Stock Market Rally: What does it mean for your portfolio?

21 July 2023 6 min read

9 min read

Published:

Updated:

Mohsin Patel

Co-founder

I recently came across Finispia – a halal stock screening solution – through an IFG reader who mentioned it in a conversation (thanks Umar!). We are interested in this whole area. We’ve released (completely free) a zero-debt list of all the halal stocks for the UK and USA here, which we update annually, as well as a course on halal stock screening here.

So naturally we were interested in Finispia.

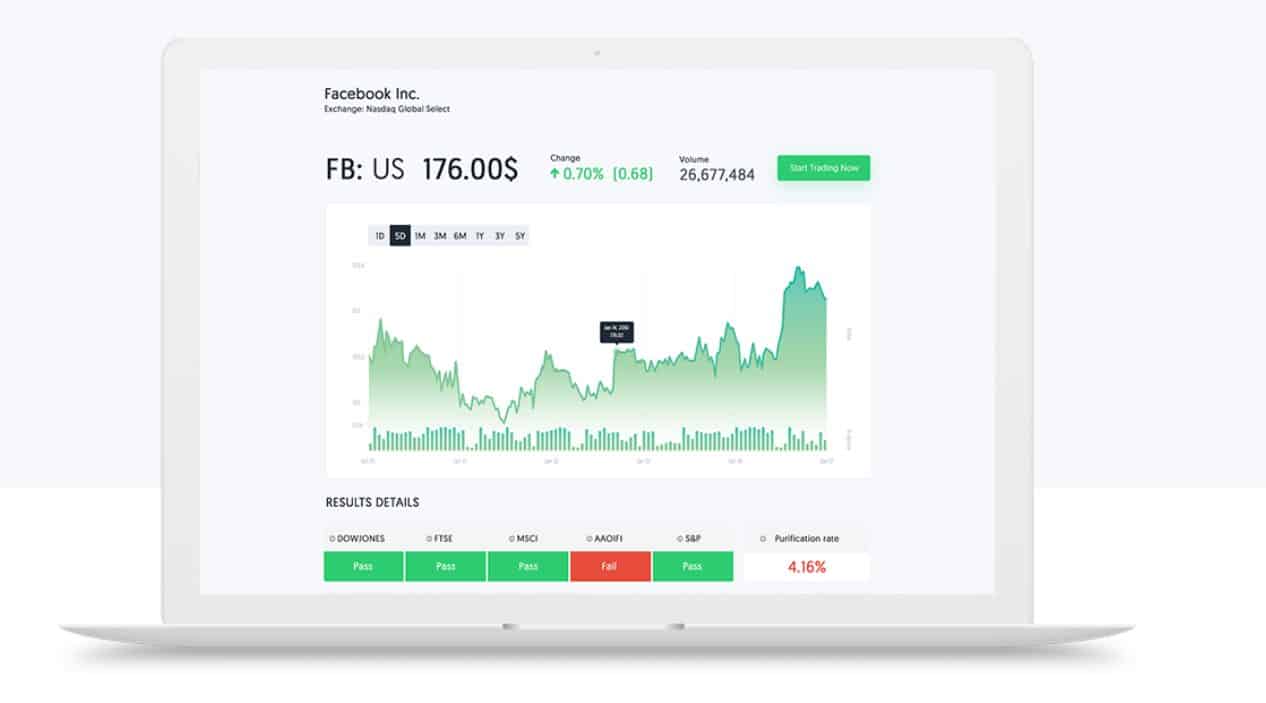

Finispia is an automated tech solution that helps answer that question that so many of us face – is this company halal to invest in or not?

What made it stand out for me on first inspection was 2 things:

Finispia also has a cool few other features too. Things like being able to set your own filters (note: only a feature on the most expensive package out of 4) and being alerted if a company in your list which was once halal has become haram overnight (note: only a feature on the top 2 most expensive packages). These are nice little features which I could see being very useful to track your portfolio without having to worry.

For transparency, we do get a small commission if you go on to sign up with Finispia – but this doesn’t stop us sharing the down-sides (as I am sure you will see)

Finispia is ideal for people who want to invest in halal stocks and shares across the world. That means that you want to buy the company shares directly, rather than buying into a fund. For example, if you wanted to buy shares in BT and you wanted to check whether or not BT was a halal company to invest in, Finispia is a tool that you can use to check.

Let’s talk about what I like first of all. My list of pros is:

So let me start this off by saying that on an initial look around Finispia, I thought this was going to be a straightforward positive review. I would have been happy with that, because we like it when there are good tools out there for Muslims. As I delved a bit deeper though, I realised that there are some flaws with Finispia. Once these are worked through, Finispia will be a great tool.

If there is one thing you want a stock screener to do, it’s to accurately tell you when a company is halal or not. You can undoubtedly forgive the odd error either down to a tech issue or down to a fiqhi difference of opinion. But I’m talking about genuine flaws here.

Let me illustrate. There’s a picture above that shows you that Vodafone fails all five Finispia screens. Yet, when I run it through the Wahed stock screener app, it passes on 2 of their 6 screens.

One of Wahed’s 6 screens is the Dow Jones Islamic Market standard. Yet I get a conflicting answer for the same industry standard between Wahed and Finispia. We’ll analyse who’s right later on.

Another example of a stock listed as haram when it probably isn’t (again, we’ll run the manual analysis later on in this article) is a big pharmaceutical company called AstraZeneca. Finispia comes back with a complete fail rate on all 5 of their standards. Yet Wahed, who have at least 4 industry standards in common, say that is passes 2 of their screens (AAOIFI and DJIM). Who’s right? More on that in the next section.

I’m sure that Finispia does get things right on other companies, but I can only write based on what I test.

When a company fails the sharia compliance test, all you get is a simplistic reason like “Debt”. What about the debt? How far away was it from the threshold? What threshold does that standard even use? By contrast, the Wahed Invest stock screener app tells you the criteria that each industry standard uses and where the company you’re searching for has failed. I would want to see at least the same level of detail in Finispia, if not more. For example, listing all the criteria for that standard and showing a calculation for the particular stock you’re searching for.

Remember I mentioned that a cool Finispia feature was a filter for stocks? It lets you choose a certain investment criteria (e.g. PE ratio) and filter halal stocks that way. It’s a premium feature, only available on their top-level subscription.

Overall, it is good. I think there is room for improvement though. For example, I did a search (as a test) for something that should have brought zero or very few companies up by searching for halal companies with a PE ratio of less than 1. PE ratio is a simple measure which is explained well here. It would be almost impossible for a PE ration of less than 1 to be the case except in very extreme circumstances.

Yet Finispia returned 519 stocks that hit my criteria. After much head scratching I realised that it was returning stocks with a negative PE ratio. Of course, technically this is right. A minus figure is “less than 1” after all. But when an investor searches for PE ratio less than x, I don’t think they envisage having to deal with negative numbers. To counter this, I tried to add in an additional layer to my filter: i.e. to say less than 1 but greater than 0. Sadly, this wasn’t possible.

Things like this are a result of the tech being automated but could easily be fixed. I would expect better from a product that charges $29.99/month or $285.99/year. That leads me on to…

Finispia comes in four flavours which you can see below with their monthly and annual prices:

You don’t need me to tell you that this is not cheap. Only the very top subscription plan gets you unlimited stock searches. Until then you’re limited to 3 (free), 9 ($4.99/month) or 21 ($9.99/month).

The filter only comes with the top plan too. Given that this is a nifty little feature, this would have been nice to see on lower-priced plans.

This is a decent bit of tech, I’m just not sure that I would be able to justify paying that amount per month or annually. The Wahed Invest stock screener app (I plan to do a separate review of this in due course) does just as good a job for the most part. It doesn’t have the neat filter that Finispia has though, and if you really want this, then I think Finispia is the way to go.

I mentioned earlier that some stocks were listed as haram in Finispia but halal in Wahed Invest. I also promised to look at the truth myself. Let’s look at the first company: Vodafone Group Plc on the London Stock Exchange.

I manually screened Vodafone and concluded that it was halal but only by the skin of its teeth. As such, I would actually avoid because it was so close to the interest-bearing debt to total assets ratio (read here about the criteria we use in-house at IFG).

That explains why Vodafone failed on some screens but not others. Some screens go for a more conservative approach like taking a ratio of total debt to total assets. But the confusing thing here is that Finispia reported it as a fail for all 5 of its industry standards, whereas it passed a few of Wahed’s, despite these standards overlapping. In this case, Wahed passed it on the Dow Jones Islamic Market standard whereas Finispia didn’t. I have checked, and Wahed have correctly stated DJIM’s conditions and applied them correctly.

As for the other example I mentioned earlier, AstraZeneca. This is a total fail for Finispia, but passes 4/6 of Wahed’s standards. I have checked the Wahed screens manually and they are all applied correctly. But AstraZeneca in particular throws up a nuance that leads me to my next point.

As good a job as Finispia, Wahed or whoever does, automated stock screeners are problematic.

As a small example, let’s keep looking at AstraZeneca. One of the standards – SCM (Securities Commission Malaysia) – which Wahed uses but Finispia doesn’t seem to, has a criterion that the total debt should not be more than 33% of total assets. We also follow this criterion. On the Wahed app, this comes up as a lovely green pass. However, on my manual analysis, I realised that this figure is just under 32%.

Now technically this is fine. But looking at things in the round, I probably would rule myself out of AstraZeneca because it’s so close to the threshold and this probably isn’t a temporary situation. A company like that will probably always have that level of debt and not really be concerned by it because they can service it.

Doing this review really brought into focus how much better manual screening is. It doesn’t actually take that long either. What it does give you though is the ability to look at a company as a whole, to decide what criteria are genuinely important and to assess accordingly. Ultimately, the reason for the differences in opinion are because these are basically arbitrary figures that scholars have come up with as acceptable. In an ideal world, we’d have zero interest and none of these issues really arise. It doesn’t mean that 33% is an acceptable ratio of debt in of itself, but this is what (some) scholars have decided as being small enough that it doesn’t affect the whole picture.

A manual screen allows you to truly think for yourself and exercise your judgement using scholarly criteria.

We have a course on this that we’ve had really good reviews for alhamdulillah and if you’re someone who invests regularly, it’s an investment worth making so that you can actually understand what screening for halal stocks truly means. You can check the course out here.

Check out the manual sharia screening course.

Finispia is a decent tool that needs some refining. I personally wouldn’t be rushing to buy it for two reasons: 1) I genuinely think manual screening is better because you actually understand the Islamic basis for judging whether a stock is halal or not and you can judge the nuances better; and 2) Wahed seem to have a very able alternative that is free. A word of caution with the Wahed stock screener app though: it is quantitative only (i.e. it might throw up some companies that are in haram industries – so please be careful).

If you do want an automated stock screener rather than the manual approach, you should definitely check Finispia out and do what I’ve done for yourself. See what works for you.

If you do opt for Finispia, please use our link as this helps to support us iA! Ultimately, Finispia have got the start of a potentially good thing – I just think that some of the key things I have mentioned above need some work. Once that is resolved, this could be a very useful product indeed.

21 July 2023 6 min read

15 February 2023 7 min read

10 January 2023 11 min read