Liquid Asset/Market Capitalization [Less Than 100%] | 7% |

| Business Fundamentals Screen | Intuitive Surgical |

| Business Fundamentals | |

| Product Resilience | High |

| Business Model | Strong |

| Industry Outlook | Strong |

| Performance and Profitability | |

| Revenue Growth | 20.25% |

| Return on Assets | 14.20% |

| Net Profit Margin | 30.80% |

| Price Dynamics | |

| P/E Ratio | 51.18 |

Being a medical product, the demand for these systems is quite resilient to external shocks and economic downturns (although they are not completely immune, as many of the procedures carried out by the device are elective).

It has also recently started to branch out into hospital informatics with its takeover of Orpheus Medical.

Intuitive Surgical’s business model is quite stable and self-reinforcing. Meaning that the company’s revenue stream gets stronger as it sells more of the systems.

A significant portion of the revenue comes from the replacement parts that are needed for the da Vinci System after each (or a set number of) procedures and accessories that hospitals can opt to buy for the devices to extend the functionality.

Additionally, the company leases out a lot of the da Vinci systems as a lot of hospitals can’t pay the costs up front (which can range from USD 500,000 to USD 2,500,000).

Leases, combined with parts replacement and accessory sales account for around 70% of the company’s revenue. Which means high switching costs for customers, and low risk of large revenue fluctuations for ISRG.

In addition, ISRG has been debt free throughout its more than 15 years on the stock market. This makes it especially resilient to adverse effects from the business cycle.

The minimally invasive robotic surgery market is set to expand in the coming years. Companies like Johnson & Johnson [Ticker: JNJ] and Medtronic [Ticker: MDT] have already caught on to the trend and are competing with ISRG in this space, albeit with significant disadvantages of being late comers.

ISRG’s revenue growth has been accelerating over the last few years. The company registered a year on year growth of 15.95% in 2017, 18.67% in 2018 and 20.25% in 2019.

To put the growth numbers into perspective, the revenue figures that the company had in 2010 (USD 1.4 Billion) was its net earnings in 2019!

The company’s Return of Asset (asset utilization) has been stable over the course of the last 15 years and stands at 14.2%.

ISRG has a Net Profit Margin of 30.8%, which means it manages to keep USD 30.8 out of every USD 100 it earns – helped by the fact that they have no debt payments!

Although the P/E ratio of 51.18 seems high when compared to the Healthcare sector average P/E of 24.3, it reflects the value of its solid track record and its expanding industry according to us.

TIP: You can base your buy price on the 200 day moving average, and purchase the stock as close to that price as possible.

With a solid track record, nearly 2 decades of debt free growth, 20% revenue growth, 70% recurring revenue, strong profit margins and an expanding industry, ISRG should be one of the first stocks in your Halal investment portfolio.

Abiomed describes itself as “A provider of mechanical circulatory support devices offering a continuum of care to heart failure patients”.

It is most famous for its Impella Heart pump, which is one of the few certified for minimally invasive heart procedures and has little competition at its price range.

| Shariah Screen | Abiomed |

| Business Permissibility | |

| Is the Main Business of the Company Halal? | Yes |

| Riba Transaction Profile | |

| Interest Earnings | |

| Non Shariah Compliant Income | 8,166,000 |

| Total Gross Revenue | 769,432,000 |

| Non Halal Revenue/Gross Revenue [Less Than 5%] | 1% |

| Interest Bearing Debt | |

| Debt to Asset Ratio [Less Than 33%] | 0% |

| Liquidity Profile | |

| Illiquid Assets | 377,149,000 |

| Total Assets | 1,054,346,000 |

| Illiquid Asset to Total Asset [More Than 20%] | 36% |

| Net Liquid Asset Cap | |

| Net Liquid Asset | 677,197,000 |

| Total Market Capitalization | 7,700,000,000 |

| Net Liquid Asset/Market Capitalization [Less Than 100%] | 9% |

| Business Fundamentals Screen | Abiomed |

| Business Fundamentals | |

| Product Resilience | High |

| Business Model | Strong |

| Industry Outlook | Strong |

| Performance and Profitability | |

| Revenue Growth | 29.59% |

| Return on Assets | 24.57% |

| Net Profit Margin | 33.70% |

| Price Dynamics | |

| P/E Ratio | 32.07 |

Similar to Intuitive Surgical, the products Abiomed sells are resilient to downturns as it offers lifesaving circulatory support devices to critical patients.

Furthermore, its Impella RP heart pump became the only percutaneous (read: minimally invasive) temporary ventricular support device that is FDA-approved as safe and effective for right heart failure.

Finally, the company has expanded into portable oxygenation systems with the acquisition of Breethe. This will provide strong complementarity to the heart pumps that are the main product line of the company.

Abiomed’s business is in a unique position. This is because it has more than 200 patents and its heart pumps are some of the only ones that are FDA approved for percutaneous coronary interventions.

Its main competitor is the Intra-aortic Balloon Pump (IABP), which has been used since the 1960s. But the key difference is that the Abiomed pump operates under its own power, while IABP does not. This basically puts it in a league of its own and increases the chances that the company will hold on to its dominant position in the category.

The market for heart pumps was valued at around USD 1 Billion with a CAGR of 12.5% until 2023. When combined with the dominant position of Abiomed’s Impella heart pumps, this paints a very optimistic picture for the company for the foreseeable future.

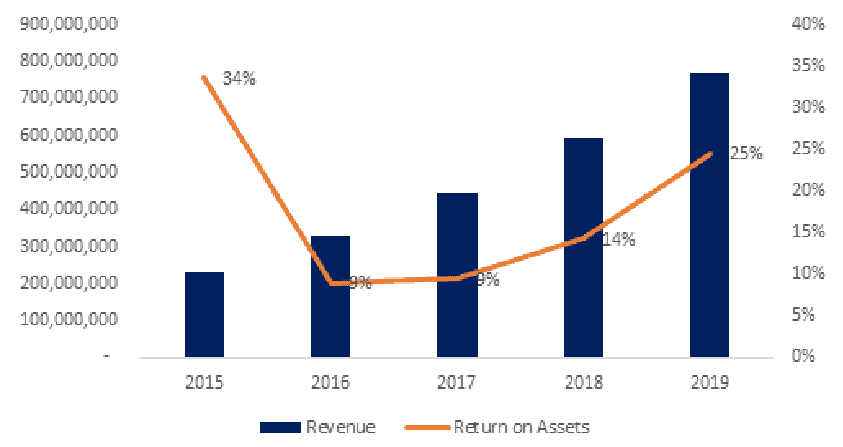

Revenue has been steadily increasing for the company from 2005, with significant growth taking place from 2014 and reaching USD 0.769 Billion in 2019. The most recent year on year growth was 29.59%.

Abiomed registers USD 24.57 as income for every USD 100 of assets it has (ROA of 24.57%). This has been steadily climbing in recent years.

Similar to the Return on Asset scenario, the Net Profit Margin has been steadily gaining ground, especially since 2012 and stands at 33.7%. This provides a long and consistent track record of strong performance for the company. One that is projected by industry analysts to continue into the future.

The P/E ratio of 32.07 is a bit higher than the industry average of 24.3. This can be attributed to its strong growth outlook according to investors.

TIP: As usual, you can base your buy price on the 200 day moving average, and purchase the stock as close to that price as possible.

Having the only modern heart pump approved for percutaneous coronary interventions by the FDA in your portfolio is a very good start. Add to that zero debt, continuously expanding product line and a decades long history of growth – and you have a winning Halal stock that is worthy of serious consideration.

Axon Enterprise specializes in the development and manufacture of electrical weapons for law enforcement services. In fact, the company invented the TASER! That was also the company’s former name (TASER International).

| Shariah Screen | Axon Enterprise |

| Business Permissibility | |

| Is the Main Business of the Company Halal? | Yes |

| Riba Transaction Profile | |

| Interest Earnings | |

| Non Shariah Compliant Income | 8,700,000 |

| Total Gross Revenue | 530,860,000 |

| Non Halal Revenue/Gross Revenue [Less Than 5%] | 2% |

| Interest Bearing Debt | |

| Debt to Asset Ratio [Less Than 33%] | 0% |

| Liquidity Profile | |

| Illiquid Assets | 226,548,000 |

| Total Assets | 845,639,000 |

| Illiquid Asset to Total Asset [More Than 20%] | 27% |

| Net Liquid Asset Cap | |

| Net Liquid Asset | 619,091,000 |

| Total Market Capitalization | 4,340,000,000 |

| Net Liquid Asset/Market Capitalization [Less Than 100%] | 14% |

| Business Fundamentals Screen | Axon Enterprise |

| Business Fundamentals | |

| Product Resilience | High |

| Business Model | Strong to Medium |

| Industry Outlook | Stable |

| Performance and Profitability | |

| Revenue Growth | 26.37% |

| Return on Assets | 0.104% |

| Net Profit Margin | 0.166% |

| Price Dynamics | |

| P/E Ratio | 70.02 |

For more useful information on Halal investments, see IFG’s Halal Investment hub here.

Finally, IslamicFinanceGuru provides access to Sharia-compliant, institutional-grade investments in Venture and Real Estate Capital through Cur8. You can learn all about it here.

05 January 2024 8 min read

30 October 2023 4 min read

27 February 2023 10 min read

Leave a Reply