Should I Buy a Car or Lease a Car? | Islamic Finance Guru

7 min read

Published:

Updated:

Mohsin Patel

Co-founder

Should I buy a car or lease?

Continuing on from our earlier article on easy ways to save money on essential bills, today we cover an important question for many readers: should I buy a car or lease one?

We will initially work on the premise that you are looking to buy a new car (more on the second-hand market later on in the article). Please also see the comments section for a brief fiqhi perspective from Ibrahim.

Buying a new car

Buying a brand new car can, contrary to popular opinion, actually be quite a sensible move. You will, after all, be picking something up effectively straight off the production line, made to your specifications. There is also the added bonus that you will not have to MOT the car for 3 years, and it is likely in the current market that you will be picking up a car which is very fuel-efficient and low on tax (but don’t forget the new car tax changes that apply to cars registered after 1 April 2017!).

All of this means that you will have the luxury of a lovely, shiny, purring motor, which is much less likely to have repair costs involved for quite some time.

However, the big problem for most people is without doubt the capital outlay that comes with buying a brand new car. Let’s take a popular car for professionals in their 20s, a BMW 3 series. With the cheapest model starting at £25,740 (taken from the BMW website), it is likely that with a few ‘extras’ like choosing the colour you want, alloys, and some neat gadgets for the interior, you will inevitably be pushing at least the £30,000 mark. That’s an awful lot of money to be shelling out on a car – money that could be invested elsewhere and working for you, rather than being essentially stuck in four wheels on your driveway.

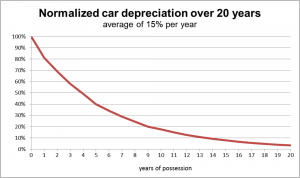

The other major disadvantage is that cars are, for the overwhelming majority of us, a liability, and never an investment. And that is even more pronounced when it comes to brand new cars, since their depreciation is the greatest. See this graphic below which depicts the fact that cars lose, as a percentage most of their value within the first 3 years. So if you are going to sell the car in 3 years’ time, you need to prepared for around 50% of your initial outlay to be wiped out.

I personally find that quite difficult to contend with, but I do know people who have bought brand new cars and literally kept them for over 10 years. In a circumstance like that, it might be argued that the buyer has ended up saving money in the long term, even though their initial outlay was quite high. This is because they have saved on monthly lease payments, and their repair bills probably only really started coming in after a certain amount of time.

Leasing a car

Leasing is a very popular option amongst car owners and involves paying a simple monthly fee (and also invariably an initial fee equivalent to, say, 3 months’ worth of monthly fees which is not refunded, it is simply part of the cost) to the leasing company for a fixed term (e.g. 24 months); during this time, the car is registered to you and you will be contractually obliged to return the vehicle at the end of the agreed term.

The first benefit is immediately obvious: you can pick up the fancy new car that you would have if you bought it outright, just with the major advantage that you’re not laying out so much capital initially. To continue our example above, you could get a BMW 3 series for say £300 a month; that is a significant difference to taking £30,000 out of your bank in one go. With such manageable monthly payments (depending on your monthly budget of course), you could put the rest of the money (assuming you have around £30,000 liquid) to better use elsewhere, whilst still managing to drive the fancy new car you wanted.

The problem, of course, arises with the fact you inevitably pay a premium for the fact that the leasing company is allowing you to have this car for such relatively small monthly payments. From their point of view, they have to make their ownership of the vehicle worthwhile, which means they certainly have to beat the effects of depreciation. So it is likely that you will be paying more over a 3-year period than you would ordinarily lose in depreciation over the same amount of time, since otherwise it wouldn’t make sense for the leasing company.

Let me break that down into a practical example: let’s say you bought the £30,000 BMW and in 3 years it’s worth £20,000. That £10,000 loss is due to the effects of depreciation.

Now if you leased that car at say £300 a month with initial payment of £1200, you would be paying £12,000 over a 3-year period [(300×36) + 1200]. You will have effectively paid a £2,000 premium, and that is fairly standard when it comes to a lease for the reasons above.

You also might end up having to fork out some money when you return the car to the leasing company: this can be for things like scuffed alloys, tyres that need replacing, or general bodywork that needs sorting out beyond general wear and tear. You should always read the fine print of a lease agreement to check how likely you are to have to be coughing up some extra cash at the end! If you do end up having to fork some money out, the £2,000 premium you paid could realistically become a £2,500-£3,000 premium.

Now you might argue that even if you end up paying a few grand more, it’s worth it for the fact that it means you invested £20,000 or more elsewhere and made good money on that investment over the same 3 years. And I suppose this is the point I’m getting to – if you can afford to pay more on a lease because you are reasonably confident that you are going to make far more money by investing the capital you would have used on buying a car, then it makes sense to lease.

Verdict: when deciding whether to buy or lease a brand new car, weigh up depreciation vs cost of lease. You can check on places like Autotrader what your car will fetch as a 3-year old with the mileage you would expect to have, in order to help you work out approximate depreciation for your car. If depreciation is greater than or equal to cost of lease, of course it makes sense to lease. If, however, depreciation is less than cost of lease (which is usually the case), you should weigh up whether you are willing to pay the lease premium and why (e.g. you want to invest the money and are confident of making good returns).

There is no clear-cut answer for everyone’s individual circumstance, but with the understanding of the points I have raised above, hopefully you are in a better position to decide! Here’s a quick summary for your benefit:

Buying:

+ Few, if any, repairs to worry about as it is a brand new car;

+ No MOT for 3 years;

+ Usually cheaper overall than a lease, even taking depreciation into account.

– Big initial outlay;

– Depreciation is a massive factor.

Leasing:

+ Few, if any, repairs to worry about as it is a brand new car;

+ No MOT for 3 years;

+ No big initial outlay;

+ Can invest your money elsewhere instead of buying a car (a liability) with it.

– Cost of lease usually higher than effects of depreciation;

– Can be hit with unexpected costs when returning car to leasing company.

What about buying second-hand?

I said earlier on that I would touch on buying second-hand instead of worrying about buying or leasing a brand new car. Depending on individual circumstance, this can also make sense. In fact, I often talk people into buying on the second-hand market if they’re serious about wealth creation. I will probably run a separate article on the idea of wealth creation itself and how this relates, but for now it suffices to say that one should limit liabilities.

If we accept that premise, and also accept the idea that wealth creation is facilitated by making the best financial decisions, buying on the second-hand market is often the most prudent choice. The main reason for this is that the major effects of depreciation which we discussed earlier have already happened. So when you buy, say, a 4-year old car, you will not be losing anywhere near as much in percentage terms year-on-year than you would buying brand new. In essence, you have limited your liability effectively.

I do accept that you increase your risk of liabilities elsewhere, mainly through repair costs as things are more likely to go wrong as cars get older with more mileage on the clock. But if you buy a decent car, maintain it well through regular services, etc, you should generally not worry too much about this side of things.

Here’s my summary of buying second-hand:

+ You can pick up a very nice car relatively inexpensively;

+ You will lose much less money over the course of your ownership than through buying/leasing a brand new car;

+ Lower initial capital outlay than buying the equivalent car brand new.

– More likely to be hit with repair costs;

– Buyers buy caveat emptor which can lead to difficulties if you didn’t spot something when buying (you can limit this risk by buying from a reputable dealer);

– Higher initial capital outlay compared to leasing;

– Don’t get the benefit of a brand new car.

Conclusion

So there we have it. As I have hinted, my personal preference is to buy well on the second-hand market but if you absolutely must buy brand new, consider the factors I mentioned and see what works best for your personal finance situation. Do not forget though – a car is, and always will be, a liability, and we must always seek to limit our liabilities!

Please remember to subscribe to our email list (box on the top right), and follow us on Facebook and Twitter.