Stock Market Rally: What does it mean for your portfolio?

21 July 2023 6 min read

10 min read

Published:

Updated:

Xander Effingham

Growth Executive

| - Introduction

- What are the costs? |

Equity funds are a great way to invest your money and diversify in lots of stocks. However, you want to know what they are, which ones are halal and how to invest in them. As always, we’ve got you covered!

First, we’ll look at:

Following from there, we’ll discuss the different funds that you can add to your portfolio.

Equity (AKA mutual) funds allow you to purchase a large selection of stocks within one fund, in one transaction. This can be done through a broker.

This is great if you want to diversify in a lot of stocks.

Funds can specialise in certain areas, e.g. tech, Europe or the overseas market.

You should pick a fund due to:

Why is this a good thing?

If you want a more detailed guide on stock investing in general, read our halal stock investing guide – it’s a great introduction for beginners.

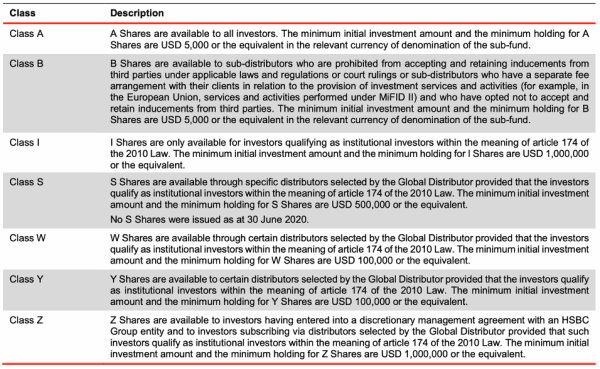

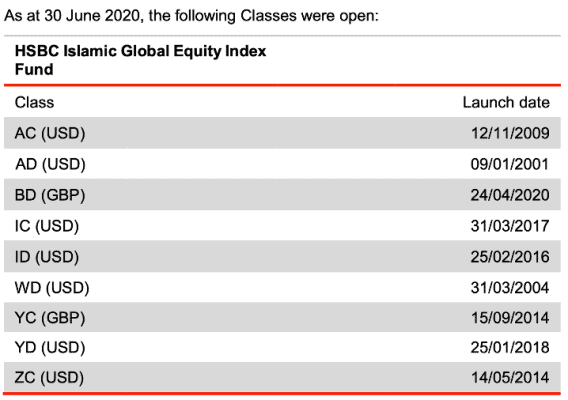

When you’re looking up a fund, you may find the same one multiple times with different variants in the name. The difference is their Share Class and how they pay investors. We have a full explanation below, using HSBC Islamic Global Equity Index Fund.

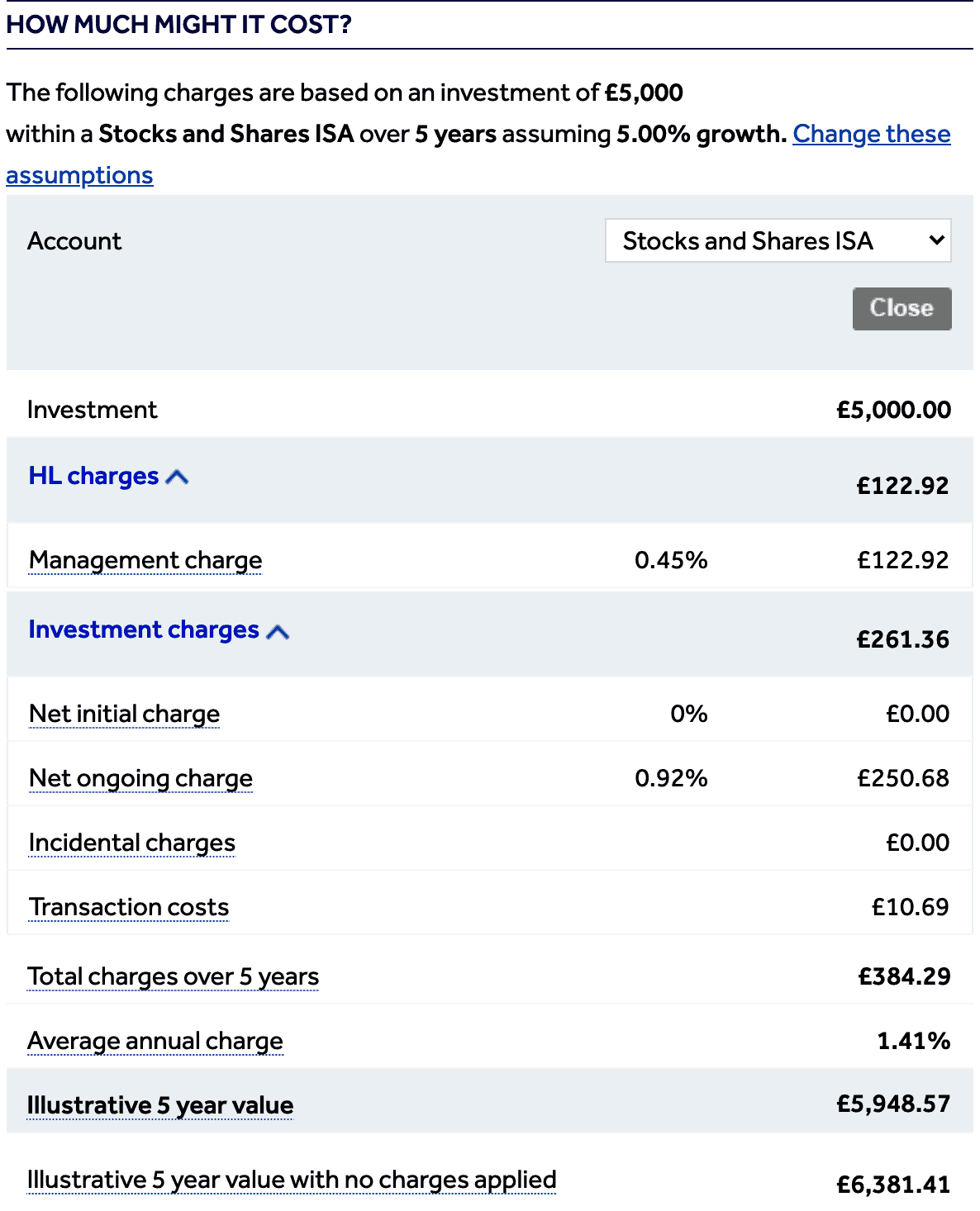

This is something that shouldn’t be overlooked. You can easily find the charges on the fund you’re interested in and they are certainly worth looking at. Some of the key costs include:

The fees vary depending on which broker you choose. Let’s look at some examples from AJ Bell and Hargreaves Lansdown (HL).

The AJ Bell SIPP has no set-up fees or charges to transfer a SIPP to them – that’s pretty good. However, there is an exit fee charge if you want to switch accounts.

There is a max custody charge of 0.25% that operates on a sliding scale, based on your account value – you can see fuller details here. It’s capped at £40 a year for an ISA and £120 for the SIPP.

Other charges include £1.50 per transaction for funds and £5 for shares. FX charges start at 1% for the first £10k and it moves downwards if more is invested.

HL has handily summarised ongoing charges that you should be aware of here.

Most funds have no dealing charges. They have AMC charges of 0.45% a year (capped at £45 a year for an ISA and £200 for the SIPP) – However the investments you choose may have their own initial and annual charges and a bid-offer spread.

Charges are either taken in one of two ways:

They have two different types of unit funds – inclusive (which have higher management fees) and unbundled (which are lower). Let’s look at their HSBC Islamic Global Equity Index fund. This is unbundled. Charges are deducted from the capital. There are no dealing or initial charges. There is however a management charge of 0.45% and the fund manager’s ongoing charge is 0.92%. See this illustrated below:

There’s one charge that you won’t have to pay – SDLT.

One of the advantages of buying funds (unit trusts, OEICS) or ETFs is that they are exempt from SDLT, unlike when you buy UK shares online, which comes to 0.5% of the total of the transaction.

You can invest in a fund through a brokerage.

We at IFG recommend AJ Bell as they offer tax-efficient wrappers for UK customers and because they have a wide-ranging basket of sharia-compliant funds to choose from too. You can also open a SIPP with them using this link.

You can compare some funds on our Halal Investment Platform.

Many equity funds are haram. However, luckily for us, there are funds out there that have been created specifically for the Muslim investor.

A sharia-compliant fund is an investment fund which meets all of the requirement of Shariah law and the principles articulated for Islamic Finance.

What makes them halal depends on the stocks they hold. Obviously, those who created the Islamic fund would have done the sharia screening for you. However, you have a duty to check that you’re happy with the sharia board and the overall reputation of the fund.

To be extra-safe, you may wish to check the holdings (i.e., the companies that the funds have invested in) and do a sharia screening on any you’re unsure about.

It’s very easy to do and you can learn how to on our sharia screening course. You can also look at some of our sharia screening articles, e.g. on Apple, Tesla, Netflix and Amazon.

Now we’re all on the same page, let’s have a look at some of the Sharia-compliant funds we know about. Note, these are not all available on every broker so you will have to check.

The following is a full list of the sharia-compliant funds that we know about:

Specifically, for US investors:

The following funds are available on Hargreaves Lansdown:

AJ Bell offers:

The following are also available, but may have minimum investment amount and/or one-off entry charge:

Freetrade currently has:

If you can’t see an ETF on a platform you use, some brokers have systems in place for users to request their availability.

Now you have a full list, let’s look at three of them in detail, including:

This fund mainly invests in software, tech and pharmaceuticals.

According to HSBC, the index holds the largest 100 stocks traded globally that pass rules-based screens for compliance with Islamic investment guidelines.

HSBC has some info and docs for further reading here.

When you search for HSBC’s Islamic funds, you’ll come across the same title using different letters.

Let me break it down for you.

HSBC offer seven different Share Classes, such as ‘Class A’ and Class Z’. The difference between them is who they are available to and where you can buy them. See picture below for more detail.

Some shares are Distribution, whilst others are Capita Accumulation. How can you identify them and what are the differences?

Luckily, HSBC has handily differentiated Distribution and Capital-Accumulation Shares as different classes of the sub-fund.

Below you can see the different Share Classes.

Below are the dividends that were declared, out of the profits of the Company for the year ended 31 December 2019, for the Classes of Shares listed below:

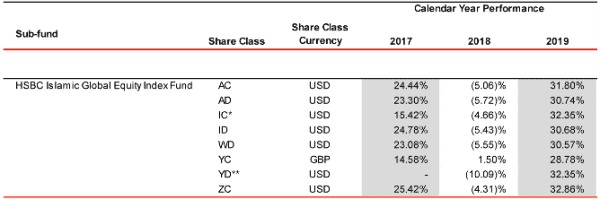

Now we’ve gone over the meaning of the different titles, below is a table of the performance for sub-funds.

HSBC clearly have a number of funds for you to take a look at – it may depend on which ones will best diversify your portfolio.

These guys have a number of stocks, Sukuk fixed income and property funds.

The Oasis Crescent Equity Fund provides investors with the opportunity to invest in Sharia compliant equities that are listed on the stock exchange in South Africa.

The fund adheres to the ethical investment guidelines of the range of the organisations Sharia investment products.

You can invest in their funds via Hargreaves Lansdown.

Here are links to their fund facts Q4 2020:

Let’s take their Property Fund as an example.

The Property Fund is a closed-ended property fund. The Fund consists of offices, industrial buildings and retail.

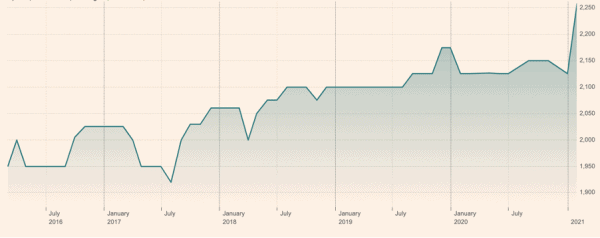

It’s net income deteriorated -68.96% from 155.21m to 48.17m despite relatively flat revenues. However, the price recently reached a new 52-week high of 2,341.00 on the 15th Feb 2021. Year on year, growth in dividends per share increased 29.38%.

iShares are ETFs by BlackRock. They offer a number of Islamic ETFs which you can invest in on HL (see our full list).

Let’s take their performance of iShares MSCI World Islamic UCITS ETF as a quick example.

The aim of the fund is to achieve a return on your investment, through a combination of capital growth and income. The Share Class is passively managed.

This Fund is suitable for medium to long-term investment. However, it may also be suitable for shorter-term exposure to the Index. They rank it has high risk.

The base currency is in USD.

Most of their holdings are in healthcare, IT and materials. The US has the highest % of market value, followed by Switzerland and Japan.

A lot of Islamic equity funds end up basically investing in similar stocks – US technology stocks. This is fine when US tech stocks are rising but not so great when they’re not.

It’s also not great because as a Muslim you may want to invest in various different flavours that are just not offered as an Islamic fund just yet.

But there are over 120,000 funds out there.

Imagine if there was a way to take the best performing of those in each different investment strategy, strip out all the haram stocks they invest in, and leave just the halal ones.

Well now there is.

Funds are a great way to have a hands-off approach to investing. As we’ve shown, there’s plenty of choices out there for the Muslim investor.

What is key is making sure the fund you choose is halal. Make life easier – compare different funds on our Halal Investment Comparison page.

“Or you can check our new platform Cur8 which will provide you with access to the best equity funds that are shariah compliant”

It’s also critical you check the charges as some of them can cost quite a bit. Do some research on what the objects of the fund are and see if they meet your investment goals. See if it will diversify your portfolio – e.g. it has some sukuk which the individual investor may find difficult to buy.

Or think if it’s better off you DIY it and buy stocks individually and manage them yourself. Finally, funds have minimal investment and minimal additional investments – so keep an eye on that.

When investing, remember these key points:

If you enjoyed this article, you can follow me on Twitter or LinkedIn.

21 July 2023 6 min read

15 February 2023 7 min read

10 January 2023 11 min read