What IFG will do to help bring about a truly Islamic economy

05 January 2024 8 min read

6 min read

Published:

Updated:

Mohsin Patel

Co-founder

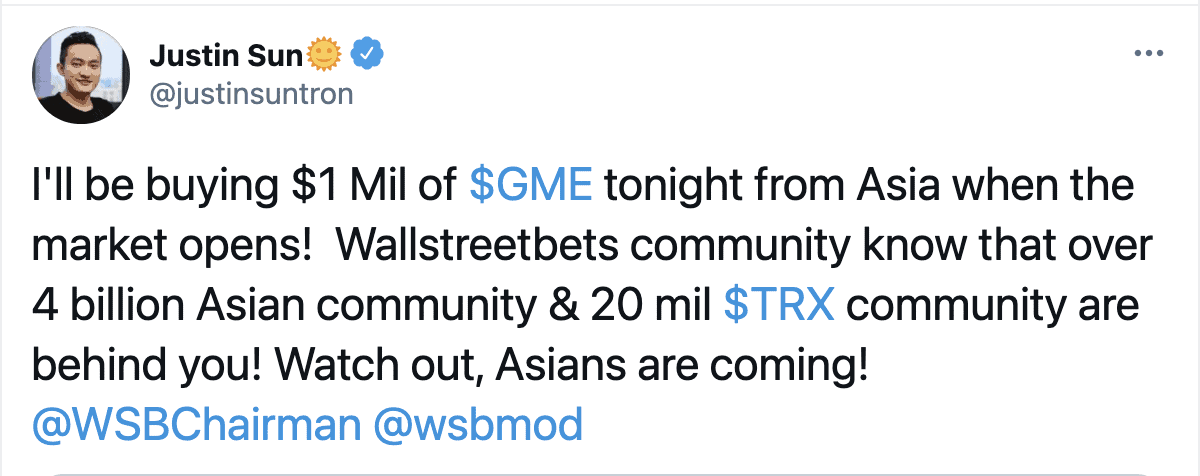

It’s probably the biggest thing to happen in the world of stocks for quite some time. The co-ordinated buying of a stock called Gamestop by everyday people like you and me has cost professional hedge funds billions.

In this article, we’ll be exploring what exactly happened and more importantly, whether it is halal to partake in such co-ordinated buying for your own gain. We’ll also be getting a word from Mufti Faraz Adam and Mufti Billal Omarjee at the end.

An online community of ordinary people noticed that Gamestop was heavily shorted by hedge funds.

Shorting explained in a nutshell:

Shorting is when you borrow something, sell it immediately, and then later buy the same thing back for a lower price. The difference in the two prices is your profit. For instance:

I believe that the price of bananas will fall dramatically within the next 6 months. I therefore borrow 100 bananas off my friend and promise to pay him back 100 bananas. I then take those bananas and sell them on the market at today’s prices. This is because I think the banana prices today are higher today than they will be in the future. So let’s say the market rate for a banana is £1. I get £100 in my pocket today for selling 100 bananas. I believe that I can give back my friend’s 100 bananas by buying 100 bananas for cheaper than £1 per banana in the future. If I am right and bananas fall to 50p, I can buy 100 bananas on the market and net myself the £50 difference.

Replace bananas here with Gamestop shares. What happened here though is because the Reddit community wanted to stick it to the hedge funds, they decided to buy up Gamestop shares to prevent the shorters from being able to buy shares back for when they need to repay the borrowed shares.

So imagine in the above example if when I come to buy my 100 bananas to return to my friend, it turns out that no bananas are available in the market. Those that have them don’t want to sell them to me. I can get the odd banana here or there, but suddenly people are charging £2 per banana.

That’s the situation that the shorters find themselves in. For those who have bought Gamestop shares, they’ve seen an incredible rise in the share price. The shorters HAVE to buy these shares back as they are obligated to, and so the scarcity is driving the price up.

You could buy Gamestop shares for around $20 a share before it was driven up all the way to $347 at one point, in a matter of days.

Those arguing for this will say that this is a great example of the power of the people. Shorting has long been criticised both Islamically and in the mainstream, since ultimately you want a business to fail in order to profit.

From a Muslim perspective though, how are we supposed to think about something as unique as this?

Let’s be clear: this is market manipulation.

Clearly, with the global power of the internet and online communities, the potential for market manipulation is huge. Historically, market manipulation has been the reserve of billionaires or large institutions. Now, market-moving trades are possible with everyday people as long as they act in unison.

The coordinated purchasing of Gamestop was market manipulation – an attempt to artificially drive up the price of the stock so that the shorters would basically be put out of business.

So can Muslims participate in this kind of market manipulation? The answer is a little complicated.

It was narrated from ‘ibn Umar that:

The Prophet (SAW) forbade artificially inflating prices (Sahih, Sunan an-Nasa’i 4505)

Narrated Anas ibn Malik:

The people said: Messenger of Allah , prices have shot up, so fix prices for us. Thereupon the Messenger of Allah (SAW) said: Allah is the one Who fixes prices, Who withholds, gives lavishly and provides, and I hope that when I meet Allah, none of you will have any claim on me for an injustice regarding blood or property. (Sahih, Sunan Abi Dawud 3451).

The above ahadith are interesting. The first is self-explanatory, whilst the second really drives at the fact that orderly markets are key in Islam.

A third hadith is also very instructive on this matter:

The Messenger of Allah said, “…Do not artificially raise prices against one another;…and do not undercut one another in business transactions. And be, [O] servants of Allah, bretheren. A Muslim is the brother of a Muslim. He does not wrong him. He does not fail him [when he needs him]. He does not lie to him. And he does not show contempt for him. Piety is here” – and he pointed to his chest three times. “It is enough of evil for a person to hold his brother Muslim in contempt. All of a Muslim is inviolable to another Muslim: his blood, his wealth and his honor.” (Recorded in Muslim)

In this context the hadith is talking about other Muslims and not partaking in behaviour that would harm them – but the principle is a general one too.

Raising prices artificially and undercutting people to cause loss to others where the intent is to harm as opposed to trade, is hugely problematic.

But is buying Gamestop shares haram then in this situation?

Firstly, if you are using options or futures or derivatives or CFDs or swaps or any number of other non-equity instruments to invest and magnify your returns – that of course is not permissible.

But if you are just investing in the stock itself, from a pure technical and legal perspective, there is nothing wrong with buying Gamestop shares in this scenario.

“As long as the transaction and the stock are themselves permissible, it cannot be said that the investment is impermissible or non-compliant. However, there could be wider considerations for investors to consider before investing. Islam likes orderly markets and it prohibits situations where a party gains at the expense of another’s loss. Using instruments such as shorting and option trading to manipulate the market to drive up the Gamestop stock price is highly reprehensible, even if you are only a small part of it,” opined Mufti Faraz Adam when I caught up with him.

That being said, there is a wider issue here which goes beyond the pure technical and legal.

The situation here is one where one group of people are out to destroy another group of people. That makes this a zero-sum game where one party wins at the expense of another.

From an ethical and moral perspective, this is dubious.

Mufti Billal Omarjee’s considered thoughts were that “this is very much a case where the transaction itself is not impermissible. But an individual should pause and question morally whether they think harm is being done to the economy or society and make their own mind up.”

Participating in what is effectively targeted market manipulation is a highly dubious activity from a moral and ethical standpoint. Sure, from a purely technical perspective it may not be impermissible. But Islam doesn’t work just on the technical.

Our in-house view at IFG is that Muslims would be best-served staying away from such activity from both a commercial and an Islamic standpoint.

From an Islamic perspective the above hadith should give us plenty of reasons for pause, and from a commercial perspective you are no longer investing on fundamental data, technical analysis or anything substantive – you are literally investing on the basis of how other investors are feeling and behaving. For the inexperienced, it is very much akin to trying to catch a falling knife. Do it enough times and you will most likely get hurt. And badly.

05 January 2024 8 min read

21 July 2023 6 min read