What IFG will do to help bring about a truly Islamic economy

05 January 2024 8 min read

13 min read

Published:

Updated:

A

Anonymous

Given the current back and forth around Twitter, this post helps breakdown the Musk / Twitter dialogue so far, explains why Musk’s offer (as of today) is not that serious of an offer and shares some thoughts on what Twitter can/may do.

This is an anonymous post from someone in the industry.

Musk tweets the below:

Free speech is essential to a functioning democracy.

Do you believe Twitter rigorously adheres to this principle?

— Elon Musk (@elonmusk)

March 25, 2022

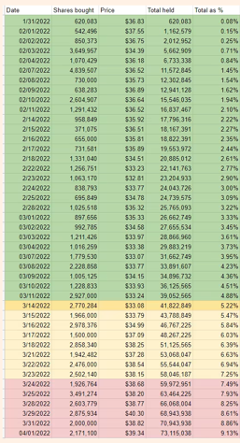

Musk’s 9.2% stake in Twitter worth $2.9B becomes public, see SEC filing here. This is 4x Twitter founder Jack Dorsey’s stake of 2.25% and makes Musk the largest shareholder of Twitter.

Twitter stock increased by 27% to $49.97 following the announcement.

For those wondering why the stock would increase that much following Musk’s investment, there are a few reasons but most notably: (a) it serves as a sign of great confidence to the market and retail investors to see someone like Musk taking a financial stake in Twitter, (b) even though he is not an activist investor, he may through his stake take an active role in improving Twitter and (c) this may be a stepping stone for him to offer to acquire Twitter which would lead to the share price to increase further (as what happened).

It is also worth noting that in the US a person/entity that acquires a 5% stake in a public company must make this known publicly via a SEC filing within 10 days.

If you read the date on the filing, Musk passed that threshold on the 14th of March and filed slightly late on the 4th of April. Not that we think Musk is approaching this from a highly financially-motivated angle (it seems he may have overpaid slightly just to make a cannabis joke), but as the price of Twitter stock shot up post his stake announcement Musk was able to buy the extra 4.2% at a much cheaper rate than he otherwise would have had he disclosed at the right time.

You might think “so what?”. He just announced it a few days late. Imagine, however, if you had sold your Twitter stock between the days Musk was supposed to file and the day he actually filed, or if you had options kicking in above the ~$40 price the stock surpassed after his announcement that expired in the interim time period in which Musk should have announced. You’d be pretty annoyed and probably take up lawsuits.

See below for exactly how his stake was built up. You’ll see he slowly started building his position from the end of January and surpassed the 5% stake on 14th March at which point he bought his last shares under the 5% threshold at $33.08. It is also slightly humorous that as Musk was tweeting polls on Twitter and mentioning how he is “giving serious thought” to building a new anti-censorship social media platform, he was secretly sitting on a 7% – 8% stake in Twitter.

Contrary to everyone’s expectations and the fact Twitter announced he was officially due to join the Board of Directors (BoD) on Saturday 9th April, Musk does a u-turn and declines Twitter’s offer for him to join their BoD.

In simple terms, the BoD are tasked with representing the interest of a company’s shareholders (this is in the US, in other countries they can also represent other stakeholders such an employees and unions) and collectively decide on all major decisions pertinent to the company without getting involved in day-to-day management affairs which are handled by the CEO.

For example the BoD elects the CEO, sets management compensation, decides on financial transactions (equity raises, significant M&A) and anything else which impacts the long term strategic direction of the company.

When someone builds a significant stake in a public company, in most cases they do not want to be a passive investor (even though they can).

They would rather join the BoD, have their voice heard and drive the performance of the company they are now financially invested in. In the case of Musk, his changes were expected to be much more strategic such as changes to censorship policy, making Twitter’s code open source etc.

Firstly, becoming a Director of Twitter would tie Musk with a variety of fiduciary duties he would have to observe. These would imply he must first and foremost act in the interest of “all” shareholders of Twitter.

This would quite dramatically change the way Musk currently uses Twitter, he could probably no longer get away with writing stuff like Twitter is dying or that their HQ should be turned into a homeless shelter.

He would also have to seriously think about any potential conflicts between what appears to be his personal goal of turning Twitter into an open source free speech absolutist platform vs. achieving a more financially-driven goal of increasingly monetizing Twitter and making it an advertiser-friendly platform.

The second reason is quite simple. As per the terms of him joining the BoD, he would be restricted from owning more than 14.9% of Twitter shares. That would immediately rule out any public takeover offer by Musk.

As such, it appears that following Musk’s engagement with Twitter he realised he is not going to be able to achieve his goal by just joining the BoD. There must have been many meetings between the Twitter CEO, his BoD and Musk which likely highlighted some fundamental disagreements about each person’s future vision of Twitter.

Musk did after all sign the agreement to join the BoD and agree to the 14.9% standstill threshold pointing to the fact it is unlikely a full takeover of Twitter was pre-mediated from the start. Of course we don’t know with certainty but seems like plan A for Musk was to acquire a large stake, join the BoD and shake things up to his liking. When he realised a BoD seat would be met with too much friction he decided to go the public takeover route.

Musk announces a hostile takeover offer for Twitter. Most public M&A deals are “friendly” deals, that is where the acquirer and the target’s BoD agree on all the details privately without any public attention or announcements and then collectively draft an agreement for public release that reads something like “The BoD of Company X recommend this offer to the shareholders”. From there shareholders can vote on the deal but they key point here is that the acquirer and target are aligned and supportive of the deal.

What do you do though if you are an acquirer and either the BoD is not taking you seriously or you have reason to believe that if you do approach them, they will not be supportive? You publicly announce the fact you are considering an offer before agreeing details with the target BoD thereby putting pressure from public shareholders on the BoD. This is known as a hostile approach.

More precisely, this is what happened.

Musk sends a text to the Chairman of the Twitter Board saying:

“As I indicated this weekend, I believe that the company should be private to go through the changes that need to be made.

After the past several days of thinking this over, I have decided I want to acquire the company and take it private.

I am going to send you an offer letter tonight, it will be public in the morning.

Are you available to chat?”

A summary of the voice script from Musk is below:

As mentioned before, to say “it will be public in the morning” is considered quite hostile in the world of public M&A. Rather than allow time for Twitter to consider Musk’s offer, think through their options, explore other bidders, they will immediately be under the public spotlight – which is why deals are almost always explored on a friendly basis first before becoming hostile.

The offer went public on the 14th of April, below we include an excerpt from the offer and will explain the key terms in bold. You can find the SEC filing here.

“On April 13, 2022, the Reporting Person delivered a letter to the Issuer (the “Letter”) which contained a non-binding proposal (the “Proposal”) to acquire all of the outstanding Common Stock of the Issuer not owned by the Reporting Person for all cash consideration valuing the Common Stock at $54.20 per share (the “Proposed Transaction”). This represents a 54% premium over the closing price of the Common Stock on January 28, 2022, the trading day before the Reporting Person began investing in the Issuer, and a 38% premium over the closing price of the Common Stock on April 1, 2022, the trading day before the Reporting Person’s investment in the Issuer was publicly announced.

The Proposal is non-binding and, once structured and agreed upon, would be conditioned upon, among other things, the (i) receipt of any required governmental approvals; (ii) confirmatory legal, business, regulatory, accounting and tax due diligence; (iii) the negotiation and execution of definitive agreements providing for the Proposed Transaction; and (iv) completion of anticipated financing.”

Side note: for those of you wondering, there is typically quite a detailed financial model that comes up with a fair value of the target company which in conjunction with qualitative factors such as previous trading, VWAPs and sometimes just “what feels right” are used come up with an offer value. In the case of Musk, one wonders whether the original offer was supposed to be $54.00 and then $0.20 was added as a reference to a cannabis joke, if so, that’s an expensive joke at ~$200m.

Twitter swallows a poison pill. A poison pill, as you are probably wondering, is a defence strategy against a hostile takeover. It essentially deters a hostile bidder from acquiring a large stake of the targets company’s stock.

On Friday 15th April Twitter announced its BoD unanimously approved a year-long shareholder rights plan to “enable all shareholders to realise the full value of their investment in Twitter”. The rights will become exercisable if an entity/person/group acquires beneficial ownership of 15% or more of Twitter’s outstanding common stock in a transaction not approved by the BoD. Each right will entitle its holder to purchase, at the then-current exercise price, additional shares of common stock having a then-current market value of twice the exercise price of the right.

A key provision is that “the person/entity/group triggering the rights plan” will not be able to exercise these rights. The rights plan will expire one year from now, on April 14, 2023.

This essentially means that if Musk takes his stake up to 15%, then every Twitter shareholder other than Musk will be issued new Twitter shares at a 50% discount which would significantly dilute Musk’s holdings.

Given this poison pill, it is now almost certain Musk cannot continue with a hostile takeover of Twitter but importantly this does not prevent him from privately engaging with the BoD and agreeing a revised offer price with them which they can approve.

In short, a friendly acquisition still remains possible.

We can split what happens next by discussing what the two camps are likely doing.

On the side of Twitter, their BoD first and foremost have fiduciary duties which is a fancy way of saying they, by law, have to “do the right thing” for their shareholders which in most cases simply means deliver them the best value. That can be in the form of soliciting a higher offer from Musk, or from someone else, or not selling the company but generating further shareholder value whilst remaining public.

Twitter’s BoD, even if it wanted to, cannot simply accept Musk’s offer. That would be a breach of their fiduciary duties. They would have to run a sale process (with the help of an investment bank) first to discover what other offers are on the table and only when you can “prove” Musk’s offer is the best offer and it represents a fair value of the company can they accept the offer.

Even if they run a sale process and discover Musk’s offer is the best, they can still reject the offer without breaching fiduciary duties so long as they believe the fundamental value of the company is much higher and are executing on a plan to achieve that fundamental value through growing users, increasing monetization, improving margins etc.

To put that into context, imagine two scenarios:

It is also worth noting that from the Twitter side, Musk’s offer, until he secures committed financing, is hard to take very seriously. Musk has in the past tweeted he secured funding for a Tesla take private which failed. Even if the Twitter BoD find the share price attractive, their first response to Musk would likely be something along the lines of “thanks, but please let us know when you have secured funding”. In the meantime they can go and explore other options.

On Musk and Morgan Stanley’s side, two main questions will be: (a) how much, if at all, can we increase the offer price by and (b) how are we going to fund this acquisition? Musk seems to of already answered (a) but it wouldn’t come as a surprise for the offer price to move up from the first offer, that is quite common in public M&A.

On funding there are a few options but they have their restraints:

Whilst I mentioned private equity above, this will most definitely not be your typical LBO, with the sky high valuation and minimal cash flow, Twitter is almost the polar opposite example of a good “LBO candidate”.

Let’s see what happens next.

05 January 2024 8 min read

30 October 2023 4 min read

27 February 2023 10 min read