How to claim back SEIS / EIS tax relief: the complete 2022 guide – IslamicFinanceGuru

5 min read

Published:

Updated:

Mohsin Patel

Co-founder

Claiming back SEIS and EIS is a great perk of being a startup investor (see video above). Now that we regularly get asked on how to do this from our own angel syndicate members (IFG.VC) we thought we’d create a comprehensive guide for the wider community as we found most guides out there to be insufficient.

This guide is bang up to date 2022. It’s also completely illustrated with screenshots step-by-step-. We’ve also included an annotated PDF that you can download for help whilst filling in the form.

What happens after you invest

Once you’ve invested in a startup that is SEIS or EIS eligible, the startup submits its list of eligible investors to HMRC. This is known as the SEIS1 or EIS1 form.

When HMRC is happy with everything, they’ll send back to the startup a form in your individual name. This is the SEIS3 or EIS3 form (or certificate) and it evidences your ability to claim tax relief.

Keep this form safe.

How do you claim back the SEIS or EIS relief?

There are two routes to claiming back your SEIS/EIS tax relief. The key ingredient you’ll need here is the SEIS3 or EIS3 certificate which we referenced above.

Two methods

There are two ways you can claim back your relief:

- After the tax year end when you complete your self assessment return; or

- Immediately. You can get a rebate against the last tax bill you had, or you can ask HMRC to adjust your tax code in your PAYE salary to factor in the tax relief.

This guide is a step-by-step illustrated guide for both of these methods using personal screenshots.

Method 1: Self Assessment route

If you’re somebody who has the absolute joy and pleasure of filling in a self assessment return each year, then you’ll know what self assessment is and if you have to do one.

If you’re not sure if you do one because you leave everything to your accountant, just ask them if they fill in a self-assessment tax return on your behalf. If they say yes, get them to deal with your tax relief too (they’ll know how to do it).

If you don’t pay tax by self assessment, then this method doesn’t apply to you and you’ll have to go for Method 2 (below).

Claiming SEIS / EIS tax relief by Self Assessment

Claiming back via the Self Assessment route could not be more straightforward. You just need to look out for the right section when you are filling out your self assessment.

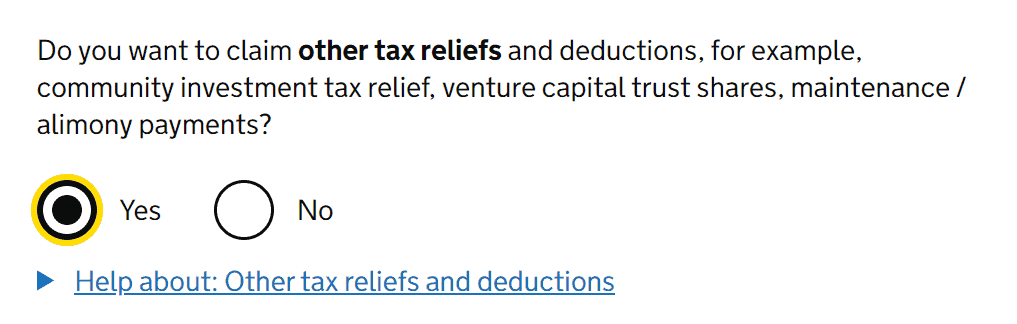

When you log in to do your 2019-20 tax year return, you’ll get an initial 3-page questionnaire. On page 3, make sure you hit yes on the following question (this makes sure you get the option to enter EIS and SEIS investments later):

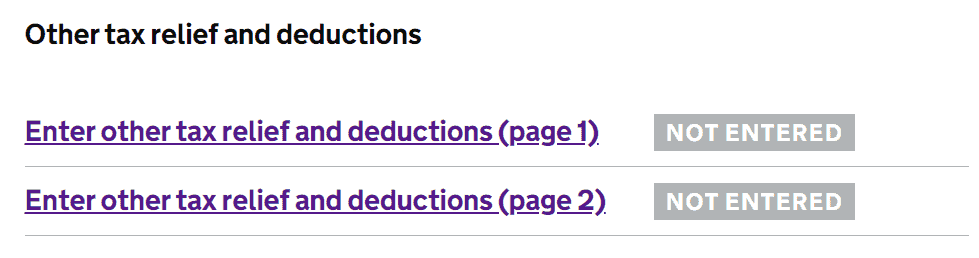

Fill in all the sections as usual. You’ll see from the main menu within your tax return the following option (which appears because you selected yes to the option above):

The ability to enter EIS and SEIS investments is in the page 2 option above. Click into it.

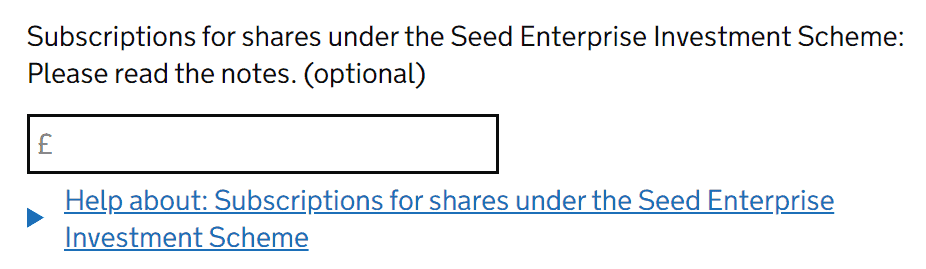

For EIS investments (not SEIS), enter the amount of your investment in the following box:

Top tip: the investment amount should match exactly what is on your EIS3 form. Sometimes you end up paying a random amount due to the share price so be sure to enter it exactly.

If you made an SEIS-eligible investment (not EIS), scroll a bit further down and you’ll find this option:

Enter the amount of your investment in here.

Fill in the rest of your tax return as normal and that’s it!

What you’ll see at the end is that you get your usual calculation but HMRC will have deducted your tax relief from your final bill.

Result!

HMRC will not ask you for any proof of your investment during your self assessment. What we strongly encourage though is that you keep your SEIS3 or EIS3 form safe. Ideally you get it as a PDF and store it in your personal cloud storage. HMRC can request to see this.

The advantages and disadvantages of this route are:

Advantages:

- Quick, easy, fully online

- You’ll be doing your self assessment anyway so it just forms part of that exercise

- No need to post anything off and wait

Disadvantages:

- You might need to wait a while if your self assessment isn’t due for a while. For instance, if you usually do your tax return in January, but you invest in May, that’s money locked up which you could otherwise get your hands on.

Method 2:

This method lets you immediately benefit from your SEIS or EIS investment. You choose to either:

- get a one-time rebate against your previous tax bill;or

- you can ask HMRC to adjust your PAYE tax code to factor in your tax relief.

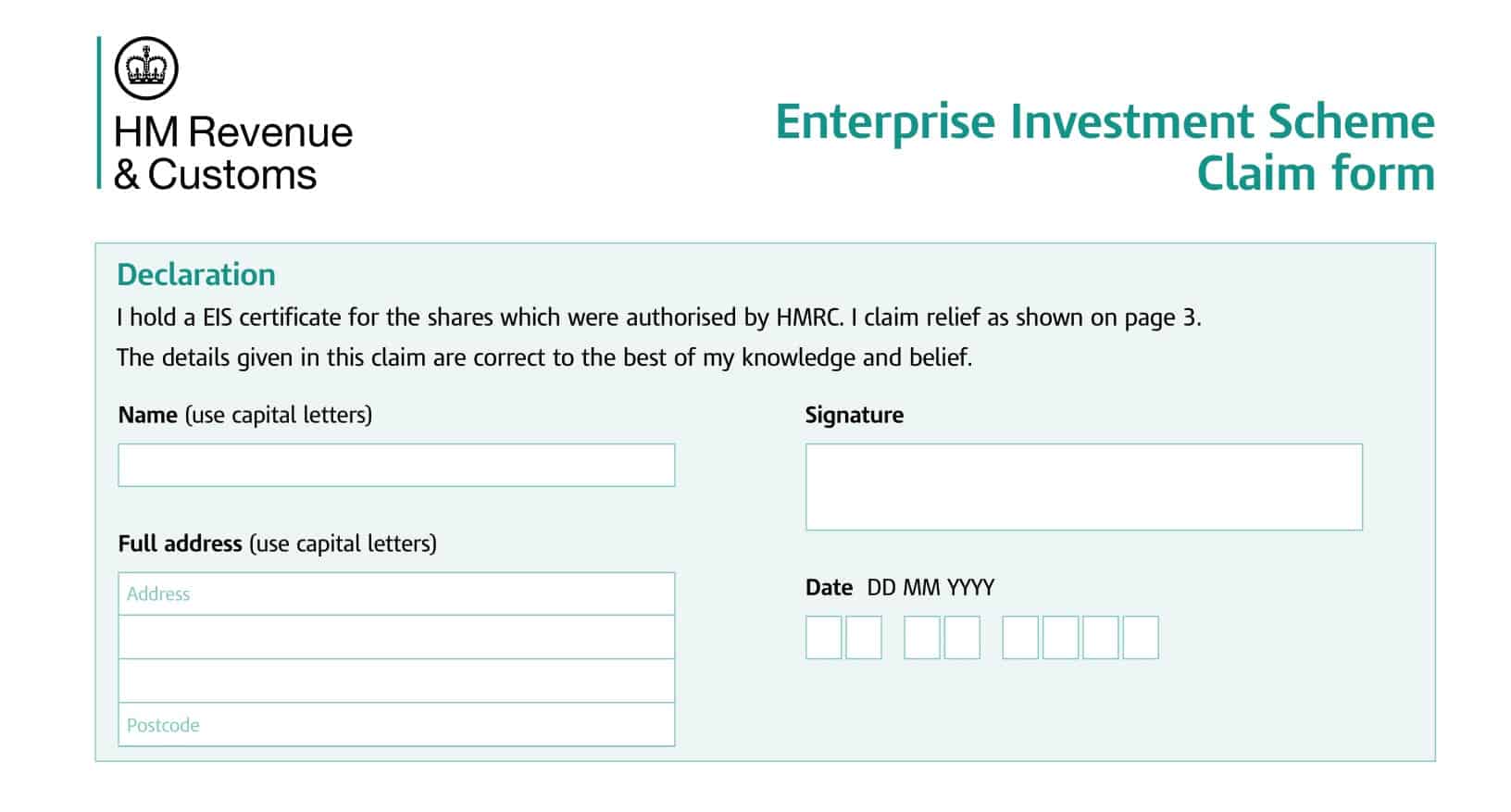

Whichever one you choose, you do it by filling in the form which is contained within your SEIS3 or EIS3 form.

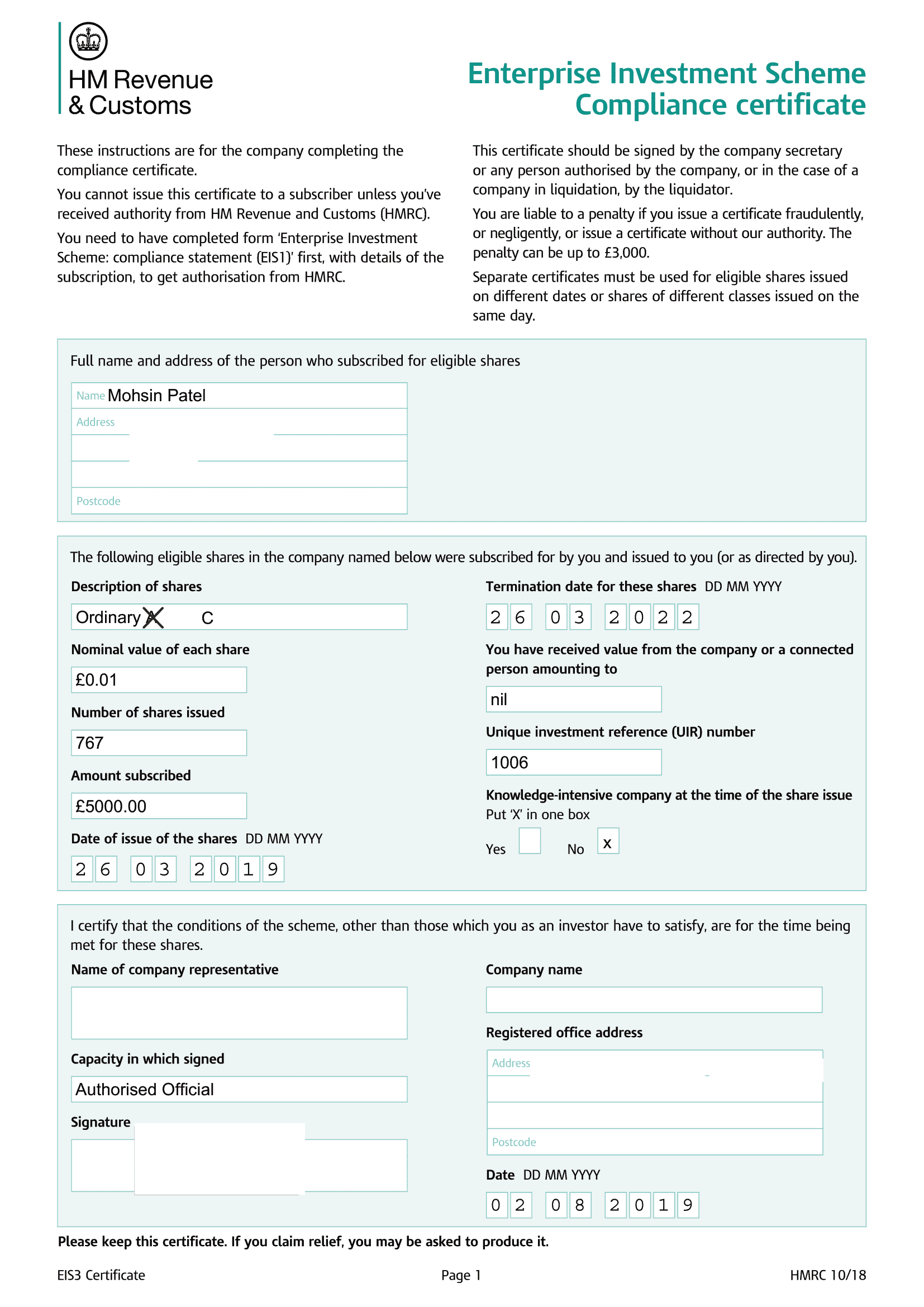

Here’s what the first page of your SEIS3 or EIS3 form will look like. You’ll see I’ve redacted some stuff including the last 4 digits of the UIR:

This first page is all filled in by the company. The key things for you to note are the UIR and the amount subscribed.

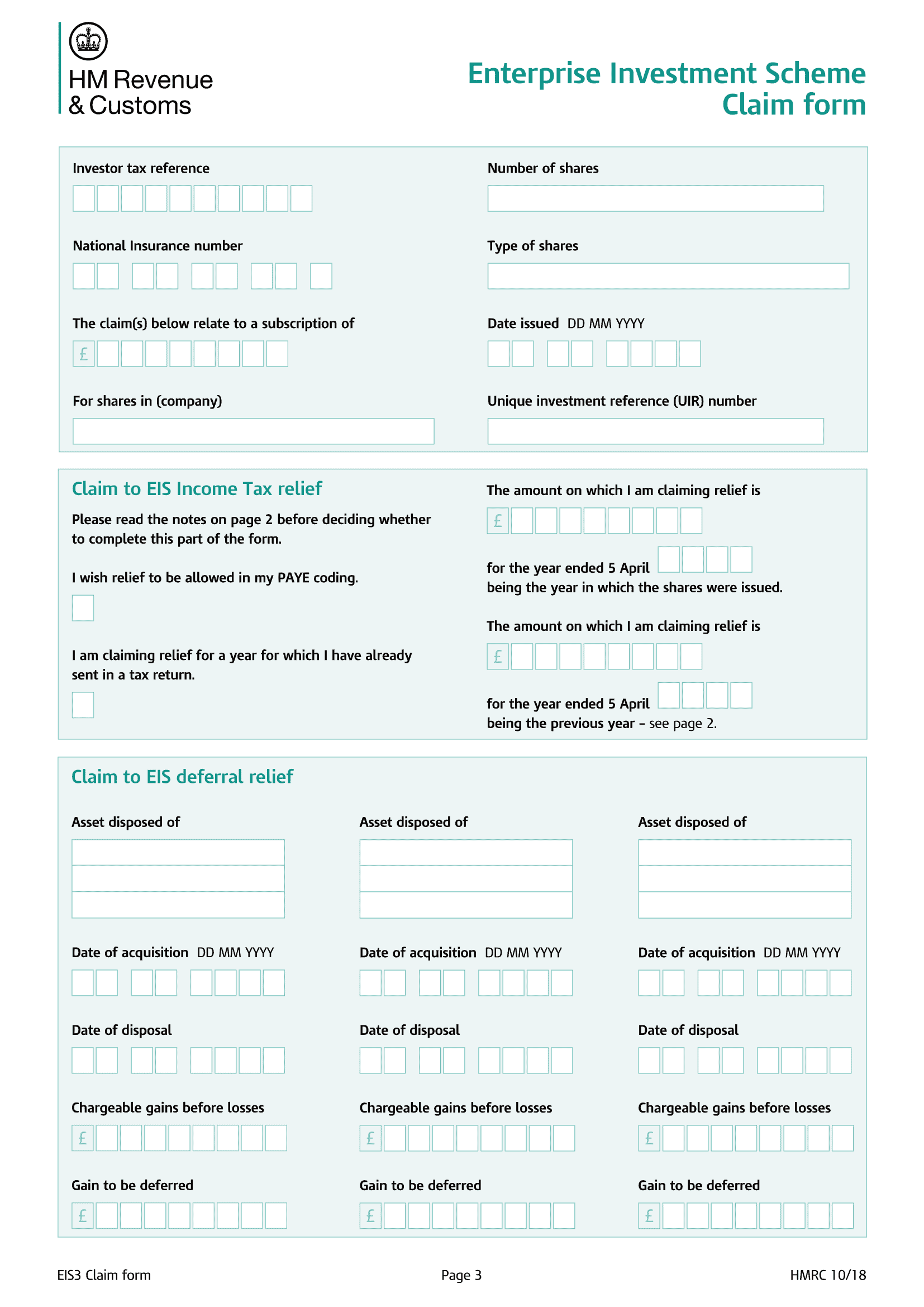

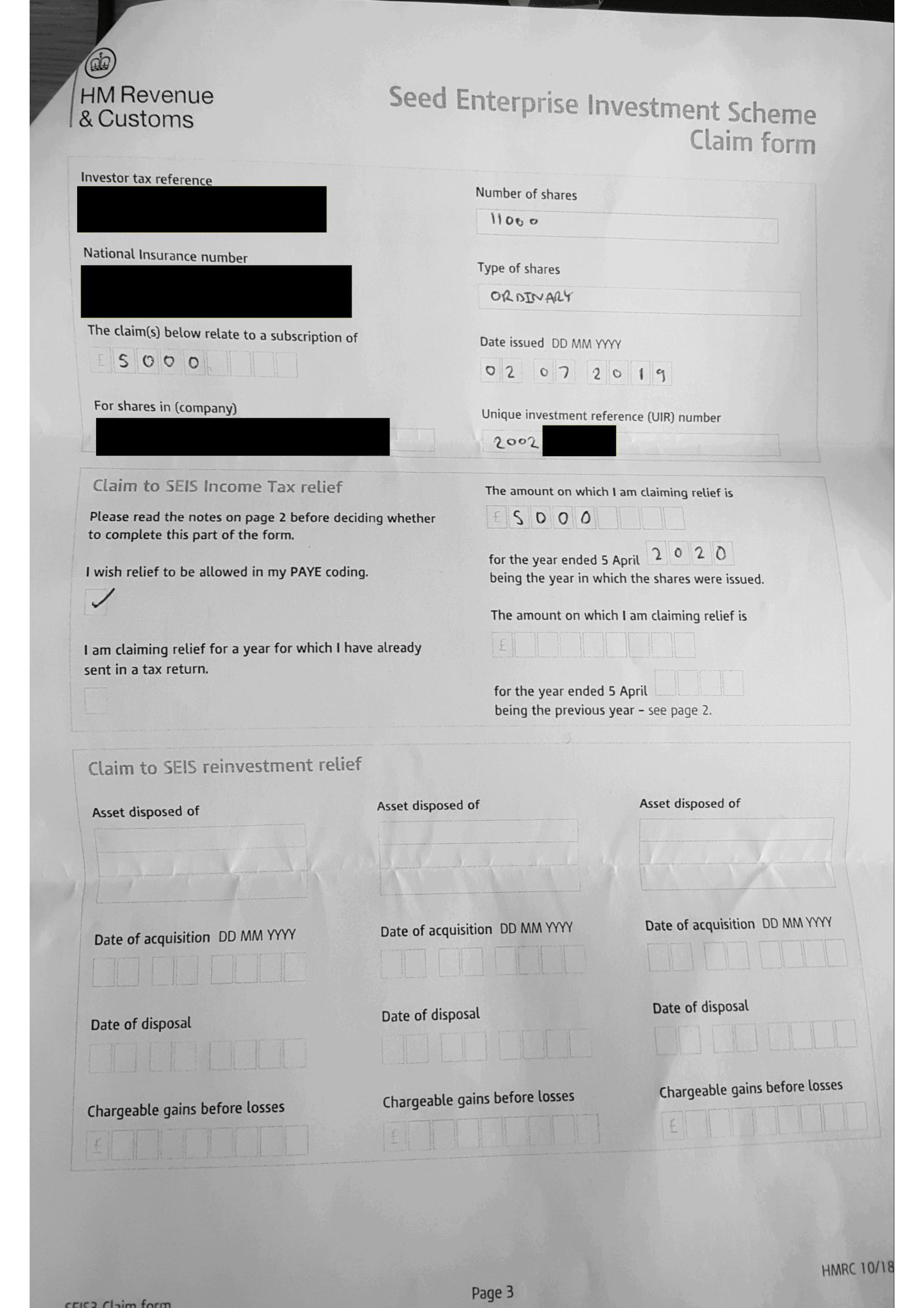

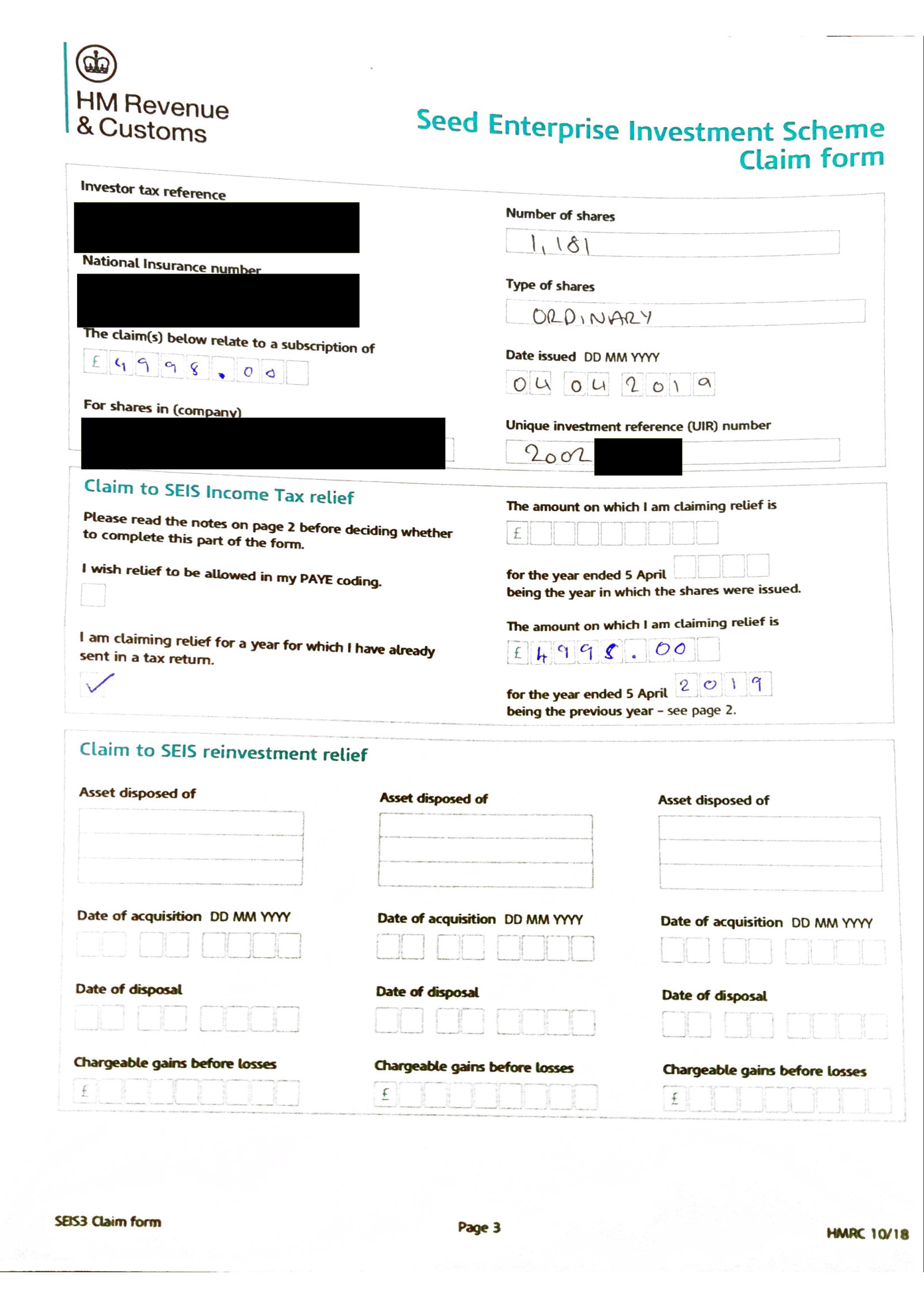

The claim form is at page 3 onwards of your SEIS3 or EIS3 certificate. Here’s what it looks like:

Worked example

Worked example

Here’s a worked example of an SEIS3 form filled out to claim back as a PAYE adjustment:

And here’s one filled out as a one-off tax rebate against the previous tax year bill (pay particular attention to the difference in which boxes are ticked):

Annotated PDF

We created an annotated PDF that you can download and use whilst you fill in your form. You can get that by clicking here.

Where do you send the SEIS3 / EIS3 form?

I have had it confirmed by HMRC that the address to post the form to is:

PAYE and Self Assessment

HM Revenue and Customs

BX9 1AS

There’s a lot of conflicting advice online and HMRC themselves don’t make it clear. But having spoken directly to HMRC, they’ve confirmed this is the address to send it to.

Final thoughts

Hopefully this helps clear up any confusion for claiming back your EIS / SEIS tax relief. If you are investing in startups, you should definitely check out our syndicate – IFG.VC. We regularly co-invest with some of the biggest names in venture capital like Y Combinator, founders like Biz Stone (Twitter co-founder) and we have great fun along the way.

This article is part of our angel investing series. Check it out here.

PS: here’s a video we did of a bunch of other tax reliefs out there too: